The asset pricing kernel, also known as the stochastic discount factor, plays a crucial role in determining the present value of future cash flows by capturing investors' risk preferences and time value of money. It links asset returns to marginal utility, helping to explain variations in asset prices across different market conditions. Explore the rest of this article to understand how the asset pricing kernel influences financial decision-making and portfolio management.

Table of Comparison

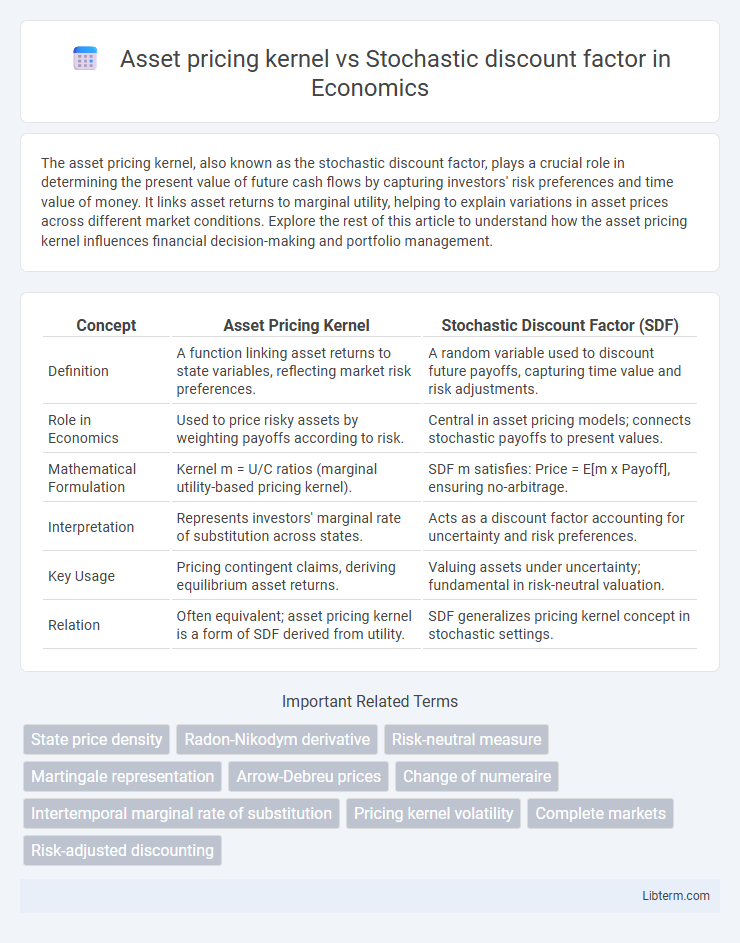

| Concept | Asset Pricing Kernel | Stochastic Discount Factor (SDF) |

|---|---|---|

| Definition | A function linking asset returns to state variables, reflecting market risk preferences. | A random variable used to discount future payoffs, capturing time value and risk adjustments. |

| Role in Economics | Used to price risky assets by weighting payoffs according to risk. | Central in asset pricing models; connects stochastic payoffs to present values. |

| Mathematical Formulation | Kernel m = U/C ratios (marginal utility-based pricing kernel). | SDF m satisfies: Price = E[m x Payoff], ensuring no-arbitrage. |

| Interpretation | Represents investors' marginal rate of substitution across states. | Acts as a discount factor accounting for uncertainty and risk preferences. |

| Key Usage | Pricing contingent claims, deriving equilibrium asset returns. | Valuing assets under uncertainty; fundamental in risk-neutral valuation. |

| Relation | Often equivalent; asset pricing kernel is a form of SDF derived from utility. | SDF generalizes pricing kernel concept in stochastic settings. |

Introduction to Asset Pricing Kernel and Stochastic Discount Factor

The asset pricing kernel, also known as the stochastic discount factor (SDF), is a fundamental concept in financial economics used to price risky assets by discounting future payoffs to present value. It captures investors' time preferences and attitudes toward risk, enabling the valuation of uncertain cash flows through expected discounted returns. The stochastic discount factor serves as a key tool in asset pricing models, linking state-contingent payoffs with their current prices under the risk-neutral probability measure.

Core Concepts: Defining Asset Pricing Kernel

The asset pricing kernel, also known as the stochastic discount factor (SDF), serves as a fundamental concept linking asset payoffs to their current prices by capturing the state-dependent marginal utility of consumption. It operates as a random variable that discounts future uncertain cash flows to present values, reflecting investors' risk preferences and time value of money. Core to asset pricing theory, the kernel satisfies the no-arbitrage condition through its role in expected value calculations of discounted payoffs under the physical probability measure.

