Moral hazard occurs when individuals or institutions take greater risks because they do not bear the full consequences of their actions, often due to protection like insurance or guarantees. This behavior can lead to inefficient market outcomes and increased systemic risks in finance, insurance, and other sectors. Explore the rest of this article to understand how moral hazard impacts economic decisions and what measures can mitigate its effects.

Table of Comparison

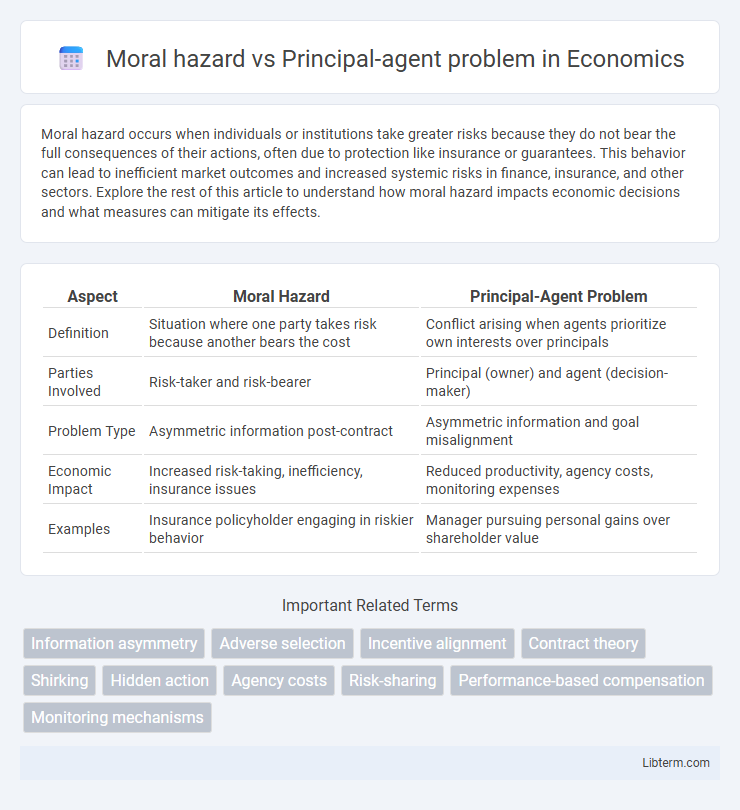

| Aspect | Moral Hazard | Principal-Agent Problem |

|---|---|---|

| Definition | Situation where one party takes risk because another bears the cost | Conflict arising when agents prioritize own interests over principals |

| Parties Involved | Risk-taker and risk-bearer | Principal (owner) and agent (decision-maker) |

| Problem Type | Asymmetric information post-contract | Asymmetric information and goal misalignment |

| Economic Impact | Increased risk-taking, inefficiency, insurance issues | Reduced productivity, agency costs, monitoring expenses |

| Examples | Insurance policyholder engaging in riskier behavior | Manager pursuing personal gains over shareholder value |

Understanding Moral Hazard: An Overview

Moral hazard occurs when one party takes on excessive risks because another party bears the consequences, often arising from asymmetric information between involved entities. The principal-agent problem highlights conflicts of interest where the agent's actions may not align with the principal's goals, exacerbating moral hazard in contractual relationships. Understanding moral hazard involves analyzing incentives, risk-shifting behaviors, and mechanisms such as monitoring or contracts designed to mitigate its impact.

Defining the Principal-Agent Problem

The principal-agent problem arises when one party (the agent) makes decisions on behalf of another party (the principal), but their interests are not perfectly aligned, leading to conflicts and inefficiencies. This problem centers on information asymmetry, where the agent possesses more information about their actions or intentions than the principal, making it difficult for the principal to monitor or control behavior effectively. Unlike moral hazard, which specifically involves risk-taking due to misaligned incentives, the principal-agent problem broadly encompasses challenges in contract design, monitoring, and ensuring that agents act in the principals' best interests.

