Behavioral economics explores how psychological, cognitive, and emotional factors influence economic decision-making, often deviating from traditional rational models. It reveals how biases, heuristics, and social influences shape your financial choices and market behavior. Discover how these insights can improve your understanding of economic actions by reading the full article.

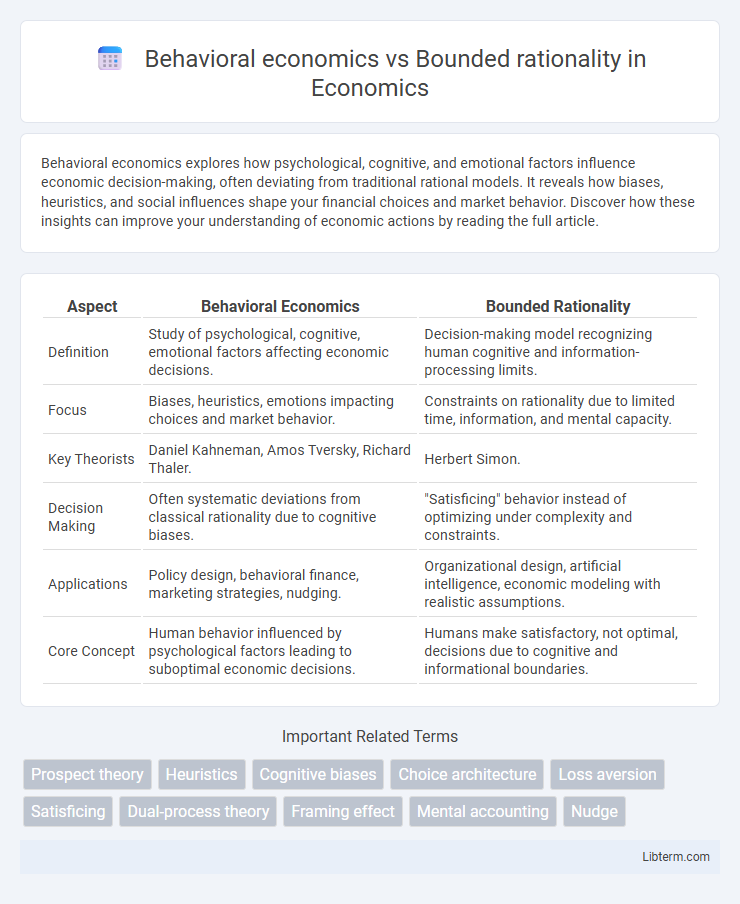

Table of Comparison

| Aspect | Behavioral Economics | Bounded Rationality |

|---|---|---|

| Definition | Study of psychological, cognitive, emotional factors affecting economic decisions. | Decision-making model recognizing human cognitive and information-processing limits. |

| Focus | Biases, heuristics, emotions impacting choices and market behavior. | Constraints on rationality due to limited time, information, and mental capacity. |

| Key Theorists | Daniel Kahneman, Amos Tversky, Richard Thaler. | Herbert Simon. |

| Decision Making | Often systematic deviations from classical rationality due to cognitive biases. | "Satisficing" behavior instead of optimizing under complexity and constraints. |

| Applications | Policy design, behavioral finance, marketing strategies, nudging. | Organizational design, artificial intelligence, economic modeling with realistic assumptions. |

| Core Concept | Human behavior influenced by psychological factors leading to suboptimal economic decisions. | Humans make satisfactory, not optimal, decisions due to cognitive and informational boundaries. |

Introduction to Behavioral Economics and Bounded Rationality

Behavioral economics studies how psychological, cognitive, and emotional factors influence economic decision-making, deviating from classical economic models of rationality. Bounded rationality, a concept introduced by Herbert Simon, refers to the limitations individuals face in processing information, leading to satisficing rather than optimizing decisions. Both frameworks highlight the impact of human cognitive constraints and biases on economic behavior, challenging the assumption of fully rational agents.

