The balance of payments is a comprehensive record of a country's economic transactions with the rest of the world, tracking exports, imports, investments, and financial transfers. Understanding how your nation's current and capital accounts interact helps reveal its economic stability and global financial relationships. Explore the detailed components and implications of the balance of payments to gain deeper insights.

Table of Comparison

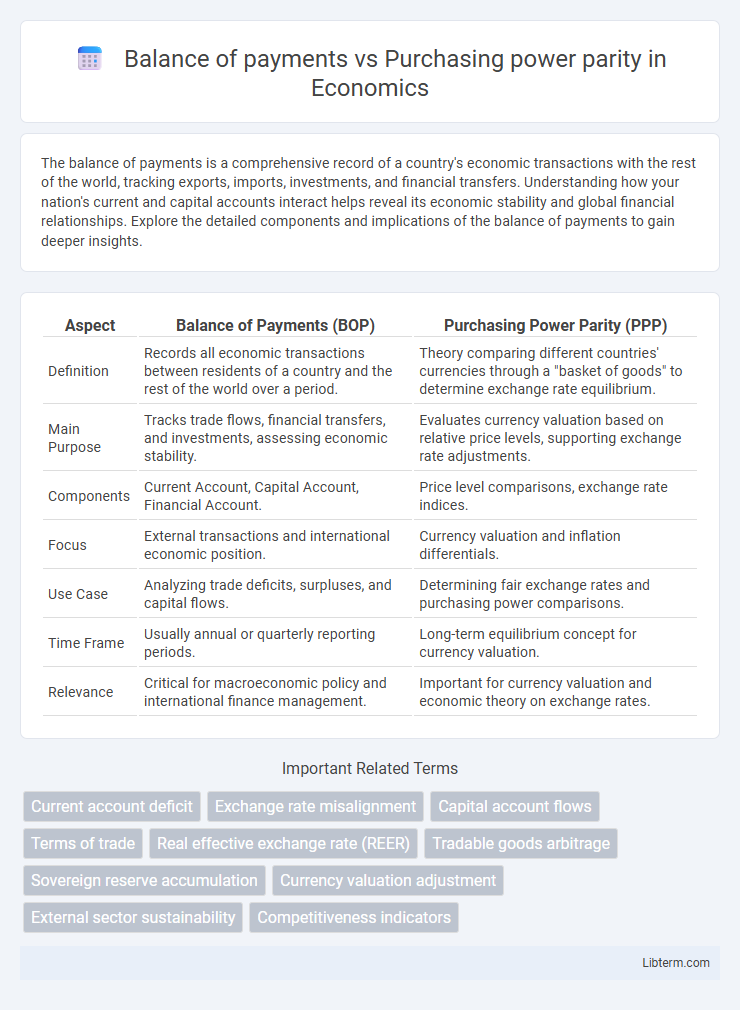

| Aspect | Balance of Payments (BOP) | Purchasing Power Parity (PPP) |

|---|---|---|

| Definition | Records all economic transactions between residents of a country and the rest of the world over a period. | Theory comparing different countries' currencies through a "basket of goods" to determine exchange rate equilibrium. |

| Main Purpose | Tracks trade flows, financial transfers, and investments, assessing economic stability. | Evaluates currency valuation based on relative price levels, supporting exchange rate adjustments. |

| Components | Current Account, Capital Account, Financial Account. | Price level comparisons, exchange rate indices. |

| Focus | External transactions and international economic position. | Currency valuation and inflation differentials. |

| Use Case | Analyzing trade deficits, surpluses, and capital flows. | Determining fair exchange rates and purchasing power comparisons. |

| Time Frame | Usually annual or quarterly reporting periods. | Long-term equilibrium concept for currency valuation. |

| Relevance | Critical for macroeconomic policy and international finance management. | Important for currency valuation and economic theory on exchange rates. |

Introduction to Balance of Payments and Purchasing Power Parity

Balance of Payments (BoP) is a comprehensive record of a country's economic transactions with the rest of the world, including trade, investment, and financial transfers. Purchasing Power Parity (PPP) measures the relative value of currencies based on the cost of a standard basket of goods and services, reflecting the exchange rate at which currencies have equal purchasing power. Understanding BoP helps analyze a nation's economic health and external position, while PPP provides insight into currency valuation and living standards across countries.

