A constant discount rate simplifies the process of valuing future cash flows by applying a fixed percentage over time, ensuring consistent time value assessments. This approach is widely used in financial modeling, investment evaluations, and cost-benefit analyses to provide clarity and comparability. Explore the rest of the article to understand how a constant discount rate impacts your financial decisions and valuation accuracy.

Table of Comparison

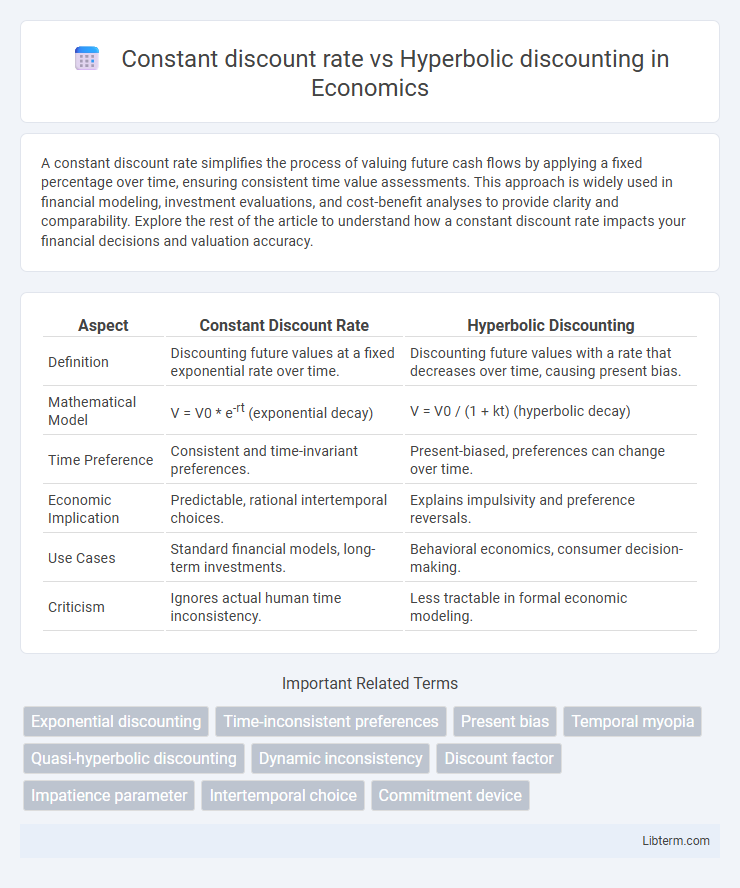

| Aspect | Constant Discount Rate | Hyperbolic Discounting |

|---|---|---|

| Definition | Discounting future values at a fixed exponential rate over time. | Discounting future values with a rate that decreases over time, causing present bias. |

| Mathematical Model | V = V0 * e-rt (exponential decay) | V = V0 / (1 + kt) (hyperbolic decay) |

| Time Preference | Consistent and time-invariant preferences. | Present-biased, preferences can change over time. |

| Economic Implication | Predictable, rational intertemporal choices. | Explains impulsivity and preference reversals. |

| Use Cases | Standard financial models, long-term investments. | Behavioral economics, consumer decision-making. |

| Criticism | Ignores actual human time inconsistency. | Less tractable in formal economic modeling. |

Introduction to Discounting in Economics

Discounting in economics measures how future values are perceived in present terms, reflecting time preferences and decision-making under uncertainty. Constant discount rate assumes a fixed rate over time, simplifying models of intertemporal choice and investment valuation. Hyperbolic discounting captures decreasing impatience, where individuals disproportionately prefer immediate rewards, explaining behaviors like procrastination and inconsistent preferences.

What is Constant Discount Rate?

Constant discount rate refers to a fixed rate used in financial and economic models to determine the present value of future cash flows or benefits by applying a consistent percentage over time. This method assumes time preferences remain stable, discounting future outcomes at the same rate regardless of when they occur. In contrast to hyperbolic discounting, which implies a declining discount rate over time, constant discounting simplifies calculations and supports long-term planning by maintaining uniform valuation of future returns.

