Short-term capital refers to investments or funds held for a brief period, typically less than a year, aimed at generating quick returns. Managing your short-term capital effectively can enhance liquidity and support immediate financial goals. Explore the rest of this article to learn strategies for optimizing your short-term capital.

Table of Comparison

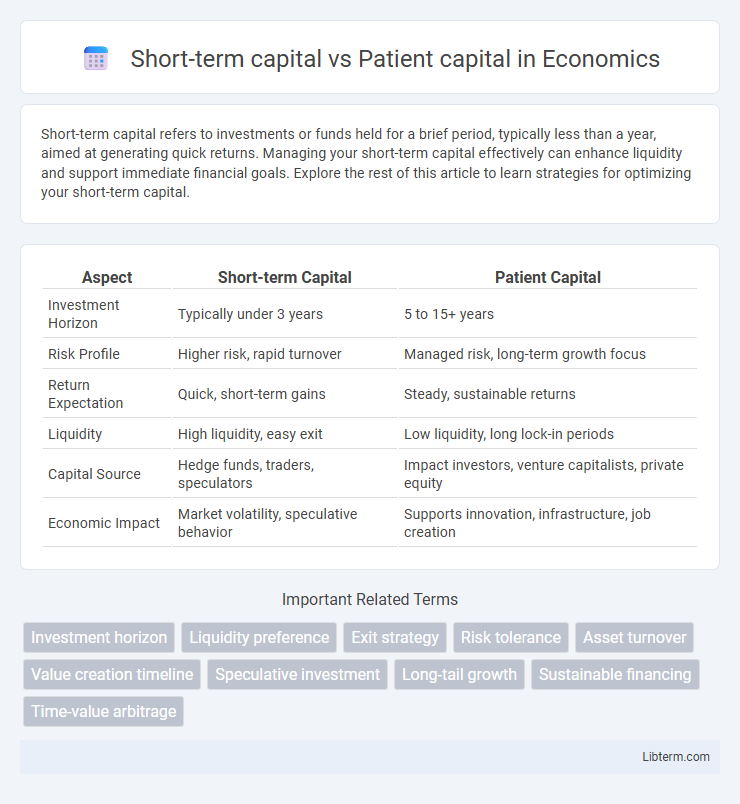

| Aspect | Short-term Capital | Patient Capital |

|---|---|---|

| Investment Horizon | Typically under 3 years | 5 to 15+ years |

| Risk Profile | Higher risk, rapid turnover | Managed risk, long-term growth focus |

| Return Expectation | Quick, short-term gains | Steady, sustainable returns |

| Liquidity | High liquidity, easy exit | Low liquidity, long lock-in periods |

| Capital Source | Hedge funds, traders, speculators | Impact investors, venture capitalists, private equity |

| Economic Impact | Market volatility, speculative behavior | Supports innovation, infrastructure, job creation |

Understanding Short-term Capital

Short-term capital refers to investments held for a brief period, typically under one year, aimed at quick returns through rapid buying and selling of assets. This type of capital prioritizes liquidity and flexibility, allowing investors to capitalize on market volatility and short-term opportunities. Understanding short-term capital involves recognizing its higher risk due to market fluctuations and its suitability for investors seeking immediate gains rather than long-term growth.

Defining Patient Capital

Patient capital refers to long-term investments characterized by extended time horizons and a willingness to accept lower immediate returns for sustainable growth and social impact. Unlike short-term capital, which targets quick profits and rapid exit strategies, patient capital supports innovation, business development, and community advancement over years or decades. This investment approach emphasizes resilience, gradual value appreciation, and alignment with broader environmental, social, and governance (ESG) goals.

Key Differences Between Short-term and Patient Capital

Short-term capital aims for quick returns, typically within months to a few years, and is often associated with higher risk and liquidity. Patient capital, on the other hand, involves long-term investments with a horizon of several years to decades, focusing on sustained growth and social impact over immediate profits. The key differences include investment duration, risk tolerance, expected returns, and the strategic goals of investors.

Investment Horizons: Short-term vs Patient Approaches

Short-term capital targets quick returns within months or a few years, prioritizing liquidity and fast profit realization through market fluctuations. Patient capital emphasizes long-term growth, with investment horizons spanning decades, supporting sustainable business development and innovation. This approach aligns with impact investing and venture capital, where value creation unfolds over extended periods.

Risk Tolerance and Return Expectations

Short-term capital typically involves higher risk tolerance due to its focus on quick returns and market volatility, often seeking returns within months to a few years. Patient capital, characterized by a lower risk tolerance, aims for sustainable growth and long-term value creation, with return expectations spread over several years or decades. Investors favoring patient capital accept delayed liquidity in exchange for potentially higher cumulative returns and impact.

Impact on Business Growth

Short-term capital drives rapid business growth by providing quick access to funds for immediate operational needs and swift market expansion, often expecting fast returns. Patient capital supports sustainable growth by allowing companies to invest in long-term projects, innovation, and infrastructure without the pressure of immediate profitability. Businesses leveraging patient capital typically experience greater stability and scalability over time, fostering enduring competitive advantage and market resilience.

Short-term Capital in Venture Funding

Short-term capital in venture funding focuses on quick returns, typically within a few years, making it ideal for startups aiming for rapid growth and early exit strategies such as acquisitions or IPOs. Investors prioritize projects with high potential for fast scalability and market impact, often demanding significant equity stakes and regular performance milestones. This type of funding drives innovation cycles but may pressure companies to prioritize speed over long-term sustainability.

The Role of Patient Capital in Sustainable Innovation

Patient capital plays a crucial role in sustainable innovation by providing long-term funding that supports research, development, and deployment of eco-friendly technologies. Unlike short-term capital focused on quick returns, patient capital enables startups and enterprises to prioritize environmental and social impact while scaling solutions. This approach fosters resilience and continuous improvement in sustainability-driven projects, accelerating systemic change.

Choosing the Right Capital Type for Your Startup

Choosing the right capital type for your startup depends on your business goals and growth timeline. Short-term capital suits startups needing quick funding for immediate expansion or operational needs, emphasizing faster returns and liquidity. Patient capital supports long-term growth with flexible timelines and tolerance for risk, ideal for innovative companies prioritizing sustainable development over rapid profits.

Future Trends in Capital Investment Strategies

Short-term capital prioritizes quick returns, often driving high-frequency trading and speculative ventures, while patient capital emphasizes long-term value creation in sectors like clean energy, infrastructure, and technology innovation. Future trends in capital investment strategies show a growing shift toward patient capital, fueled by increasing environmental, social, and governance (ESG) considerations and a rising demand for sustainable impact investing. Venture capital and private equity firms are progressively integrating longer time horizons and strategic partnerships to support scalable, resilient businesses in emerging markets.

Short-term capital Infographic

libterm.com

libterm.com