The Fisher effect explains the relationship between nominal interest rates, real interest rates, and expected inflation, indicating that nominal rates adjust to reflect changes in inflation expectations. This concept is essential for understanding how inflation impacts your investment returns and borrowing costs over time. Explore the article to discover how the Fisher effect shapes financial decisions and economic policies.

Table of Comparison

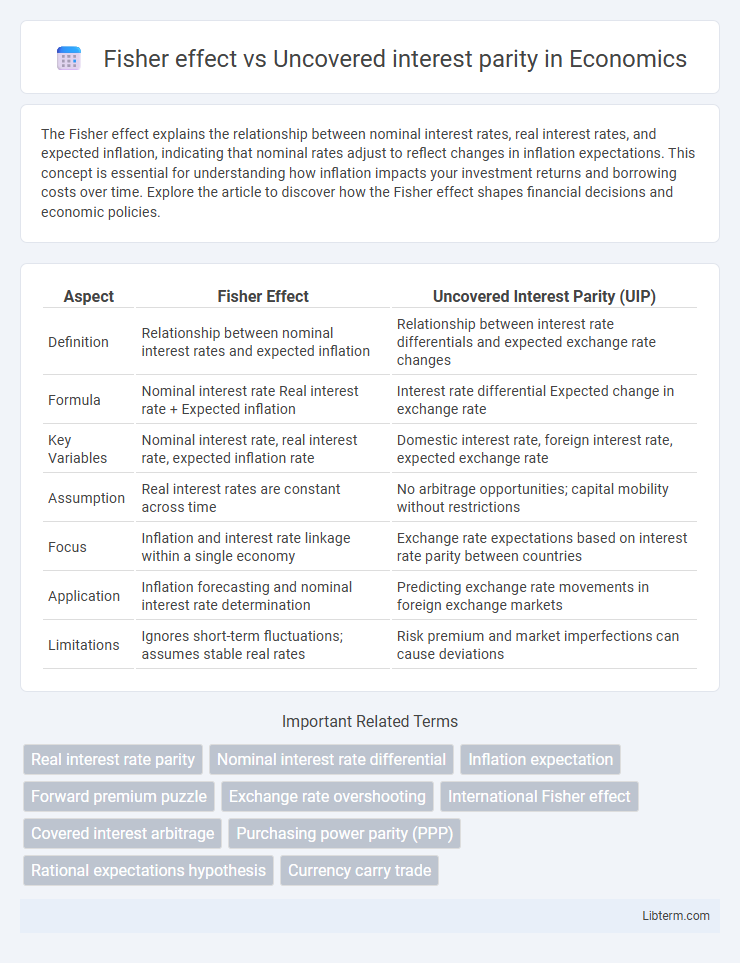

| Aspect | Fisher Effect | Uncovered Interest Parity (UIP) |

|---|---|---|

| Definition | Relationship between nominal interest rates and expected inflation | Relationship between interest rate differentials and expected exchange rate changes |

| Formula | Nominal interest rate Real interest rate + Expected inflation | Interest rate differential Expected change in exchange rate |

| Key Variables | Nominal interest rate, real interest rate, expected inflation rate | Domestic interest rate, foreign interest rate, expected exchange rate |

| Assumption | Real interest rates are constant across time | No arbitrage opportunities; capital mobility without restrictions |

| Focus | Inflation and interest rate linkage within a single economy | Exchange rate expectations based on interest rate parity between countries |

| Application | Inflation forecasting and nominal interest rate determination | Predicting exchange rate movements in foreign exchange markets |

| Limitations | Ignores short-term fluctuations; assumes stable real rates | Risk premium and market imperfections can cause deviations |

Introduction: Understanding Fisher Effect and UIP

The Fisher Effect explains the relationship between nominal interest rates and expected inflation, emphasizing that nominal rates adjust to reflect inflation expectations to maintain real interest rates. Uncovered Interest Parity (UIP) describes the equilibrium condition where the difference between nominal interest rates of two countries equals the expected change in exchange rates, influencing international capital flows. Both concepts are fundamental in understanding how inflation and exchange rate expectations drive interest rate dynamics in global financial markets.

Defining the Fisher Effect

The Fisher Effect defines the relationship between nominal interest rates, real interest rates, and expected inflation, stating that nominal rates adjust to reflect anticipated inflation changes. This concept is fundamental in macroeconomics to understand how inflation expectations influence interest rate movements over time. Unlike Uncovered Interest Parity, which connects interest rate differentials with expected exchange rate changes, the Fisher Effect centers solely on the interplay between inflation and interest rates domestically.