Defining Hyperbolic Discounting

Hyperbolic discounting is a behavioral economic model describing how people disproportionately prefer smaller, immediate rewards over larger, delayed rewards, with the discount rate decreasing over time. Unlike a constant discount rate, which assumes a stable valuation of future rewards, hyperbolic discounting captures time-inconsistent preferences and decreasing impatience. This model explains phenomena such as procrastination and impulsivity better than traditional exponential discounting approaches.

Mathematical Formulation: Constant vs Hyperbolic

Constant discount rate is mathematically represented by the exponential discount function \( D(t) = e^{-\rho t} \), where \( \rho \) is the constant discount rate and \( t \) is time. Hyperbolic discounting uses a non-exponential, typically hyperbolic function such as \( D(t) = \frac{1}{1 + k t} \), where \( k \) represents the degree of present bias and discounting decreases as time \( t \) increases. The key difference lies in the time consistency, with exponential discounting maintaining constant relative valuations over time, while hyperbolic discounting leads to decreasing discount rates and preference reversals.

Psychological Roots of Discounting Behavior

Constant discount rate stems from exponential discounting, rooted in classical economics assuming time-consistent preferences and rational decision-making. Hyperbolic discounting arises from psychological factors such as impulsivity and inconsistent valuation of immediate versus delayed rewards, reflecting a declining discount rate over time. This behavioral pattern highlights the influence of cognitive biases and affective states on intertemporal choice, challenging traditional models of rational discounting.

Real-World Impacts of Discounting Models

Constant discount rate models lead to consistent, time-independent valuations of future benefits, often used in financial and environmental policy-making for predictable long-term planning. Hyperbolic discounting reflects decreasing impatience over time, causing individuals to prioritize immediate rewards disproportionately, contributing to issues like under-saving for retirement or procrastination in health-related behaviors. Understanding these distinct discounting models helps economists design interventions and policies that better align with actual human decision-making patterns, improving outcomes in areas such as climate change mitigation and personal finance.

Advantages of Constant Discount Rate

Constant discount rate models provide straightforward and consistent valuation over time, simplifying long-term financial and economic decision-making. Their mathematical simplicity allows for easier computation and comparison of future cash flows or utilities, facilitating stable planning frameworks. This model's time-consistent preferences avoid the preference reversals commonly seen in hyperbolic discounting, enhancing predictability and rational behavior in intertemporal choices.

Benefits and Pitfalls of Hyperbolic Discounting

Hyperbolic discounting offers the benefit of modeling human behavior more accurately by capturing the tendency to prefer immediate rewards over future ones, reflecting real-life decision-making patterns. This approach explains impulsivity and preference reversals better than constant discount rates, which assume consistent time preferences. However, hyperbolic discounting can lead to inconsistent and potentially suboptimal choices, posing challenges for long-term planning and commitment to future goals.

Applications in Finance and Decision Making

Constant discount rate assumes a fixed rate over time, simplifying financial models for long-term investment valuation and loan amortization. Hyperbolic discounting captures human tendencies to prefer immediate rewards, influencing behavioral finance models addressing retirement savings and consumer credit decisions. Incorporating hyperbolic discounting enhances prediction accuracy in decision-making scenarios involving time-inconsistent preferences and impulsive financial behavior.

Comparing Outcomes: Which Model Is Better?

Constant discount rate models assume future rewards diminish at a steady exponential rate, providing consistent time preferences that simplify long-term financial and economic planning. Hyperbolic discounting reflects a declining discount rate over time, capturing observed human behaviors such as preference reversals and impulsive decisions, which often lead to more accurate predictions of real-world decision-making. Comparing outcomes, hyperbolic discounting better explains actual behavior in dynamic settings, while constant discounting offers more tractable, theoretically stable frameworks for optimal policy design.

Constant discount rate Infographic

libterm.com

libterm.com