Exchange rate policy directly influences a country's economic stability by managing the value of its currency against others to control inflation, boost exports, and attract foreign investment. Effective exchange rate strategies help you navigate global markets, protect purchasing power, and foster economic growth. Discover how different exchange rate policies impact economies and what they mean for your financial decisions in the full article.

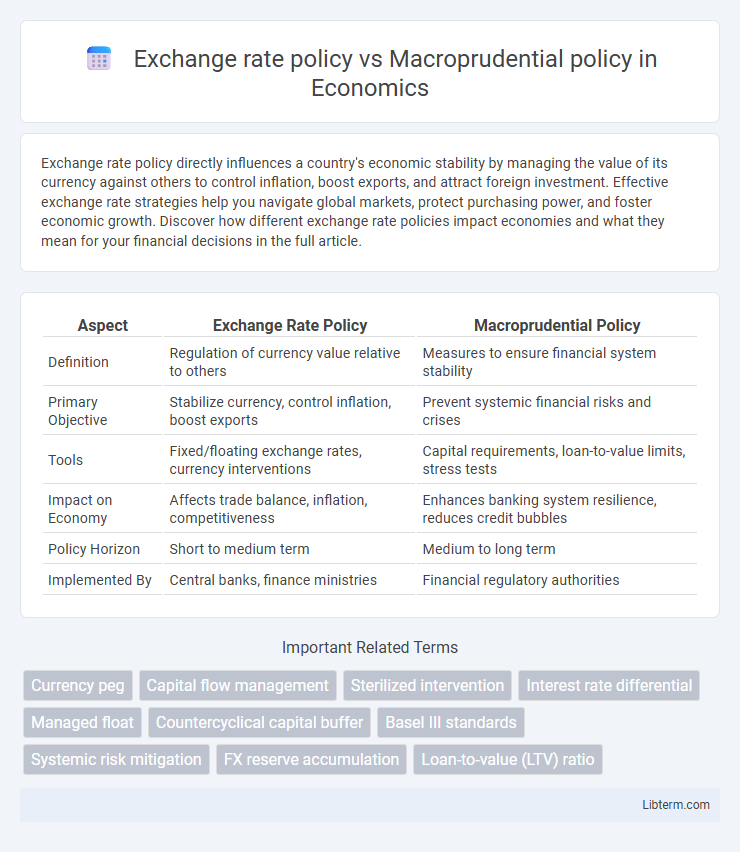

Table of Comparison

| Aspect | Exchange Rate Policy | Macroprudential Policy |

|---|---|---|

| Definition | Regulation of currency value relative to others | Measures to ensure financial system stability |

| Primary Objective | Stabilize currency, control inflation, boost exports | Prevent systemic financial risks and crises |

| Tools | Fixed/floating exchange rates, currency interventions | Capital requirements, loan-to-value limits, stress tests |

| Impact on Economy | Affects trade balance, inflation, competitiveness | Enhances banking system resilience, reduces credit bubbles |

| Policy Horizon | Short to medium term | Medium to long term |

| Implemented By | Central banks, finance ministries | Financial regulatory authorities |

Introduction to Exchange Rate Policy and Macroprudential Policy

Exchange rate policy involves managing a country's currency value relative to others to influence trade balances and economic stability, often through fixed, floating, or managed exchange rate regimes. Macroprudential policy focuses on reducing systemic risks within the financial system by implementing regulatory measures like capital requirements, stress testing, and leverage limits to enhance economic resilience. Both policies aim to stabilize the economy, with exchange rate policy targeting external sectors and macroprudential policy concentrating on internal financial stability.

Defining Exchange Rate Policy: Objectives and Tools

Exchange rate policy aims to stabilize a country's currency value relative to others, promoting trade competitiveness and controlling inflation through instruments like fixed, floating, or managed exchange rates. Governments and central banks use interventions such as foreign exchange reserves adjustment, currency pegs, and interest rate changes to influence exchange rates. These measures target objectives including economic stability, export growth, and prevention of currency volatility risks.

