Walrasian equilibrium refers to a state in an economy where supply equals demand across all markets simultaneously, ensuring that no excess goods or shortages exist. This concept, fundamental to general equilibrium theory, helps explain how prices adjust to balance markets efficiently. Discover how Walrasian equilibrium shapes economic models and impacts your understanding of market dynamics in the rest of the article.

Table of Comparison

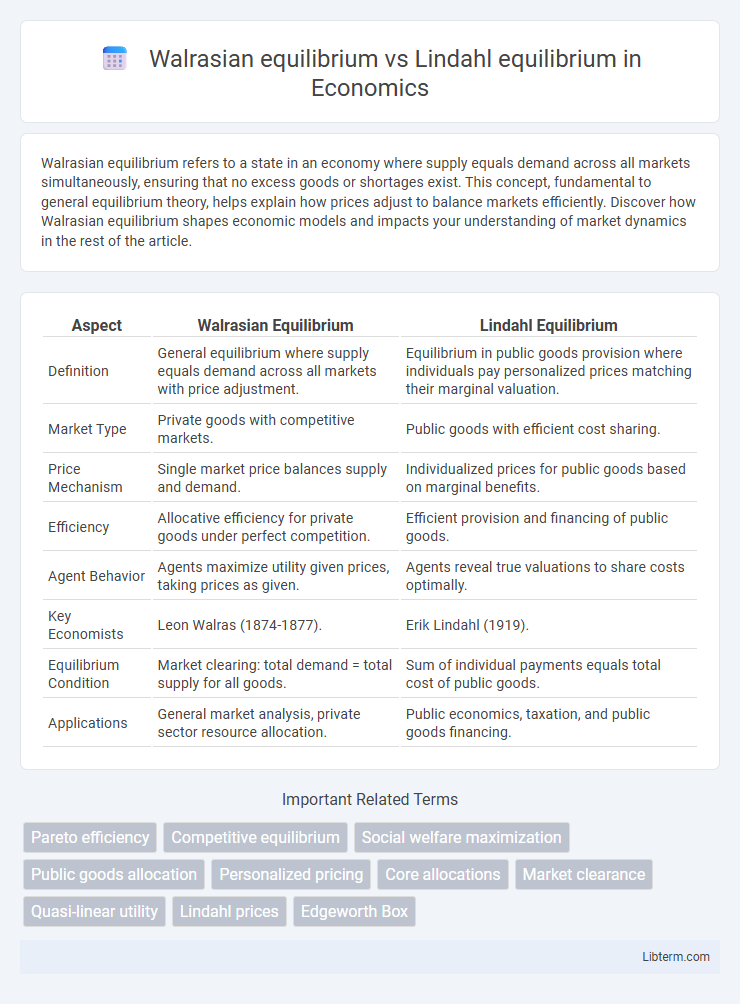

| Aspect | Walrasian Equilibrium | Lindahl Equilibrium |

|---|---|---|

| Definition | General equilibrium where supply equals demand across all markets with price adjustment. | Equilibrium in public goods provision where individuals pay personalized prices matching their marginal valuation. |

| Market Type | Private goods with competitive markets. | Public goods with efficient cost sharing. |

| Price Mechanism | Single market price balances supply and demand. | Individualized prices for public goods based on marginal benefits. |

| Efficiency | Allocative efficiency for private goods under perfect competition. | Efficient provision and financing of public goods. |

| Agent Behavior | Agents maximize utility given prices, taking prices as given. | Agents reveal true valuations to share costs optimally. |

| Key Economists | Leon Walras (1874-1877). | Erik Lindahl (1919). |

| Equilibrium Condition | Market clearing: total demand = total supply for all goods. | Sum of individual payments equals total cost of public goods. |

| Applications | General market analysis, private sector resource allocation. | Public economics, taxation, and public goods financing. |

Introduction to Economic Equilibrium Concepts

Walrasian equilibrium describes a price system where supply equals demand in all markets, ensuring that no agent can improve their utility by changing their consumption or production decisions. Lindahl equilibrium, in contrast, addresses the provision of public goods by assigning personalized prices reflecting each individual's marginal valuation to achieve an efficient allocation. Both concepts illustrate foundational economic equilibrium models, but Walrasian equilibrium applies to private goods markets while Lindahl equilibrium specifically resolves challenges in financing and distributing public goods.

