Fiscal responsibility ensures that budgets are managed effectively to avoid excessive debt and promote long-term financial stability. Maintaining control over spending and saving habits strengthens your economic foundation, preparing you for unexpected expenses and future goals. Explore the rest of the article to discover practical strategies for enhancing your fiscal responsibility.

Table of Comparison

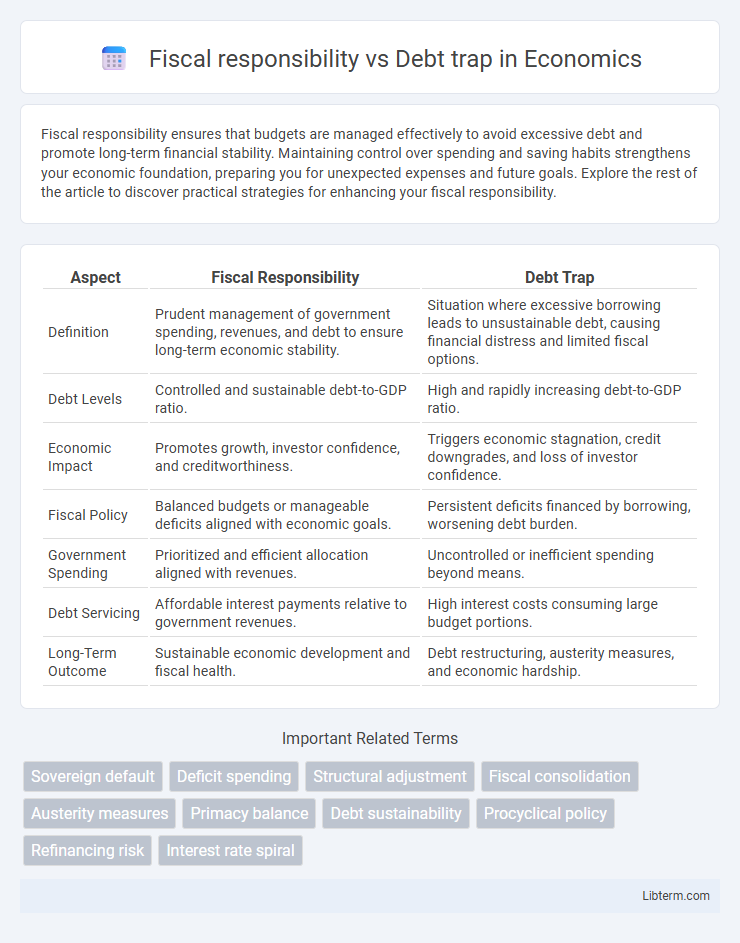

| Aspect | Fiscal Responsibility | Debt Trap |

|---|---|---|

| Definition | Prudent management of government spending, revenues, and debt to ensure long-term economic stability. | Situation where excessive borrowing leads to unsustainable debt, causing financial distress and limited fiscal options. |

| Debt Levels | Controlled and sustainable debt-to-GDP ratio. | High and rapidly increasing debt-to-GDP ratio. |

| Economic Impact | Promotes growth, investor confidence, and creditworthiness. | Triggers economic stagnation, credit downgrades, and loss of investor confidence. |

| Fiscal Policy | Balanced budgets or manageable deficits aligned with economic goals. | Persistent deficits financed by borrowing, worsening debt burden. |

| Government Spending | Prioritized and efficient allocation aligned with revenues. | Uncontrolled or inefficient spending beyond means. |

| Debt Servicing | Affordable interest payments relative to government revenues. | High interest costs consuming large budget portions. |

| Long-Term Outcome | Sustainable economic development and fiscal health. | Debt restructuring, austerity measures, and economic hardship. |

Understanding Fiscal Responsibility: Key Principles

Fiscal responsibility entails managing government revenues and expenditures to maintain sustainable budgets, avoid excessive public debt, and ensure economic stability. Key principles include aligning spending with income, prioritizing essential investments, and maintaining transparency and accountability in financial decisions. Adhering to these principles helps prevent a debt trap, where excessive borrowing leads to escalating interest payments and fiscal distress.