Key Differences Between Moral Hazard and Principal-Agent Problem

Moral hazard occurs when one party takes excessive risks because they do not bear the full consequences, while the principal-agent problem arises from conflicts of interest between a principal and an agent who makes decisions on the principal's behalf. The key difference lies in moral hazard's emphasis on hidden actions after a contract is made, whereas the principal-agent problem centers on aligning incentives and information asymmetry before and during the contract execution. Effective contract design and monitoring mechanisms target reducing both issues by improving transparency and incentive alignment.

Real-World Examples of Moral Hazard

Moral hazard occurs when one party takes undue risks because another bears the consequences, commonly seen in insurance where policyholders may engage in riskier behavior knowing they are covered. In contrast, the principal-agent problem arises when an agent prioritizes personal interests over those of the principal, such as a company's CEO pursuing growth strategies that benefit themselves rather than shareholders. Real-world examples of moral hazard include banks taking excessive financial risks knowing they might receive government bailouts during crises and employees slacking off when their performance is difficult to monitor.

Illustrative Cases of the Principal-Agent Problem

The principal-agent problem arises when an agent, entrusted to act on behalf of a principal, pursues personal interests that conflict with the principal's goals, as seen in corporate management where executives may prioritize short-term gains over shareholder value. In the insurance industry, moral hazard occurs when insured individuals engage in riskier behavior because they do not bear the full cost of that behavior, whereas the principal-agent problem involves insurers monitoring agents or brokers who might misrepresent policies. Illustrative cases include the 2008 financial crisis, where mortgage brokers originated risky loans to benefit from commissions despite the long-term risks to investors, highlighting information asymmetry and misaligned incentives between principals and agents.

Core Causes of Moral Hazard in Organizations

Moral hazard in organizations arises primarily from information asymmetry and misaligned incentives between principals and agents, leading agents to take risks or shirk responsibilities knowing they are insulated from the full consequences. The principal-agent problem intensifies this dynamic when agents possess more information about their actions than principals, resulting in actions that may not align with the organization's best interests. Core causes include lack of effective monitoring, divergent goals, and inadequate incentive structures that fail to promote accountability and transparency.

Incentives and Conflicts in Principal-Agent Relationships

Moral hazard arises when one party in a principal-agent relationship takes risks because the negative consequences are borne by the other party, leading to misaligned incentives. In principal-agent problems, the agent's objectives often diverge from the principal's goals, creating conflicts that undermine efficient decision-making and performance. Effective incentive structures and monitoring mechanisms are essential to align interests and mitigate losses caused by asymmetric information and opportunistic behavior.

Economic Impacts of Moral Hazard vs Principal-Agent Problem

Moral hazard leads to inefficient risk-taking behavior because one party, shielded from risk, may act contrary to the principal's interest, increasing costs and market failures. The principal-agent problem creates misaligned incentives between principals and agents, resulting in resource misallocation, reduced productivity, and higher monitoring expenses. Both issues distort market outcomes but moral hazard directly elevates risk exposure while principal-agent problems undermine optimal contract enforcement and decision-making efficiency.

Mitigation Strategies for Both Issues

Mitigation strategies for moral hazard include implementing performance-based incentives, increasing monitoring through audits or real-time data tracking, and designing contracts that align the interests of agents with principals. For the principal-agent problem, solutions involve clearly defining roles and responsibilities, employing screening and bonding mechanisms, and fostering transparent communication to reduce information asymmetry. Both issues benefit from the incorporation of incentive-compatible contracts and robust governance structures to ensure accountability and reduce opportunistic behavior.

Future Trends in Managing Agency Dilemmas

Future trends in managing agency dilemmas involve leveraging advanced data analytics and artificial intelligence to enhance monitoring and reduce moral hazard risks in principal-agent relationships. Blockchain technology is increasingly utilized to create transparent, tamper-proof contract enforcement, aligning interests between principals and agents more effectively. Emphasis on behavioral economics and incentive design innovations drives the development of adaptive governance frameworks, minimizing information asymmetry and agency costs in dynamic business environments.

Moral hazard Infographic

libterm.com

libterm.com