Base risk refers to the inherent likelihood of a particular event occurring without considering additional risk factors or mitigations. Understanding your base risk is essential for accurately assessing potential threats and making informed decisions in areas like finance, health, or safety. Explore the rest of the article to learn how base risk influences your risk management strategies.

Table of Comparison

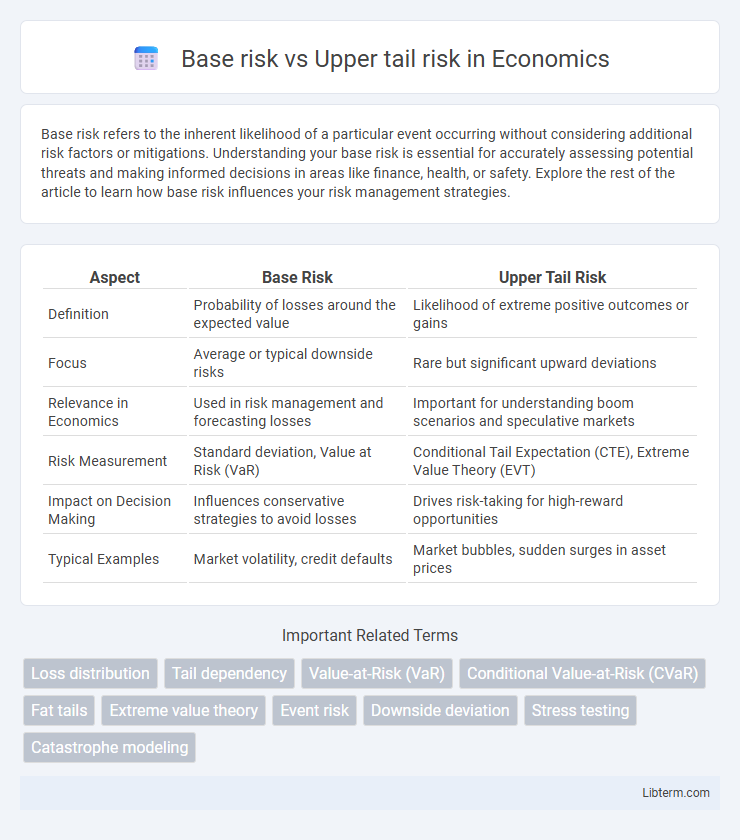

| Aspect | Base Risk | Upper Tail Risk |

|---|---|---|

| Definition | Probability of losses around the expected value | Likelihood of extreme positive outcomes or gains |

| Focus | Average or typical downside risks | Rare but significant upward deviations |

| Relevance in Economics | Used in risk management and forecasting losses | Important for understanding boom scenarios and speculative markets |

| Risk Measurement | Standard deviation, Value at Risk (VaR) | Conditional Tail Expectation (CTE), Extreme Value Theory (EVT) |

| Impact on Decision Making | Influences conservative strategies to avoid losses | Drives risk-taking for high-reward opportunities |

| Typical Examples | Market volatility, credit defaults | Market bubbles, sudden surges in asset prices |

Understanding Base Risk and Upper Tail Risk

Base risk represents the typical variability or volatility in a portfolio's returns under normal market conditions, serving as the baseline measure of risk. Upper tail risk focuses on the extreme outcomes in the distribution of returns, specifically the rare but severe losses or negative events in the upper end of the risk spectrum. Understanding the distinction between base risk and upper tail risk is crucial for comprehensive risk management and improving portfolio resilience against market shocks.

Defining Base Risk: The Everyday Uncertainties

Base risk refers to the everyday uncertainties inherent in financial markets or investments, reflecting normal fluctuations that affect asset values under typical conditions. It encompasses standard risk factors such as interest rate variability, inflation changes, and routine market volatility, which are typically predictable and manageable through diversification and hedging strategies. Understanding base risk is essential for managing portfolios because it sets the foundation for distinguishing ordinary market movements from more extreme, less frequent events reflected in upper tail risk.

