The IS-LM model illustrates the interaction between the goods market (Investment-Savings) and the money market (Liquidity Preference-Money Supply) to determine aggregate output and interest rates. It is essential for understanding how fiscal and monetary policies influence economic equilibrium. Explore the rest of the article to learn how the IS-LM framework applies to real-world economic scenarios and impacts Your financial decision-making.

Table of Comparison

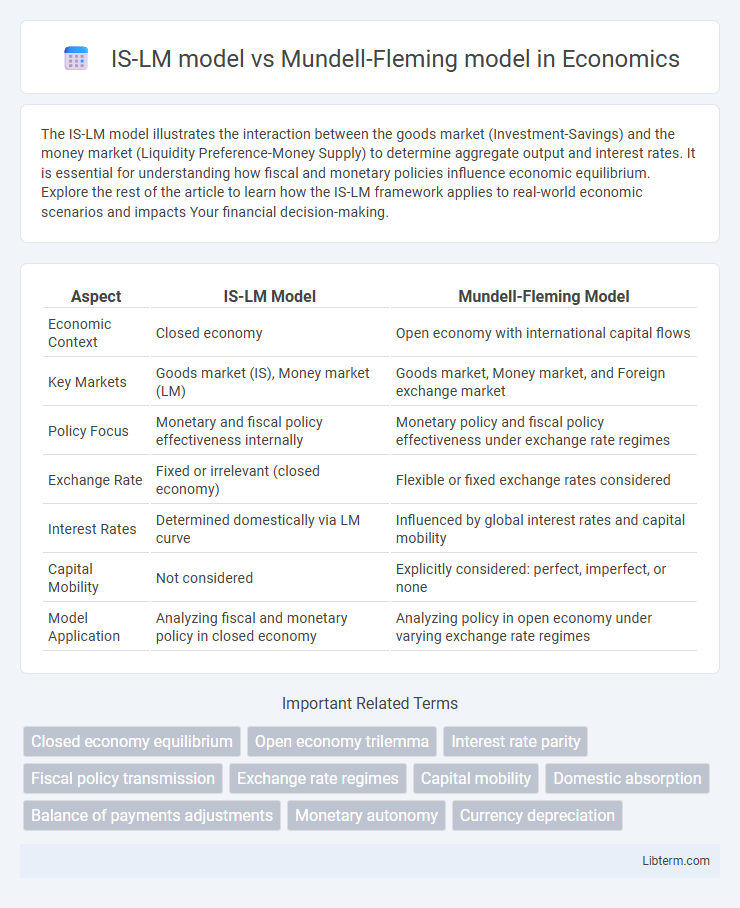

| Aspect | IS-LM Model | Mundell-Fleming Model |

|---|---|---|

| Economic Context | Closed economy | Open economy with international capital flows |

| Key Markets | Goods market (IS), Money market (LM) | Goods market, Money market, and Foreign exchange market |

| Policy Focus | Monetary and fiscal policy effectiveness internally | Monetary policy and fiscal policy effectiveness under exchange rate regimes |

| Exchange Rate | Fixed or irrelevant (closed economy) | Flexible or fixed exchange rates considered |

| Interest Rates | Determined domestically via LM curve | Influenced by global interest rates and capital mobility |

| Capital Mobility | Not considered | Explicitly considered: perfect, imperfect, or none |

| Model Application | Analyzing fiscal and monetary policy in closed economy | Analyzing policy in open economy under varying exchange rate regimes |

Introduction to Macroeconomic Models

The IS-LM model analyzes equilibrium in a closed economy by focusing on the interaction between the goods market (Investment-Savings) and the money market (Liquidity preference-Money supply). The Mundell-Fleming model extends the IS-LM framework to an open economy, incorporating international capital flows, exchange rates, and trade balances under different exchange rate regimes. These foundational macroeconomic models explain how fiscal and monetary policies influence output, interest rates, and exchange rates, providing critical insights for economic policy formulation.

Overview of the IS-LM Model

The IS-LM model represents the equilibrium in the goods and money markets within a closed economy, where the IS curve shows combinations of interest rates and output for which investment equals savings, and the LM curve represents money market equilibrium with given liquidity preference and money supply. It emphasizes the interaction between real output (GDP) and interest rates to determine short-run macroeconomic equilibrium, primarily under fixed price levels. The model forms the foundation for understanding fiscal and monetary policy effects on national income and interest rates without considering international trade or capital flows.