Core Concepts: Defining Stochastic Discount Factor

The stochastic discount factor (SDF) serves as a central tool in asset pricing, linking future payoffs to present values by accounting for time and uncertainty. It functions as a random variable that, when multiplied by asset returns, produces an expectation equaling the current asset price, embodying investors' risk preferences and market dynamics. This core concept differentiates the SDF from the asset pricing kernel, emphasizing its probabilistic role in discounting future cash flows across states of the world.

Theoretical Foundations and Mathematical Formulation

The Asset Pricing Kernel and Stochastic Discount Factor (SDF) both serve as fundamental tools in modern financial economics to price risky assets by linking payoffs to their present values through state-contingent valuation. The Asset Pricing Kernel is often expressed as a pricing function that adjusts future payoffs to their present value, defined as the ratio of marginal utility of consumption across states, while the SDF is mathematically formulated as a random variable, m_t+1, satisfying the key equation E[m_t+1 * R_t+1] = 1 for all assets, where R_t+1 represents gross returns. Both concepts rest on the Euler equation derived from intertemporal utility maximization, underpinning equilibrium asset prices through no-arbitrage conditions and consumption-based capital asset pricing models (CCAPM).

Relationship Between Asset Pricing Kernel and Stochastic Discount Factor

The asset pricing kernel and stochastic discount factor (SDF) are fundamental concepts that describe how future payoffs are discounted to present value in asset pricing models. Both terms are often used interchangeably, as the asset pricing kernel represents the state-price density that prices assets, while the SDF acts as the multiplicative factor adjusting future cash flows for risk and time preferences. The relationship lies in their role as dual representations of the same theoretical object, where the SDF weights future payoffs to reflect the marginal utility of consumption and the asset pricing kernel encapsulates this discounting mechanism in a probabilistic framework.

Economic Interpretation and Significance

The asset pricing kernel, also known as the stochastic discount factor (SDF), represents the state-price density used to discount future uncertain payoffs to their present values, reflecting investors' marginal rates of substitution across states of the economy. Its economic interpretation lies in capturing risk preferences and the time value of money, integrating consumption patterns and investment opportunities into asset valuation. This kernel is significant for linking equilibrium asset prices to macroeconomic fundamentals and for understanding how risk premia emerge from economic shocks and investor behavior.

Practical Applications in Financial Markets

The asset pricing kernel and stochastic discount factor serve as fundamental tools for evaluating the present value of uncertain future cash flows in financial markets. Both concepts enable practitioners to price derivatives, assess risk premia, and optimize portfolios by capturing time-varying risk preferences and state-dependent pricing. Practical applications include arbitrage pricing theory, risk management strategies, and calibration of models used in asset allocation and option pricing.

Differences and Similarities: Comparative Analysis

The asset pricing kernel and the stochastic discount factor (SDF) both serve as fundamental tools in financial economics for pricing assets by adjusting future payoffs to present values based on risk preferences and time value of money. The key difference lies in their interpretation: the asset pricing kernel is often viewed as a pricing operator capturing marginal rates of substitution in consumption, whereas the SDF explicitly represents the state-price density or the pricing weight applied to payoffs under uncertainty. Both concepts are mathematically equivalent and central to models like the CAPM and consumption-based asset pricing models, linking expected returns to covariation with the SDF or kernel.

Empirical Estimation and Model Implementation

Empirical estimation of the asset pricing kernel and stochastic discount factor (SDF) involves using historical asset returns and macroeconomic variables to identify a function that accurately prices all assets in the market. Model implementation typically relies on GMM (Generalized Method of Moments) or maximum likelihood estimation to estimate parameters of the SDF, ensuring it satisfies the no-arbitrage condition and fits observed return moments. Advances in econometric techniques aid in robust identification of the kernel/SDF, improving asset pricing models by capturing time-varying risk premia and heterogeneous market frictions.

Implications for Asset Pricing Theory and Investment Decisions

The asset pricing kernel, also known as the stochastic discount factor (SDF), serves as a fundamental tool in asset pricing theory by linking risk preferences to expected returns through state-price densities. Understanding the SDF enables investors to accurately price contingent claims and assess risk-adjusted performance across varying economic states. Incorporating the stochastic discount factor into investment decisions enhances portfolio optimization by accounting for time-varying risk premiums and market incompleteness, thereby improving risk management and return forecasts.

Asset pricing kernel Infographic

libterm.com

libterm.com