Understanding Macroprudential Policy: Goals and Instruments

Macroprudential policy aims to safeguard the stability of the financial system by addressing systemic risks that can lead to financial crises. Its instruments include countercyclical capital buffers, loan-to-value (LTV) ratios, and debt-to-income (DTI) limits, designed to limit excessive credit growth and leverage. These tools complement exchange rate policy, which primarily manages currency volatility and external imbalances but does not directly target financial sector vulnerabilities.

Key Differences Between Exchange Rate and Macroprudential Policies

Exchange rate policy primarily targets the stability and competitiveness of a country's currency in foreign exchange markets, influencing trade balances and inflation rates. Macroprudential policy focuses on the stability of the financial system by addressing systemic risks and preventing financial crises through tools like capital requirements and loan-to-value ratios. The key difference lies in their objectives: exchange rate policy manages external economic relations, while macroprudential policy safeguards internal financial market resilience.

Impact on Financial Stability: A Comparative Analysis

Exchange rate policy influences financial stability by managing currency volatility and external shocks, thereby affecting capital flows and inflation control. Macroprudential policy directly targets systemic risks within the financial system through tools such as countercyclical capital buffers and loan-to-value ratio limits to enhance resilience. Comparing both, exchange rate policy provides indirect stability via external balance, while macroprudential policy delivers targeted, micro- and macro-level safeguards against financial imbalances and crises.

Exchange Rate Policy and Inflation Control

Exchange rate policy directly influences inflation control by stabilizing currency value, thereby reducing imported inflation and enhancing price predictability. Central banks often use exchange rate interventions to manage inflation expectations, especially in economies highly dependent on foreign trade. Effective exchange rate stabilization can complement macroprudential measures by anchoring inflation and supporting overall economic stability.

Macroprudential Measures for Preventing Systemic Risks

Macroprudential policy employs regulatory tools like countercyclical capital buffers and loan-to-value ratio limits to prevent systemic risks and enhance financial stability by addressing vulnerabilities in the banking sector and credit markets. Unlike exchange rate policy, which targets currency valuation and trade balance, macroprudential measures focus on controlling credit growth, leverage, and liquidity risks that can trigger financial crises. Implementing these tools helps reduce the probability of widespread defaults and asset bubbles, safeguarding the economy from shocks and imbalances.

Policy Coordination: Synergies and Conflicts

Exchange rate policy and macroprudential policy interact closely, with coordinated efforts enhancing financial stability and mitigating currency volatility. Synergies arise when exchange rate interventions complement macroprudential measures, such as capital controls, to reduce systemic risks and manage external shocks. Conflicts can occur if exchange rate policies aimed at competitiveness undermine macroprudential restraints, potentially triggering asset bubbles or capital flight.

Case Studies: Global Approaches to Policy Implementation

Exchange rate policy and macroprudential policy often intersect in managing financial stability, as evidenced by case studies from emerging markets like South Korea and advanced economies such as the Eurozone. South Korea's use of capital flow management alongside targeted macroprudential measures helped stabilize the exchange rate during volatile periods, while the Eurozone's emphasis on macroprudential buffers supports currency stability without direct exchange rate interventions. These examples highlight global approaches where tailored macroprudential tools complement exchange rate policies to mitigate external shocks and enhance economic resilience.

Future Trends in Monetary and Macroprudential Policy Integration

Future trends in monetary and macroprudential policy integration emphasize coordinated approaches to managing exchange rate fluctuations and financial stability. Central banks are increasingly using real-time data analytics and machine learning to fine-tune exchange rate policies alongside macroprudential tools like capital buffers and loan-to-value ratios. This integration aims to enhance resilience against cross-border capital flow volatility and systemic risks in global financial markets.

Exchange rate policy Infographic

libterm.com

libterm.com