Key Assumptions of the IS-LM Framework

The IS-LM model assumes a closed economy with fixed prices and interest-sensitive investment and savings, where the goods market (IS curve) and money market (LM curve) determine equilibrium output and interest rates. It presumes a fixed exchange rate regime, ignoring international capital flows and trade effects. In contrast, the Mundell-Fleming model extends the IS-LM framework to an open economy by incorporating currency exchange rates, capital mobility, and the balance of payments, highlighting how monetary and fiscal policies affect output under fixed or flexible exchange rates.

Introduction to the Mundell-Fleming Model

The Mundell-Fleming model extends the IS-LM framework by incorporating an open economy setting, analyzing how exchange rates and capital mobility affect output and interest rates under different exchange rate regimes. It emphasizes the interaction between fiscal and monetary policy with external balance, highlighting the limited effectiveness of domestic policies in an open economy with perfect capital mobility. This model demonstrates that under fixed exchange rates, fiscal policy is potent while monetary policy is neutral, whereas the opposite holds true under flexible exchange rates.

Core Assumptions of the Mundell-Fleming Model

The Mundell-Fleming model assumes a small open economy with perfect capital mobility and a fixed or flexible exchange rate regime, contrasting with the IS-LM model's closed economy framework. It incorporates the balance of payments equilibrium alongside goods and money markets, emphasizing the impact of international capital flows on national income and interest rates. This model assumes that domestic interest rates are influenced by foreign interest rates and exchange rate expectations, integrating external sector dynamics absent in the traditional IS-LM analysis.

Closed Economy vs. Open Economy: A Fundamental Distinction

The IS-LM model is designed for a closed economy, analyzing the interaction between the goods market (IS curve) and the money market (LM curve) to determine equilibrium output and interest rates without international trade considerations. In contrast, the Mundell-Fleming model extends this framework to an open economy by incorporating capital mobility and exchange rate regimes, highlighting how fiscal and monetary policies affect national income under varying degrees of capital openness. This fundamental distinction between closed and open economies critically influences policy effectiveness and macroeconomic outcomes in each model.

Policy Effectiveness: Fiscal and Monetary Policy Comparison

The IS-LM model illustrates that fiscal policy is highly effective in influencing output in a closed economy, while monetary policy primarily affects interest rates with limited direct impact on real output. In contrast, the Mundell-Fleming model, designed for an open economy with capital mobility, shows that under fixed exchange rates, fiscal policy is more effective and monetary policy is largely neutralized, whereas under flexible exchange rates, monetary policy becomes potent in adjusting output, but fiscal policy loses effectiveness due to exchange rate adjustments. The differential responses in both models underscore how exchange rate regimes and capital mobility critically determine the relative effectiveness of fiscal and monetary policies.

Exchange Rate Regimes and Model Implications

The IS-LM model primarily addresses closed economy analysis, assuming fixed prices and no exchange rate considerations, making it less suited for open economies with varying exchange rate regimes. In contrast, the Mundell-Fleming model extends the IS-LM framework to an open economy, explicitly incorporating exchange rate regimes by differentiating between fixed and flexible exchange rates, which critically impacts monetary and fiscal policy effectiveness. Under fixed exchange rates, monetary policy loses effectiveness due to capital mobility, while fiscal policy shifts output; flexible exchange rates reverse this dynamic, emphasizing the Mundell-Fleming model's importance in analyzing international macroeconomic policy under different exchange rate systems.

Limitations and Criticisms of Both Models

The IS-LM model, designed for a closed economy, faces limitations in capturing the complexities of open economies and international capital flows, often oversimplifying exchange rate and trade dynamics. The Mundell-Fleming model extends IS-LM to an open economy but assumes perfect capital mobility and fixed or flexible exchange rates, which can misrepresent real-world frictions and policy effectiveness under varying capital controls. Both models are criticized for relying on static analysis, ignoring expectations and financial market imperfections, limiting their predictive accuracy in modern dynamic and globalized economic environments.

Conclusion: Choosing the Right Model for Economic Analysis

The IS-LM model suits closed economies by effectively analyzing interest rates and output through monetary and fiscal policy interactions. The Mundell-Fleming model extends this framework to open economies, incorporating exchange rates and capital mobility for comprehensive international economic analysis. Selecting between these models depends on the economy's openness and the specific policy variables under consideration.

IS-LM model Infographic

libterm.com

libterm.com