Real business cycle theory explains economic fluctuations through real shocks such as technology changes and supply variations, highlighting how these factors impact productivity and labor decisions. It emphasizes the role of individuals' responses to these shocks in driving business cycles without relying on monetary or demand-side influences. Explore the rest of the article to understand how this theory reshapes your perspective on economic stability and growth.

Table of Comparison

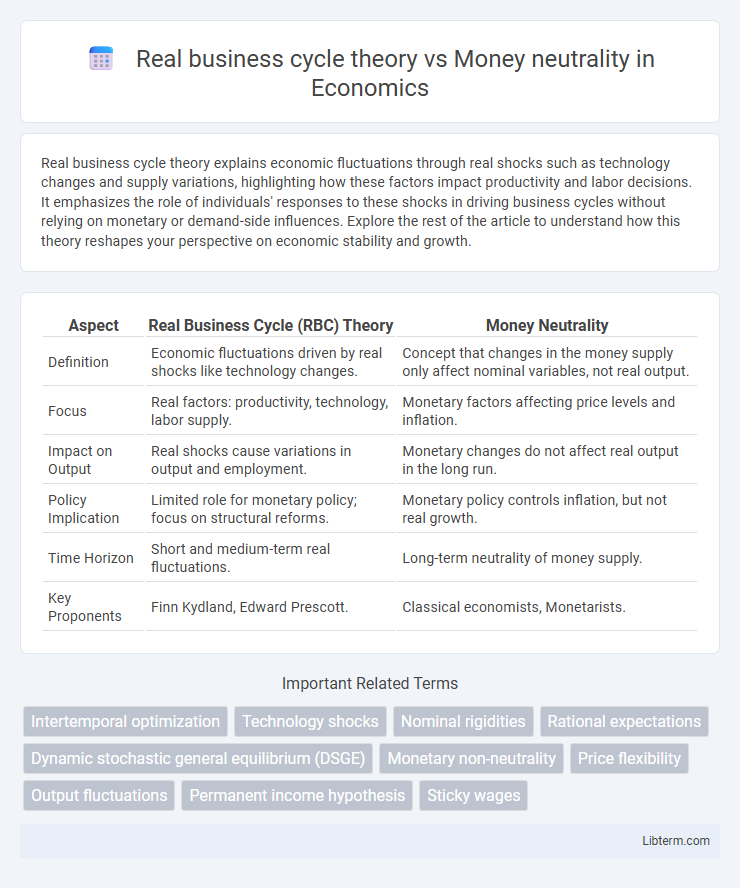

| Aspect | Real Business Cycle (RBC) Theory | Money Neutrality |

|---|---|---|

| Definition | Economic fluctuations driven by real shocks like technology changes. | Concept that changes in the money supply only affect nominal variables, not real output. |

| Focus | Real factors: productivity, technology, labor supply. | Monetary factors affecting price levels and inflation. |

| Impact on Output | Real shocks cause variations in output and employment. | Monetary changes do not affect real output in the long run. |

| Policy Implication | Limited role for monetary policy; focus on structural reforms. | Monetary policy controls inflation, but not real growth. |

| Time Horizon | Short and medium-term real fluctuations. | Long-term neutrality of money supply. |

| Key Proponents | Finn Kydland, Edward Prescott. | Classical economists, Monetarists. |

Introduction to Real Business Cycle Theory

Real Business Cycle (RBC) theory emphasizes that economic fluctuations result primarily from real shocks such as technology changes rather than monetary factors, highlighting the role of productivity variations in driving output and employment. In contrast, the concept of money neutrality posits that changes in the money supply only affect nominal variables without influencing real economic activity in the long run. RBC theory challenges the traditional Keynesian view by attributing business cycles to real, not monetary, disturbances, suggesting that fiscal and monetary policies have limited impact on real output.

Core Principles of RBC Theory

Real Business Cycle (RBC) theory emphasizes that economic fluctuations result from real shocks such as technology changes, not monetary factors, aligning with the principle that money is neutral in the long run. RBC models use technology shocks to explain variations in productivity, labor supply, and output, asserting that these real factors primarily drive business cycles. This core approach contrasts with theories attributing cycles to monetary disturbances, reinforcing the idea that nominal variables do not influence real economic dynamics.