Defining Walrasian Equilibrium

Walrasian equilibrium is defined as a state in a perfectly competitive market where supply equals demand across all goods and services, resulting in a set of prices that clear the market without excess supply or demand. It assumes price-taking behavior by agents, complete markets, and no externalities, ensuring Pareto efficiency. This equilibrium contrasts with Lindahl equilibrium, which addresses public goods provision through personalized prices reflecting individual valuations.

Understanding Lindahl Equilibrium

Lindahl equilibrium represents a state in public finance where individuals pay personalized prices for public goods equal to their marginal benefit, ensuring efficient provision without free-rider problems. Unlike Walrasian equilibrium, which focuses on private goods markets and assumes price-taking behavior, Lindahl equilibrium addresses public goods by aligning individual preferences with cost shares. This concept highlights the role of individualized pricing mechanisms in achieving Pareto-efficient outcomes in collective decision-making contexts.

Historical Development and Theoretical Foundations

Walrasian equilibrium, introduced by Leon Walras in the late 19th century, established the foundation of general equilibrium theory through the concept of market-clearing prices for private goods in perfectly competitive markets. Lindahl equilibrium, developed by Erik Lindahl in the early 20th century, extended the notion of equilibrium to public goods by proposing personalized tax prices that reflect individuals' marginal valuations to achieve efficient provision. Both frameworks rely on the principles of Pareto efficiency and individual rationality but differ in their treatment of private versus public goods and the aggregation of preferences in market outcomes.

Key Assumptions of Walrasian vs Lindahl Equilibria

Walrasian equilibrium assumes perfectly competitive markets with price-taking agents, complete markets, and no externalities, enabling prices to coordinate supply and demand efficiently. Lindahl equilibrium presumes public goods provision with personalized prices reflecting individual marginal benefits, requiring agents to truthfully reveal preferences to achieve Pareto optimality. Unlike Walrasian models, Lindahl equilibrium addresses the free-rider problem by aligning individual payments with public good consumption.

Mathematical Formulation and Models

The Walrasian equilibrium is mathematically formulated through a system of simultaneous equations where supply equals demand in each market, typically solved using fixed-point theorems in general equilibrium models. The Lindahl equilibrium involves personalized prices for public goods, where individuals pay according to their marginal valuations, modeled by solving a set of equations balancing individual contributions with the collective provision level. Both frameworks utilize optimization and equilibrium conditions but differ in addressing private versus public goods through distinct mathematical representations.

Efficiency and Optimality Comparison

Walrasian equilibrium achieves efficiency by equating supply and demand in competitive markets, ensuring Pareto optimality under perfect competition and complete markets. Lindahl equilibrium extends this concept to public goods, achieving efficiency by assigning personalized prices that reflect individuals' marginal benefits, leading to an optimal provision of public goods. While Walrasian equilibrium applies primarily to private goods markets, Lindahl equilibrium addresses public goods, both aiming for allocative efficiency but differing in the feasibility and implementation of pricing mechanisms.

Role of Public Goods in Lindahl Equilibrium

Lindahl equilibrium addresses the efficient provision of public goods by assigning personalized prices reflecting individual valuations, ensuring that the sum of these prices covers the public good's cost. Unlike Walrasian equilibrium, which primarily applies to private goods markets, Lindahl equilibrium incorporates public goods' non-excludability and non-rivalry by enabling voluntary and efficient contributions according to individual preferences. This mechanism aligns individual incentives with social optimality, overcoming free-rider problems inherent in public goods provision.

Practical Applications and Limitations

Walrasian equilibrium is widely applied in competitive market analysis, enabling efficient resource allocation through price mechanisms but assumes perfect information and complete markets, limiting its real-world applicability. Lindahl equilibrium offers a theoretical solution for public goods financing by assigning personalized prices reflecting individual valuations, yet it faces challenges in practical implementation due to preference revelation and strategic behavior problems. Both equilibria highlight fundamental insights in economic theory while encountering significant difficulties when applied to complex, imperfect, and decentralized modern economies.

Conclusion: Implications for Economic Policy

Walrasian equilibrium, emphasizing market-clearing prices without public goods consideration, often leads to suboptimal resource allocation in the presence of externalities or public goods. Lindahl equilibrium, incorporating individualized pricing for public goods, enables efficient provision reflecting individuals' marginal valuations, thus addressing free-rider problems. Economic policy informed by Lindahl equilibrium supports tailored taxation and public good funding mechanisms, improving welfare efficiency beyond the competitive market outcomes suggested by Walrasian models.

Walrasian equilibrium Infographic

libterm.com

libterm.com