Rising inflation impacts the cost of everyday goods and services, reducing your purchasing power over time. Understanding the causes and effects of inflation can help you make informed financial decisions to protect your savings. Explore the rest of this article to learn effective strategies for managing inflation in your personal finances.

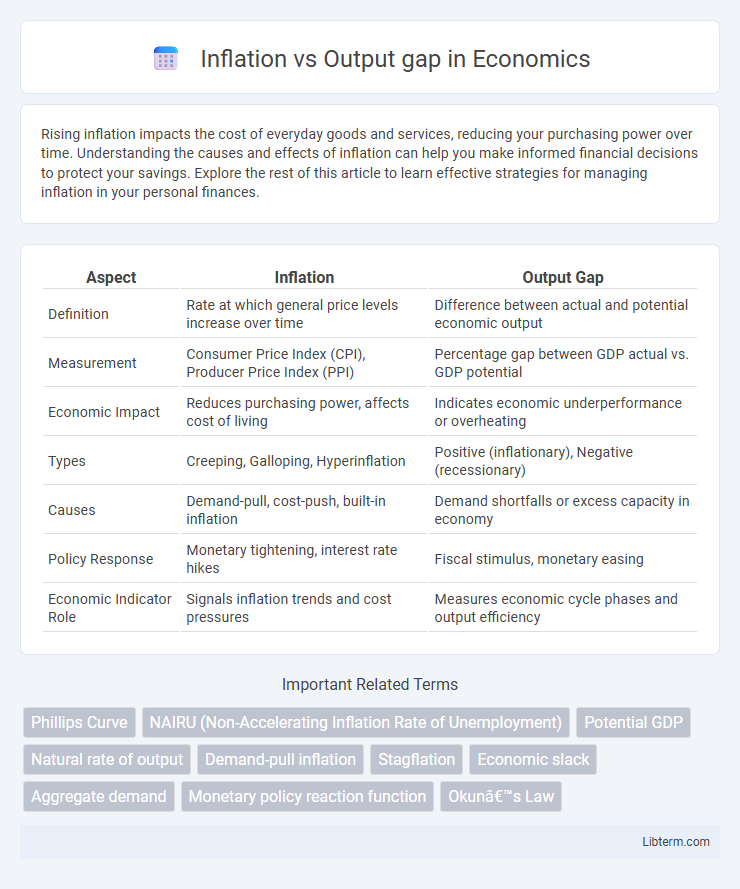

Table of Comparison

| Aspect | Inflation | Output Gap |

|---|---|---|

| Definition | Rate at which general price levels increase over time | Difference between actual and potential economic output |

| Measurement | Consumer Price Index (CPI), Producer Price Index (PPI) | Percentage gap between GDP actual vs. GDP potential |

| Economic Impact | Reduces purchasing power, affects cost of living | Indicates economic underperformance or overheating |

| Types | Creeping, Galloping, Hyperinflation | Positive (inflationary), Negative (recessionary) |

| Causes | Demand-pull, cost-push, built-in inflation | Demand shortfalls or excess capacity in economy |

| Policy Response | Monetary tightening, interest rate hikes | Fiscal stimulus, monetary easing |

| Economic Indicator Role | Signals inflation trends and cost pressures | Measures economic cycle phases and output efficiency |

Understanding Inflation: Definition and Causes

Inflation represents the sustained increase in the general price level of goods and services, eroding purchasing power. It can arise from demand-pull factors, where aggregate demand exceeds aggregate supply, or cost-push factors, including rising input costs like wages and raw materials. The output gap, indicating the difference between actual and potential GDP, directly influences inflation pressures--positive gaps drive demand-pull inflation, while negative gaps signal underused resources and subdued inflation.

What is the Output Gap?

The output gap measures the difference between actual economic output and potential output at full capacity. A positive output gap indicates an economy operating above its sustainable capacity, often leading to inflationary pressures. Conversely, a negative output gap signals underutilized resources, causing downward pressure on inflation and slower economic growth.

The Relationship Between Inflation and Output Gap

The relationship between inflation and output gap is central to understanding macroeconomic stability, where a positive output gap--when actual GDP exceeds potential GDP--typically leads to higher inflation due to increased demand pressures. Conversely, a negative output gap signals underutilized resources, resulting in lower inflation or deflationary tendencies as aggregate demand weakens. Policymakers monitor this dynamic closely to adjust monetary policy, aiming to maintain inflation near target levels while promoting sustainable economic growth.

Measuring the Output Gap: Methods and Challenges

Measuring the output gap involves comparing actual gross domestic product (GDP) to potential GDP, which reflects the economy's maximum sustainable output without inflationary pressure. Common methods include the production function approach, which estimates potential output by assessing labor, capital, and total factor productivity, and the statistical filters like the Hodrick-Prescott filter that isolate cyclical components from trend GDP. Challenges in measuring the output gap arise from data revisions, estimating potential output amid structural changes, and distinguishing temporary fluctuations from long-term growth trends.

Types of Inflation: Demand-pull vs. Cost-push

Demand-pull inflation occurs when aggregate demand exceeds aggregate supply, driving up prices due to increased consumer spending or investment, often reducing the output gap by pushing actual output closer to or above potential output. Cost-push inflation arises from rising production costs such as wages or raw materials, which can decrease supply, widen the output gap by lowering actual output below potential, and create stagflation. The output gap reflects the difference between actual and potential GDP, and understanding the type of inflation helps policymakers tailor interventions to stabilize economic growth and control price levels.

How Output Gap Influences Inflation Rates

The output gap, defined as the difference between actual and potential economic output, significantly influences inflation rates by signaling the degree of economic slack. A positive output gap indicates an economy exceeding its capacity, leading to increased demand-pull inflation as firms raise prices amid higher consumption and production pressures. Conversely, a negative output gap reflects underutilized resources, creating downward pressure on inflation due to subdued demand and excess capacity.

Policy Responses: Central Banks and the Output Gap

Central banks adjust monetary policy to manage the output gap and control inflation, often using interest rate changes to influence economic activity. When the output gap is positive, indicating demand exceeds potential output, central banks may raise interest rates to curb inflationary pressures. Conversely, a negative output gap prompts rate cuts to stimulate growth and reduce unemployment while aiming to keep inflation near target levels.

Real-World Examples: Inflation and Output Gap in Action

In 2023, the United States experienced a positive output gap as GDP growth outpaced potential output, leading to inflation rates exceeding the Federal Reserve's 2% target and prompting aggressive interest rate hikes. Conversely, Japan faced a negative output gap amid stagnant economic growth, resulting in persistent low inflation and deflationary pressures despite expansive monetary policies. These real-world scenarios illustrate the inverse relationship between inflation and output gaps, where overheated economies generate inflationary surges while underperforming economies struggle with subdued price levels.

Risks of Misjudging the Output Gap

Misjudging the output gap can lead to inappropriate monetary policy, either overstimulating the economy during an actual inflationary gap or tightening policy unnecessarily during a recessionary gap. This miscalculation risks fueling either runaway inflation or persistent unemployment, destabilizing economic growth. Accurate assessment of the output gap is critical for balancing inflation control and sustainable output expansion.

Future Outlook: Managing Inflation with Output Gap Analysis

Inflation management relies on accurately assessing the output gap, which measures the difference between actual and potential economic output. Future outlooks emphasize using real-time output gap analysis to adjust monetary policy, targeting inflation control while supporting sustainable growth. Advanced econometric models and high-frequency data improve forecasts, enabling central banks to preempt inflationary pressures through calibrated interest rate adjustments.

Inflation Infographic

libterm.com

libterm.com