Defining Balance of Payments

Balance of Payments (BOP) is a comprehensive record of all economic transactions between residents of a country and the rest of the world during a specific period, including trade in goods and services, cross-border investments, and financial transfers. It is crucial for assessing a nation's economic stability and international financial position, influencing currency value and exchange rates. Unlike Purchasing Power Parity (PPP), which compares price levels to determine exchange rate equilibrium, BOP provides a broader view of a country's economic interactions and external financial health.

Understanding Purchasing Power Parity

Purchasing Power Parity (PPP) measures the relative value of currencies by comparing the cost of a standardized basket of goods across countries, reflecting price level differences and inflation rates. Unlike the balance of payments, which records a country's economic transactions with the rest of the world, PPP focuses on long-term currency valuation and cost of living adjustments. Understanding PPP aids in evaluating whether a currency is undervalued or overvalued, providing insights into exchange rate equilibrium beyond trade and capital flow data in the balance of payments.

Core Differences Between Balance of Payments and PPP

Balance of payments records all economic transactions between residents of a country and the rest of the world over a specific period, reflecting trade, investment, and financial flows. Purchasing power parity (PPP) measures the relative value of currencies based on the cost of a standard basket of goods and services in different countries to assess currency valuation and living standards. Core differences include balance of payments focusing on financial and trade accounts, while PPP centers on comparing purchasing power and exchange rate equilibrium.

Components of the Balance of Payments

The balance of payments (BOP) comprises the current account, capital account, and financial account, each recording transactions between a country and the rest of the world. The current account includes trade balance, net income from abroad, and current transfers, while the capital and financial accounts track foreign investments and reserve assets. Understanding these components is crucial when analyzing purchasing power parity (PPP), as imbalances in BOP can signal deviations from PPP in exchange rates.

Factors Influencing Purchasing Power Parity

Factors influencing Purchasing Power Parity (PPP) include inflation rate differentials, which directly affect the relative price levels between countries. Exchange controls, trade barriers, and transportation costs also impact the degree to which PPP holds by altering the flow and cost of goods across borders. Market imperfections, such as differing consumer preferences and product quality variations, further contribute to deviations from PPP equilibrium.

Practical Applications in Global Economics

Balance of payments (BOP) provides a comprehensive record of a country's international financial transactions, essential for assessing economic stability and guiding trade policies. Purchasing power parity (PPP) offers a method to compare countries' currency values based on relative price levels, improving accuracy in cross-country economic comparisons and exchange rate assessments. Together, BOP data and PPP adjustments enable policymakers and economists to devise effective strategies for trade negotiations, investment decisions, and inflation targeting in global markets.

Measurement Challenges and Limitations

The balance of payments faces measurement challenges due to timing mismatches and underreporting of informal transactions, impacting its accuracy in reflecting a country's economic interactions. Purchasing power parity (PPP) encounters limitations related to differences in local consumption patterns, non-tradable goods, and price level variations, which complicate direct currency value comparisons. Both concepts struggle with data inconsistencies and structural economic changes that hinder precise cross-country economic analysis.

Impact on Exchange Rates and Trade Policy

Balance of payments (BOP) reflects a country's international financial transactions and directly impacts exchange rates through supply and demand of foreign currencies, influencing trade balances and capital flows. Purchasing power parity (PPP) theory estimates equilibrium exchange rates based on relative price levels, guiding long-term currency valuation and highlighting deviations that affect competitiveness and trade policies. Policymakers use BOP data to implement trade restrictions or incentives, while PPP assessments inform adjustments in exchange rate regimes to stabilize trade imbalances and promote economic growth.

Concluding Insights: Relevance in Today’s Economy

Balance of payments (BOP) provides a comprehensive record of a country's international economic transactions, directly impacting exchange rates and global trade balances, while purchasing power parity (PPP) offers a theoretical framework for comparing currency values based on relative price levels and living costs across countries. In today's interconnected economy, BOP data is critical for policymakers to manage trade deficits and capital flows, whereas PPP remains essential for long-term currency valuation and economic comparisons beyond short-term market fluctuations. Integrating insights from both BOP and PPP enhances understanding of currency dynamics, facilitating more informed decisions in international trade, investment strategies, and economic policy formulation.

Balance of payments Infographic

libterm.com

libterm.com