Exchange rate risk refers to the potential financial loss that investors or businesses may face due to fluctuations in currency exchange rates. This risk impacts international trade, investments, and financial reporting, making it crucial for companies engaged in global markets to implement effective hedging strategies. Learn more about how exchange rate risk can affect your financial decisions and the best ways to manage it in this article.

Table of Comparison

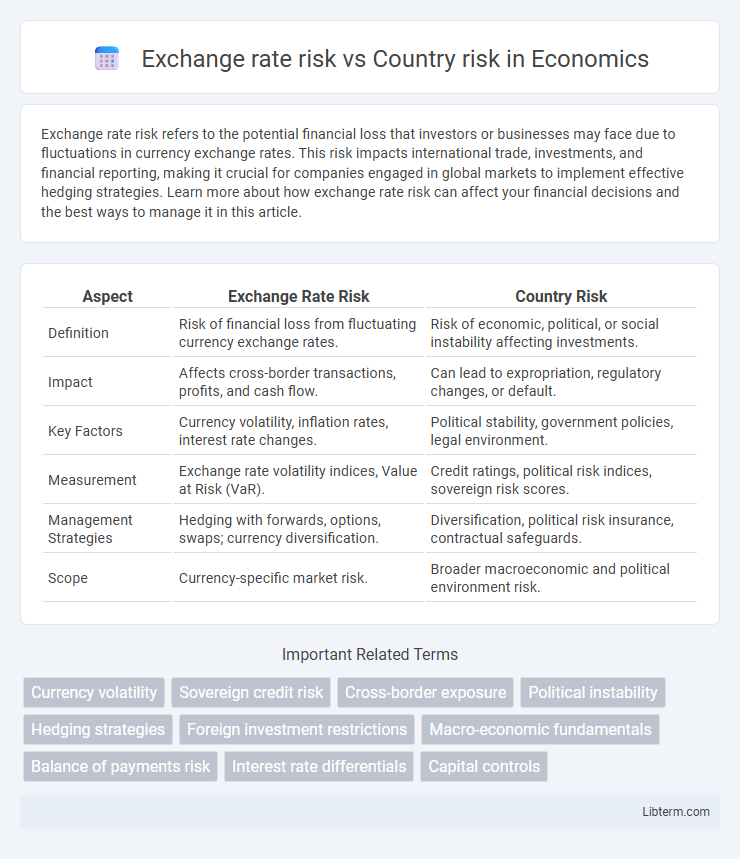

| Aspect | Exchange Rate Risk | Country Risk |

|---|---|---|

| Definition | Risk of financial loss from fluctuating currency exchange rates. | Risk of economic, political, or social instability affecting investments. |

| Impact | Affects cross-border transactions, profits, and cash flow. | Can lead to expropriation, regulatory changes, or default. |

| Key Factors | Currency volatility, inflation rates, interest rate changes. | Political stability, government policies, legal environment. |

| Measurement | Exchange rate volatility indices, Value at Risk (VaR). | Credit ratings, political risk indices, sovereign risk scores. |

| Management Strategies | Hedging with forwards, options, swaps; currency diversification. | Diversification, political risk insurance, contractual safeguards. |

| Scope | Currency-specific market risk. | Broader macroeconomic and political environment risk. |

Introduction to Exchange Rate Risk and Country Risk

Exchange rate risk refers to the potential financial loss an investor or company faces due to fluctuations in currency values when conducting international transactions. Country risk encompasses the broader economic, political, and social factors that may negatively impact investments or business operations within a specific nation. Understanding exchange rate risk involves analyzing currency volatility, whereas assessing country risk requires evaluating political stability, economic policies, and regulatory environments.

Key Definitions: Exchange Rate Risk vs Country Risk

Exchange rate risk refers to the potential financial loss resulting from fluctuations in the value of one currency relative to another, impacting international trade and investments. Country risk encompasses broader economic, political, and social uncertainties within a specific nation that could affect the profitability and security of investments, including currency controls, expropriation, and political instability. Understanding the distinction is crucial for multinational corporations and investors managing exposure to both currency fluctuations and broader sovereign risks.