What is a Debt Trap? An Overview

A debt trap occurs when a borrower continuously incurs debt to repay existing loans, leading to escalating financial obligations and inability to escape the cycle of borrowing. This situation contrasts with fiscal responsibility, which involves managing finances prudently to avoid unsustainable debt levels and maintain economic stability. Understanding the mechanics of a debt trap is crucial for governments and individuals to implement strategies that prevent long-term financial distress.

Fiscal Responsibility vs Debt Trap: Core Differences

Fiscal responsibility emphasizes balanced budgets, sustainable spending, and prudent borrowing to ensure long-term economic stability, while a debt trap arises from excessive borrowing that leads to unmanageable debt repayments and financial dependency. The core difference lies in fiscal responsibility promoting controlled debt levels and efficient resource allocation, whereas a debt trap results in a vicious cycle of borrowing that hampers economic growth and sovereignty. Governments practicing fiscal responsibility maintain creditworthiness and investor confidence, contrasting with those in a debt trap facing higher interest rates and reduced fiscal flexibility.

The Economic Impact of Poor Fiscal Management

Poor fiscal management leads to excessive national debt, increasing interest payments that divert resources from essential public services and infrastructure development. Chronic budget deficits erode investor confidence, triggering higher borrowing costs and potential downgrades in credit ratings. This debt trap constraints economic growth, reduces fiscal space for countercyclical policies, and risks long-term financial instability.

Warning Signs of Falling Into a Debt Trap

Warning signs of falling into a debt trap include consistently spending beyond income, relying heavily on credit cards for daily expenses, and accumulating high-interest debt without a clear repayment plan. Increasing minimum payments while the principal balance remains stagnant signals worsening financial health. Monitoring debt-to-income ratios above 40% and frequent late payments are critical indicators of deteriorating fiscal responsibility.

Strategies for Achieving Fiscal Responsibility

Implementing strict budgetary controls and prioritizing essential expenditures helps maintain fiscal responsibility and avoid falling into a debt trap. Developing transparent tax policies and enhancing revenue collection mechanisms ensure sustainable funding without excessive borrowing. Regular monitoring of public debt levels combined with strategic debt restructuring reduces financial risks and promotes long-term economic stability.

Case Studies: Nations in Debt Traps

Countries like Greece and Argentina exemplify fiscal irresponsibility leading to severe debt traps, where persistent budget deficits and unmanageable borrowing culminated in economic crises. Greece's debt crisis resulted from excessive public spending and GDP contraction, forcing international bailouts and austerity measures. Argentina's repeated defaults reflect chronic fiscal mismanagement and volatile currency policies, causing prolonged economic instability and loss of investor confidence.

The Role of Policy in Preventing Debt Traps

Effective fiscal policies emphasize sustainable budgeting, transparent debt management, and stringent regulatory frameworks to prevent countries from falling into debt traps. Prioritizing long-term economic growth over short-term borrowing limits excessive external debt accumulation and fosters fiscal responsibility. By implementing prudent monetary policies and enhancing institutional capacity, governments can mitigate risks associated with unsustainable debt burdens.

Social and Political Consequences of Debt Dependency

Chronic debt dependency undermines fiscal responsibility by forcing governments to allocate disproportionate portions of their budgets to debt servicing, reducing funds for social programs and infrastructure development. This fiscal strain exacerbates social inequalities and fuels public discontent, often leading to political instability and weakened governance structures. Persistent debt traps also diminish national sovereignty, limiting policy-making autonomy and increasing reliance on external creditors, which can compromise democratic processes and long-term economic sustainability.

Pathways to Sustainable Fiscal Health

Achieving sustainable fiscal health requires implementing prudent spending controls, enhancing revenue collection efficiency, and maintaining transparent budgetary practices to avoid excessive debt accumulation. Strategic debt management involves prioritizing high-return investments and establishing clear repayment plans to prevent falling into debt traps caused by unsustainable borrowing. Strengthening institutional frameworks and adopting fiscal rules can provide stability, ensuring long-term economic growth while managing liabilities responsibly.

Fiscal responsibility Infographic

libterm.com

libterm.com