What is Upper Tail Risk? Rare but Severe Events

Upper tail risk refers to the potential for rare but severe events that result in extreme losses or gains beyond normal expectations, often found in the far right tail of a probability distribution. Unlike base risk, which accounts for common fluctuations and typical volatility, upper tail risk captures outlier incidents such as financial crises, natural disasters, or market crashes that have disproportionate impacts. Understanding upper tail risk is crucial for risk management strategies aiming to mitigate catastrophic outcomes and ensure robust portfolio resilience.

Key Differences Between Base Risk and Upper Tail Risk

Base risk refers to the standard variability in expected outcomes within usual market conditions, reflecting typical fluctuations in asset returns. Upper tail risk specifically captures the potential for extreme, rare losses concentrated in the worst-case scenarios or the far right tail of the loss distribution. Unlike base risk, upper tail risk emphasizes the likelihood and impact of severe events that can significantly deviate from normal risk assessments, making it crucial for stress testing and risk management strategies targeting financial crises or black swan events.

Practical Examples of Base Risk vs Upper Tail Risk

Base risk refers to the potential loss from small or moderate market fluctuations, such as daily changes in interest rates impacting bond portfolios, while upper tail risk involves extreme, less frequent events, like a financial crisis causing a sudden market crash. For example, a pension fund experiences base risk as it manages routine mismatches between asset and liability durations, whereas upper tail risk materializes during an unforeseen economic shock leading to rapid asset devaluation. Understanding these distinctions helps risk managers develop hedging strategies that protect against both common variations and rare catastrophic losses.

Measurement Techniques for Base and Upper Tail Risk

Measurement techniques for base risk primarily involve traditional statistical methods such as variance, standard deviation, and Value at Risk (VaR) within the bulk of the return distribution. Upper tail risk measurement focuses on extreme loss events using metrics like Conditional Value at Risk (CVaR), Peak Over Threshold (POT) models, and Extreme Value Theory (EVT) to capture the probability and impact of rare, high-severity outcomes. Accurate risk management integrates both approaches by leveraging historical data and stress testing to quantify normal fluctuations and tail-end risks effectively.

Impacts on Portfolio Management and Investment Strategies

Base risk represents the typical fluctuations in asset prices that portfolio managers must navigate under normal market conditions, directly influencing asset allocation and risk tolerance decisions. Upper tail risk involves the probability of extreme, rare events causing significant portfolio losses, prompting the use of hedging strategies, diversification, and tail-risk hedging instruments like options or volatility derivatives. Effective portfolio management requires balancing exposure to base risk for growth while mitigating upper tail risk to preserve capital during market shocks.

Managing and Mitigating Upper Tail Risk

Managing and mitigating upper tail risk requires identifying extreme, low-probability events that can cause significant financial loss beyond base risk assumptions. Techniques such as stress testing, scenario analysis, and employing options or other derivatives help shield portfolios from severe market downturns and rare but impactful shocks. Diversification across uncorrelated assets and maintaining sufficient capital reserves are key strategies to reduce exposure to these catastrophic risks.

Importance in Financial Modeling and Risk Assessment

Base risk represents the fundamental level of risk inherent in a financial asset or portfolio under normal market conditions, serving as a critical benchmark for financial modeling accuracy. Upper tail risk captures the probability of extreme losses in the far end of the distribution, essential for stress testing and assessing potential financial crises. Understanding both risks enables more robust risk management strategies, ensuring comprehensive evaluation of standard fluctuations and rare catastrophic events.

Incorporating Both Risks in Decision-Making

Incorporating both base risk and upper tail risk in decision-making ensures a comprehensive assessment of potential outcomes, capturing everyday volatility and rare, extreme losses. Base risk addresses typical market fluctuations, while upper tail risk focuses on low-probability, high-impact events, critical for stress testing and risk management frameworks. Effective risk models integrate these dimensions to optimize capital allocation, portfolio diversification, and regulatory compliance.

Base risk Infographic

libterm.com

libterm.com