Main Drivers of Exchange Rate Risk

Exchange rate risk primarily arises from fluctuations in currency values driven by factors such as interest rate differentials, inflation rates, and political instability within a country. Market speculation and central bank interventions also play significant roles in influencing exchange rate volatility. Understanding these drivers is essential for businesses and investors managing exposure to foreign exchange movements.

Principal Factors Behind Country Risk

Country risk primarily arises from political instability, economic volatility, and regulatory changes within a specific nation that can impact foreign investments and business operations. Key factors include government default on debt, expropriation of assets, currency inconvertibility, and social unrest, which create uncertainty for international investors. Exchange rate risk, in contrast, is specifically linked to fluctuations in currency values, but country risk encompasses a broader spectrum of threats tied to the overall stability and governance of the country.

How Exchange Rate Risk Impacts International Business

Exchange rate risk significantly impacts international business by causing fluctuations in the value of foreign currency payments, affecting profit margins and cost structures. Companies exposed to volatile exchange rates may face unpredictable cash flows, making budgeting and financial planning more complex. Managing exchange rate risk through hedging instruments like forwards, options, and swaps is essential to mitigate potential financial losses in global trade.

Assessing the Effects of Country Risk on Investments

Country risk significantly impacts investment returns by influencing exchange rate volatility, political stability, and economic policies, which can alter cash flow values and asset prices. Investors assess country risk through metrics such as sovereign credit ratings, political risk indices, and macroeconomic indicators to quantify potential losses from government actions or events. Understanding country risk provides a comprehensive evaluation framework beyond exchange rate risk alone, encompassing legal restrictions, expropriation threats, and social unrest that directly affect investment security and profitability.

Comparative Analysis: Exchange Rate Risk vs Country Risk

Exchange rate risk arises from fluctuations in currency values affecting international transactions and investments, causing potential financial losses. Country risk encompasses broader political, economic, and social factors within a nation that can impact the stability and profitability of investments beyond currency movements. Comparative analysis reveals exchange rate risk is more market-driven and short-term focused, whereas country risk involves systemic issues, often requiring comprehensive geopolitical and macroeconomic assessments.

Risk Mitigation Strategies for Both Risk Types

Hedging techniques such as forward contracts and currency options are essential risk mitigation strategies for managing exchange rate risk by locking in future exchange rates and reducing currency volatility impact. To mitigate country risk, multinational corporations typically use political risk insurance, diversify investments across multiple countries, and engage in thorough country risk assessments to anticipate regulatory changes and economic instability. Combining financial instruments for exchange rate risk with strategic diversification and insurance helps firms safeguard against potential losses stemming from global operations.

Real-World Examples of Exchange Rate and Country Risks

Exchange rate risk materialized during the 1997 Asian Financial Crisis when rapid depreciation of the Thai baht caused massive losses for foreign investors, highlighting the volatility in currency valuations. Country risk was evident in Venezuela's economic collapse, where political instability, hyperinflation, and government interventions led to severe disruptions in foreign investment and business operations. Both risks emphasize the importance of analyzing economic policies, political stability, and currency stability before engaging in international markets.

Conclusion: Managing Exposure in Global Markets

Effectively managing exposure in global markets requires distinguishing between exchange rate risk, which involves fluctuations in currency values affecting transaction costs and profit margins, and country risk, encompassing political, economic, and regulatory uncertainties that impact overall business stability. Strategic use of hedging instruments such as forwards, options, and swaps helps mitigate exchange rate volatility, while comprehensive country risk assessments enable informed decision-making on market entry and investment. Combining financial hedging with geopolitical analysis ensures a balanced approach to safeguarding international operations against multifaceted risks.

Exchange rate risk Infographic

libterm.com

libterm.com