The IS-LM model illustrates the interaction between the goods market (Investment-Savings) and the money market (Liquidity preference-Money supply) to determine equilibrium interest rates and output levels in an economy. It helps analyze the effects of fiscal and monetary policies on national income and interest rates, guiding decisions aimed at stabilizing economic fluctuations. Explore the rest of this article to understand how the IS-LM model can deepen your grasp of macroeconomic policy impacts.

Table of Comparison

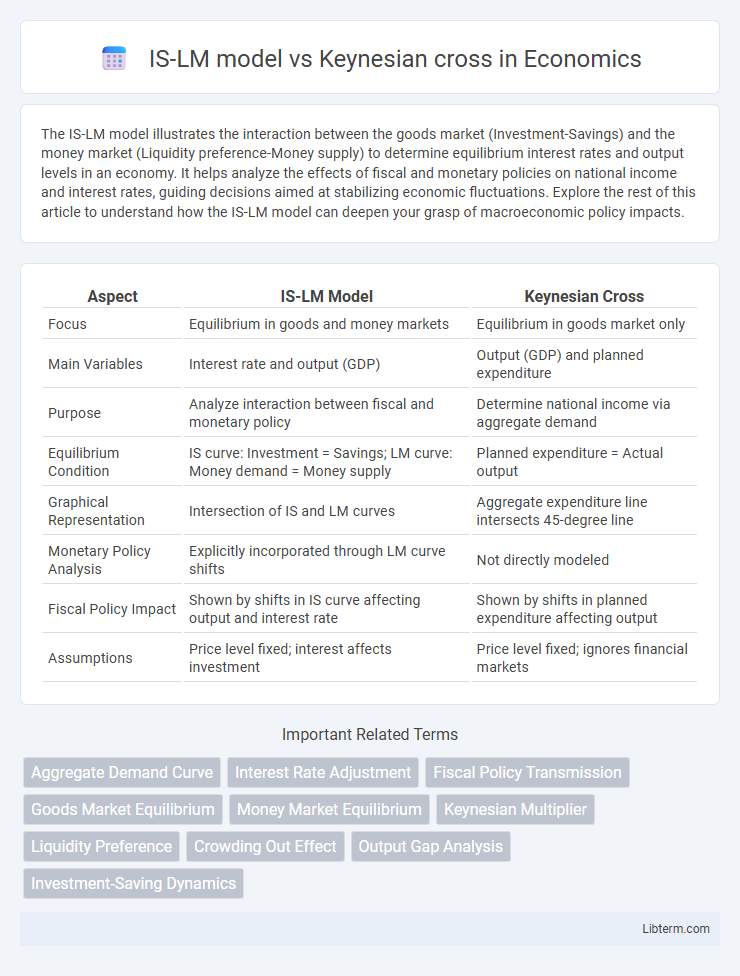

| Aspect | IS-LM Model | Keynesian Cross |

|---|---|---|

| Focus | Equilibrium in goods and money markets | Equilibrium in goods market only |

| Main Variables | Interest rate and output (GDP) | Output (GDP) and planned expenditure |

| Purpose | Analyze interaction between fiscal and monetary policy | Determine national income via aggregate demand |

| Equilibrium Condition | IS curve: Investment = Savings; LM curve: Money demand = Money supply | Planned expenditure = Actual output |

| Graphical Representation | Intersection of IS and LM curves | Aggregate expenditure line intersects 45-degree line |

| Monetary Policy Analysis | Explicitly incorporated through LM curve shifts | Not directly modeled |

| Fiscal Policy Impact | Shown by shifts in IS curve affecting output and interest rate | Shown by shifts in planned expenditure affecting output |

| Assumptions | Price level fixed; interest affects investment | Price level fixed; ignores financial markets |

Introduction to IS-LM Model and Keynesian Cross

The IS-LM model illustrates the interaction between the goods market (Investment-Saving) and the money market (Liquidity preference-Money supply), capturing equilibrium in both sectors simultaneously. In contrast, the Keynesian Cross focuses on equilibrium output where aggregate demand equals aggregate supply, emphasizing fiscal policy effects on income determination. The IS-LM framework extends the Keynesian Cross by incorporating interest rates and monetary factors, offering a comprehensive analysis of macroeconomic equilibrium.

Historical Background of Both Models

The IS-LM model, developed by John Hicks in 1937, formalized Keynesian economics by integrating the goods market (IS curve) and money market (LM curve) into a simultaneous equilibrium framework. The Keynesian Cross, introduced by Keynes in his 1936 work "The General Theory of Employment, Interest and Money," primarily illustrates equilibrium in the goods market through aggregate demand and income. The IS-LM model expanded the Keynesian Cross by incorporating liquidity preference and money supply, providing a more comprehensive macroeconomic tool during the post-Great Depression era.

