Real interest rate reflects the nominal interest rate adjusted for inflation, providing a more accurate measure of the purchasing power of your returns. Understanding how inflation impacts your investment can help you make informed financial decisions. Explore the rest of the article to learn how real interest rates affect your savings and borrowing strategies.

Table of Comparison

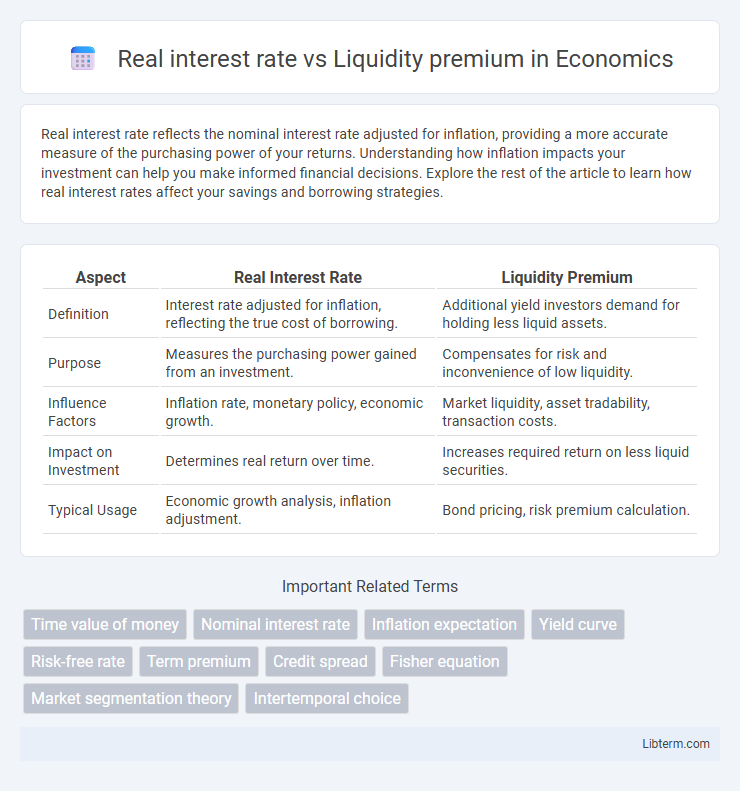

| Aspect | Real Interest Rate | Liquidity Premium |

|---|---|---|

| Definition | Interest rate adjusted for inflation, reflecting the true cost of borrowing. | Additional yield investors demand for holding less liquid assets. |

| Purpose | Measures the purchasing power gained from an investment. | Compensates for risk and inconvenience of low liquidity. |

| Influence Factors | Inflation rate, monetary policy, economic growth. | Market liquidity, asset tradability, transaction costs. |

| Impact on Investment | Determines real return over time. | Increases required return on less liquid securities. |

| Typical Usage | Economic growth analysis, inflation adjustment. | Bond pricing, risk premium calculation. |

Understanding Real Interest Rate: Definition and Importance

The real interest rate represents the nominal interest rate adjusted for inflation, reflecting the true cost of borrowing and the real yield to investors. It is crucial for evaluating investment returns and preserving purchasing power over time, as it removes the distortion caused by inflation. Understanding the real interest rate helps investors and policymakers make informed decisions by distinguishing between nominal gains and genuine increases in value.

What is Liquidity Premium? Key Concepts Explained

Liquidity premium is the extra yield investors demand for holding assets that cannot be quickly converted into cash without significant price discounts. It compensates for the risk associated with the limited marketability and lower trading volume of certain securities, contrasting with the real interest rate, which reflects the return adjusted for inflation excluding liquidity considerations. Understanding liquidity premium helps explain why bonds with similar maturities and credit risks can have different yields due to variations in their liquidity profiles.

Factors Influencing Real Interest Rates

Real interest rates are influenced by factors such as inflation expectations, economic growth, and monetary policy, which determine the true cost of borrowing after adjusting for inflation. The liquidity premium reflects the additional yield investors demand for holding less liquid assets, affected by market liquidity conditions and risk tolerance. Variations in real interest rates and liquidity premiums together shape the overall return on investments, balancing economic fundamentals with market preferences for liquidity.

Components and Determinants of Liquidity Premium

The liquidity premium represents the extra yield investors demand for holding a security that cannot be quickly converted to cash without a significant price discount. Key components influencing the liquidity premium include market depth, trading frequency, and transaction costs, which determine how easily an asset can be bought or sold. Determinants such as investor risk tolerance, overall market conditions, and the availability of alternative liquid assets play crucial roles in shaping the magnitude of the liquidity premium compared to the real interest rate.

Real Interest Rate vs Liquidity Premium: Core Differences

Real interest rate reflects the true cost of borrowing adjusted for inflation, representing the lender's real earning power, while liquidity premium compensates investors for the risk of holding less liquid assets. The core difference lies in their purpose: real interest rate measures the real purchasing power return, whereas liquidity premium addresses the ease and cost of converting assets to cash. Understanding these distinctions is vital for investors evaluating bond yields and asset valuation, particularly in volatile markets.

The Role of Inflation in Real Interest Rate Calculation

The real interest rate is calculated by subtracting the expected inflation rate from the nominal interest rate, reflecting the true purchasing power of returns. Inflation significantly impacts this calculation by determining how much of the nominal rate compensates for the loss of value over time. The liquidity premium, often added to the real interest rate, accounts for the risk and ease of converting assets to cash, but does not directly influence inflation's role in adjusting nominal rates to real terms.

Impact of Market Liquidity on Asset Pricing

The real interest rate reflects the true cost of borrowing, adjusted for inflation, while the liquidity premium compensates investors for the risk of holding less liquid assets in the market. Higher market liquidity reduces the liquidity premium, leading to lower asset pricing spreads and more efficient price discovery. Consequently, variations in liquidity directly influence asset valuation by altering the required returns investors demand.

How Real Interest Rate and Liquidity Premium Affect Investment Decisions

The real interest rate influences investment decisions by reflecting the true cost of borrowing adjusted for inflation, guiding investors to assess potential returns against purchasing power changes. The liquidity premium accounts for the additional yield demanded by investors for holding less liquid assets, impacting choices by signaling risk and timing preferences. Together, these factors shape investment strategies by balancing expected real returns with liquidity considerations in diverse market conditions.

Historical Trends: Real Interest Rate and Liquidity Premium Comparison

Historical trends reveal that real interest rates typically fluctuate in response to inflation expectations and economic growth, while liquidity premiums adjust based on market volatility and investor risk appetite. During periods of financial instability, liquidity premiums tend to spike, reflecting increased compensation demanded by investors for holding less liquid assets. Over long-term cycles, the real interest rate generally exhibits smoother variations compared to the more volatile liquidity premium, which can sharply deviate during crises or major economic shifts.

Real-World Examples: Analyzing Real Interest Rate and Liquidity Premium

Real interest rates reflect the inflation-adjusted return on investments, such as U.S. Treasury Inflation-Protected Securities (TIPS) that provide investors with real yield protection in volatile inflation periods. Liquidity premium appears prominently in corporate bond markets, where less liquid bonds often demand higher yields, as observed in emerging market debt during times of economic uncertainty. Examining the 2020 COVID-19 pandemic reveals a spike in liquidity premiums due to market stress, while real interest rates fluctuated with central bank policies aimed at controlling inflation and supporting economic recovery.

Real interest rate Infographic

libterm.com

libterm.com