Core Concepts of Behavioral Economics

Behavioral economics explores how psychological factors and cognitive biases influence economic decision-making, challenging the traditional assumption of fully rational agents. Core concepts include heuristics, framing effects, loss aversion, and prospect theory, which explain deviations from expected utility maximization. Bounded rationality complements behavioral economics by emphasizing cognitive limitations and satisficing behavior rather than perfect optimization in economic choices.

Defining Bounded Rationality

Bounded rationality, a concept introduced by Herbert Simon, defines the cognitive limitations humans face when making decisions, such as finite information, limited time, and cognitive constraints. Behavioral economics studies how these limitations, along with psychological factors, systematically influence economic decisions, deviating from the ideal of perfectly rational agents. Understanding bounded rationality is crucial for analyzing real-world economic behavior beyond traditional rational choice models.

Key Differences Between Behavioral Economics and Bounded Rationality

Behavioral economics explores systematic cognitive biases and heuristics influencing economic decisions, incorporating psychological insights to explain deviations from traditional rational choice theory. In contrast, bounded rationality emphasizes the limitations of human information processing, decision-making under constraints such as limited time and computational capacity, leading to satisficing rather than optimizing behavior. Key differences lie in behavioral economics' focus on empirical deviations and anomalies, whereas bounded rationality concentrates on the structural constraints shaping decision processes.

Theoretical Foundations and Influential Thinkers

Behavioral economics integrates psychological insights into economic theory, challenging the classical assumption of fully rational actors by highlighting systematic biases and heuristics, as established by Daniel Kahneman and Amos Tversky through Prospect Theory. Bounded rationality, introduced by Herbert Simon, emphasizes cognitive limitations and satisficing behavior, arguing that decision-making operates within the constraints of limited information and computational capacity. Both frameworks underpin a more nuanced understanding of human behavior in economic models, reshaping approaches in policy-making and market analysis.

Decision-Making Models in Both Approaches

Behavioral economics incorporates psychological insights into economic models to explain deviations from perfect rationality by analyzing decision-making processes influenced by biases and heuristics. Bounded rationality, introduced by Herbert Simon, models decision-makers as satisficers who seek satisfactory solutions within cognitive and informational constraints rather than optimal ones. Both approaches emphasize realistic decision-making models that account for human limitations but differ in focus; behavioral economics highlights systematic biases, while bounded rationality underscores cognitive constraints shaping choices.

Applications in Real-World Economic Behavior

Behavioral economics applies psychological insights to explain anomalies in traditional economic models, improving predictions in areas like consumer choice, saving behavior, and financial market dynamics. Bounded rationality recognizes cognitive limitations and incomplete information, influencing decision-making processes in scenarios such as organizational management and public policy design. Both frameworks enhance understanding of real-world economic behavior by accounting for irrationalities and constraints, leading to more effective interventions and market strategies.

Common Criticisms and Limitations

Behavioral economics faces criticism for often relying on experiments with limited external validity and sometimes lacking predictive power across diverse contexts. Bounded rationality is challenged due to its vague definitions of cognitive limitations and the difficulty in quantifying satisficing behavior within complex decision-making processes. Both approaches struggle with integrating normative models, leading to debates on their practical applicability in economic policy and market predictions.

Implications for Policy and Market Design

Behavioral economics highlights systematic biases and heuristics influencing decision-making, necessitating policy designs that incorporate nudges and defaults to improve outcomes. Bounded rationality emphasizes cognitive limitations and information-processing constraints, suggesting simplified choice architectures and adaptive regulations to accommodate limited attention and computational capacity. Both frameworks advocate for market designs that enhance decision quality by accounting for psychological factors and realistic cognitive boundaries in consumers and firms.

Future Directions in Economic Theory

Future directions in economic theory emphasize integrating behavioral economics and bounded rationality to create more realistic models of decision-making. Researchers are exploring how cognitive limitations, heuristics, and biases influence economic choices in dynamic environments, improving predictive accuracy. Advances in neuroeconomics and experimental methods are expected to refine these theories, fostering policies that better capture human behavior under uncertainty.

Behavioral economics Infographic

libterm.com

libterm.com