Core Assumptions and Frameworks

The IS-LM model integrates the goods market (IS curve) and money market (LM curve) to determine equilibrium output and interest rates under assumptions of price rigidity and fixed money supply, emphasizing monetary and fiscal policy interactions. The Keynesian cross concentrates solely on the goods market, illustrating equilibrium where aggregate expenditure equals output, based on fixed prices and income-driven consumption. While the Keynesian cross provides foundational insights into fiscal multipliers, the IS-LM model expands this by incorporating liquidity preferences and money demand, offering a more comprehensive macroeconomic framework.

Mathematical Representation: IS-LM vs Keynesian Cross

The IS-LM model mathematically represents equilibrium in both goods and money markets using two equations: IS (Investment-Savings) curve defined by Y = C(Y - T) + I(r) + G, and LM (Liquidity preference-Money supply) curve expressed as M/P = L(r, Y). The Keynesian Cross simplifies the goods market equilibrium through the equation Y = AE = C + I + G, focusing on aggregate expenditure without explicitly modeling interest rate effects. IS-LM incorporates interest rates and money market interactions, providing a simultaneous solution for income (Y) and interest rate (r), while the Keynesian Cross focuses solely on income determination through aggregate demand.

Graphical Analysis: Key Differences

The IS-LM model integrates both the goods market (IS curve) and the money market (LM curve) to determine equilibrium output and interest rates, illustrated by the intersection of these curves on a graph. In contrast, the Keynesian Cross focuses solely on goods market equilibrium, where aggregate demand intersects aggregate supply, depicted by the 45-degree line analysis without considering interest rates. The IS-LM graph highlights the interaction between fiscal and monetary policy, while the Keynesian Cross graph primarily emphasizes the multiplier effect and equilibrium income level.

Fiscal Policy Implications

The IS-LM model integrates the goods and money markets, illustrating how fiscal policy shifts the IS curve to influence output and interest rates, which helps analyze the combined effects on aggregate demand and monetary conditions. The Keynesian cross focuses primarily on fiscal policy's impact through government spending and taxation, emphasizing equilibrium output determined by aggregate expenditure without considering interest rate changes. Fiscal policy implications under the IS-LM framework are more comprehensive, accounting for crowding-out effects via interest rates, while the Keynesian cross highlights direct demand stimulation through government expenditures.

Monetary Policy Predictions

The IS-LM model integrates both the goods market (IS curve) and money market (LM curve) to analyze the effects of monetary policy, predicting that an increase in the money supply lowers interest rates and stimulates investment, thereby shifting the LM curve rightward and boosting output. In contrast, the Keynesian cross focuses solely on aggregate demand, emphasizing fiscal policy without explicitly modeling money markets or interest rates, thus offering limited predictions about monetary policy impacts. The IS-LM framework provides a more detailed analysis of monetary policy transmission mechanisms, highlighting the interaction between interest rates, liquidity preference, and investment decisions.

Strengths and Limitations of Each Model

The IS-LM model excels at integrating both goods and money markets, offering a comprehensive analysis of interest rate and output equilibrium, but it assumes fixed price levels, limiting its applicability in inflationary contexts. The Keynesian cross provides a clear mechanism for understanding output determination through aggregate demand and government spending effects, yet it lacks consideration of interest rates and monetary policy impacts, restricting its scope. Both models serve as foundational tools in macroeconomics, with IS-LM emphasizing monetary interactions and Keynesian cross highlighting fiscal multipliers, each having limitations in dynamic and price-flexible environments.

Applications in Modern Macroeconomics

The IS-LM model provides a comprehensive framework for analyzing the interaction between the goods market and money market, making it essential for understanding fiscal and monetary policy impacts in modern macroeconomics. The Keynesian cross focuses on equilibrium in the goods market through aggregate demand and output, serving as a foundational tool for evaluating government spending multipliers. Combining insights from both models enhances the analysis of short-run economic fluctuations and policy effectiveness in diverse economic conditions.

Conclusion: Choosing the Right Model for Analysis

The IS-LM model offers a comprehensive framework for analyzing equilibrium in both goods and money markets, making it essential for studying monetary policy effects and interest rate fluctuations. The Keynesian cross model emphasizes aggregate demand and fiscal policy implications, providing straightforward insights into output determination through government spending and taxation. Selecting the appropriate model depends on the analysis focus: macroeconomic equilibrium with money market dynamics favors IS-LM, while fiscal policy impact on income and output is better captured by the Keynesian cross.

IS-LM model Infographic

libterm.com

libterm.com