Explaining Money Neutrality

Money neutrality posits that changes in the money supply only affect nominal variables like prices and wages, leaving real economic variables such as output and employment unchanged in the long run. Real Business Cycle (RBC) theory emphasizes real shocks, such as technology changes, as the primary drivers of economic fluctuations, assuming money is neutral. This concept underpins RBC models by asserting that monetary policy cannot influence real economic growth, highlighting the limited role of money in altering real economic activity.

Historical Context of RBC and Money Neutrality

Real Business Cycle (RBC) theory emerged in the 1980s as a response to Keynesian economics, emphasizing technology shocks as primary drivers of economic fluctuations, thereby challenging the role of monetary policy. Money neutrality, rooted in classical economics, asserts that changes in the money supply only affect nominal variables, not real output, particularly in the long run. Historically, RBC contributed to debates on the effectiveness of monetary interventions by highlighting real shocks, contrasting with traditional views that monetary policy could stabilize real economic activity.

Economic Fluctuations: Productivity Shocks vs Monetary Shocks

Real business cycle (RBC) theory attributes economic fluctuations primarily to productivity shocks that alter the economy's actual output capacity, emphasizing real variables like technology and labor productivity. In contrast, the concept of money neutrality asserts that monetary shocks only affect nominal variables, such as prices and wages, without influencing real economic output or employment levels in the long run. Empirical studies show that while productivity shocks have persistent effects on output and growth, monetary shocks tend to cause short-term price level changes without lasting real economic impact.

Policy Implications of Each Theory

Real business cycle (RBC) theory asserts that economic fluctuations result from real shocks such as technology or productivity changes, implying that monetary policy has limited influence on output or employment. In contrast, the concept of money neutrality holds that changes in the money supply only affect nominal variables and have no long-term impact on real economic indicators, suggesting monetary policy cannot permanently alter real output. Policy implications from RBC theory emphasize structural reforms and supply-side measures, while money neutrality supports a focus on controlling inflation through monetary policy without expecting real economic stabilization effects.

Empirical Evidence: Comparing RBC and Money Neutrality

Empirical evidence shows that Real Business Cycle (RBC) theory attributes economic fluctuations to real shocks such as technology changes, revealing persistent impacts on output and employment. In contrast, money neutrality posits that changes in the money supply only affect nominal variables in the long run, with little to no lasting influence on real economic activity. Comparative studies often find mixed results, with RBC models explaining some cyclicality better, while money neutrality holds in the long term, highlighting the nuanced interaction between real shocks and monetary influences.

Criticisms and Limitations of RBC Theory

Real Business Cycle (RBC) theory faces criticism for its heavy reliance on technology shocks as the primary driver of economic fluctuations, often neglecting monetary factors, which challenges its assumption of money neutrality. Critics argue that RBC models underestimate the role of demand-side shocks and fail to explain short-term non-neutrality of money observed in real economies. Limitations include difficulties in accounting for observed price stickiness, unemployment fluctuations, and financial market imperfections that influence business cycles beyond productivity variations.

The Debate on Money’s Role in the Economy

Real business cycle theory emphasizes technology shocks as primary drivers of economic fluctuations, questioning the influence of monetary policy on real output. Money neutrality asserts that changes in the money supply affect only nominal variables, leaving real variables like output and employment unchanged in the long run. The debate centers on whether money has persistent real effects or if real economic changes are independent of monetary interventions.

Conclusion: Reconciling RBC with Monetary Theories

Real Business Cycle (RBC) theory emphasizes technology shocks as the primary driver of economic fluctuations, often sidelining monetary influences. Money neutrality posits that changes in the money supply only affect nominal variables, not real output, challenging the role of monetary policy in shaping real economic activity. Reconciling RBC with monetary theories requires integrating nominal rigidities and expectations, allowing monetary shocks to have short-term real effects while maintaining long-run neutrality, thus bridging real fluctuations with monetary dynamics for a comprehensive macroeconomic framework.

Real business cycle theory Infographic

libterm.com

libterm.com