Explaining Uncovered Interest Parity (UIP)

Uncovered Interest Parity (UIP) posits that the difference in interest rates between two countries equals the expected change in exchange rates, implying no arbitrage opportunities in foreign exchange markets. UIP assumes investors are indifferent between domestic and foreign assets when adjusted for expected currency appreciation or depreciation, linking interest rate differentials directly to expected currency fluctuations. This contrasts with the Fisher effect, which relates nominal interest rates to expected inflation within a single economy without explicitly addressing currency risk or exchange rate expectations.

Core Assumptions of the Fisher Effect

The Fisher Effect assumes that nominal interest rates adjust to expected inflation rates, maintaining a stable real interest rate over time. It presupposes perfect information and rational expectations, where investors accurately forecast inflation and incorporate it into nominal rates. Unlike Uncovered Interest Parity, which relies on currency exchange rate expectations and capital mobility, the Fisher Effect centers solely on the relationship between inflation and interest rates within a single economy.

Key Assumptions Underlying UIP

Uncovered Interest Parity (UIP) assumes perfect capital mobility and risk-neutral investors who are indifferent between domestic and foreign assets when adjusted for expected exchange rate changes. It presumes rational expectations, meaning investors have unbiased forecasts of future exchange rates. Unlike the Fisher effect, which links nominal interest rates and inflation within a single country, UIP specifically relates interest rate differentials to expected currency depreciation or appreciation.

Mathematical Representation of Fisher Effect

The Fisher effect is mathematically expressed as i = r + p^e, where i denotes the nominal interest rate, r is the real interest rate, and p^e represents the expected inflation rate. Uncovered interest parity (UIP) states that the difference between nominal interest rates in two countries equals the expected change in exchange rates, formulated as i_domestic - i_foreign = (E_t+1 - E_t)/E_t. While the Fisher effect links nominal rates and inflation expectations, UIP connects interest rate differentials to exchange rate expectations, both critical in international finance models.

Mathematical Formulation of UIP

The mathematical formulation of Uncovered Interest Parity (UIP) states that the expected change in the exchange rate between two currencies equals the interest rate differential between the two countries, expressed as \( E(S_{t+1}) / S_t = (1 + i_t) / (1 + i_t^*) \), where \( E(S_{t+1}) \) is the expected future spot rate, \( S_t \) is the current spot rate, and \( i_t \), \( i_t^* \) are domestic and foreign nominal interest rates, respectively. The Fisher effect connects nominal interest rates to expected inflation, given as \( i = r + \pi^e \), linking real interest rates \( r \) and expected inflation \( \pi^e \), which influences UIP by determining the nominal rates used in the parity condition. While the Fisher effect explains the relationship between inflation and nominal interest rates within a country, UIP uses these nominal rates to predict exchange rate movements based on international interest rate differentials.

Differences between Fisher Effect and UIP

The Fisher Effect describes the relationship between nominal interest rates and expected inflation, asserting that nominal interest rates adjust one-for-one with inflation expectations to maintain constant real rates. Uncovered Interest Parity (UIP) explains the link between interest rate differentials and expected changes in exchange rates, positing that currencies with higher interest rates will depreciate to offset returns. Unlike the Fisher Effect, which focuses on domestic inflation and real interest rates, UIP centers on international market equilibrium and currency risk without assuming perfect inflation pass-through.

Practical Implications in Forex and Investment

The Fisher effect explains how nominal interest rates adjust to expected inflation, influencing currency values through real interest rate expectations in forex markets. Uncovered Interest Parity (UIP) suggests that expected changes in exchange rates offset interest rate differentials, guiding forex traders on arbitrage opportunities and hedging strategies. Investors use the Fisher effect to anticipate inflation impacts on returns, while UIP helps forecast currency movements, both essential for optimizing investment portfolios and managing forex risk.

Conclusion: Which Concept Guides Market Expectations?

The Fisher effect explains how nominal interest rates adjust to expected inflation, providing insight into real interest rate stability over time. Uncovered interest parity (UIP) links exchange rate changes to interest rate differentials between countries, reflecting market expectations of currency movements. Market expectations are more directly guided by UIP, as it incorporates both interest rate differentials and anticipated exchange rate adjustments, making it crucial for forecasting currency risks in international finance.

Fisher effect Infographic

libterm.com

libterm.com