Gresham's law explains how "bad money" drives out "good money" in an economy when both forms are accepted at the same face value. This phenomenon occurs because people tend to hoard currency that holds intrinsic value while spending currency that is overvalued or less valuable. Discover how Gresham's law affects your finances and economic behavior by reading the rest of the article.

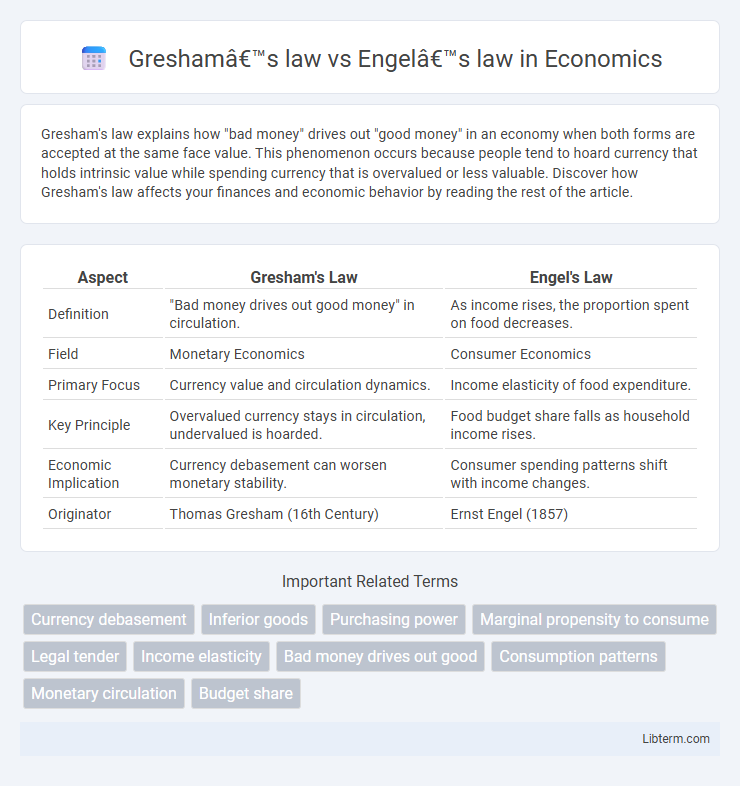

Table of Comparison

| Aspect | Gresham's Law | Engel's Law |

|---|---|---|

| Definition | "Bad money drives out good money" in circulation. | As income rises, the proportion spent on food decreases. |

| Field | Monetary Economics | Consumer Economics |

| Primary Focus | Currency value and circulation dynamics. | Income elasticity of food expenditure. |

| Key Principle | Overvalued currency stays in circulation, undervalued is hoarded. | Food budget share falls as household income rises. |

| Economic Implication | Currency debasement can worsen monetary stability. | Consumer spending patterns shift with income changes. |

| Originator | Thomas Gresham (16th Century) | Ernst Engel (1857) |

Introduction to Gresham’s Law and Engel’s Law

Gresham's Law explains the economic principle where "bad money drives out good money" when both forms are used simultaneously as legal tender. Engel's Law describes the inverse relationship between income levels and the proportion of income spent on food, indicating that as income rises, the percentage spent on necessities decreases. Both laws provide foundational insights into consumer behavior and monetary dynamics within economics.

Historical Background of Gresham’s Law

Gresham's Law, formulated in the 16th century by Sir Thomas Gresham, emerged during the Tudor period in England when debased coinage circulated alongside genuine currency, illustrating how "bad money drives out good." This principle highlighted the economic challenges faced with currency valuation and metallic standards, influencing monetary policies across Europe. Engel's Law, contrastingly, developed in the 19th century by statistician Ernst Engel, focuses on household expenditure patterns, marking distinct domains in economic theory and historical context.

Historical Context of Engel’s Law

Engel's Law was formulated in the mid-19th century by Ernst Engel, a German statistician who studied household expenditure patterns during the Industrial Revolution. This law highlights that as income rises, the proportion of income spent on food decreases, reflecting changing consumption behaviors amid economic development. The historical context of Engel's Law reveals insights into shifting living standards and the economic transformation of societies during rapid industrialization.

Core Principles of Gresham’s Law

Gresham's Law states that "bad money drives out good money" when both forms are legal tender at the same nominal value but differ in intrinsic worth, leading people to hoard higher-quality currency and spend the lower-quality one. This principle highlights the impact of currency debasement and market behavior on money circulation, emphasizing that overvalued money circulates while undervalued money disappears from active use. The law is fundamental in understanding monetary policy effects, inflation, and currency substitution in economic systems.

Key Concepts Behind Engel’s Law

Engel's Law explains the relationship between income levels and household expenditure, stating that as income rises, the proportion of income spent on food decreases, although the absolute expenditure on food may still increase. This principle reveals key consumer behavior patterns and plays a critical role in economic planning, highlighting the shift toward higher spending on non-food goods and services with rising incomes. Understanding Engel's Law aids in analyzing living standards and the allocation of resources in different income groups.

Comparative Analysis: Gresham’s Law vs Engel’s Law

Gresham's Law explains the economic phenomenon where "bad money drives out good money" in currency circulation, emphasizing monetary policy and currency valuation. Engel's Law observes that as household income increases, the proportion of income spent on food decreases, highlighting consumer behavior and income elasticity. Comparing the two, Gresham's Law centers on money supply dynamics and currency quality, while Engel's Law focuses on expenditure patterns and living standards across income levels.

Real-World Applications of Gresham’s Law

Gresham's Law, stating "bad money drives out good," explains currency circulation patterns in economies experiencing inflation or multiple legal tenders, as seen in Zimbabwe's hyperinflation crisis and Venezuela's monetary collapse. Central banks and policymakers use this principle to design effective currency stabilization strategies, preventing hoarding of valuable coins or notes. This law also clarifies phenomena in commodity money and digital currencies where inferior currencies dominate circulation, impacting global trade and exchange rate management.

Practical Implications of Engel’s Law

Engel's Law highlights that as household income rises, the proportion of income spent on food decreases, indicating shifts in consumer demand patterns crucial for economic policy and business strategy. This insight helps governments design targeted subsidies and social welfare programs that prioritize essential goods for lower-income groups, optimizing resource allocation. Businesses leverage Engel's Law to predict changing consumption behaviors, enabling more effective product positioning and market segmentation in varying income demographics.

Modern Relevance of Both Economic Laws

Gresham's Law remains relevant in modern financial systems by explaining currency circulation dynamics during inflation or the introduction of new coinage, where "bad money" drives out "good money" from active use. Engel's Law continues to hold significance in economic policy and market analysis, demonstrating that as household incomes rise, the proportion spent on food declines, influencing consumer behavior forecasts and poverty assessments. Both laws provide essential insights for contemporary economic planning, currency regulation, and welfare economics.

Conclusion: Distinctions and Critical Insights

Gresham's law explains the circulation dynamics of currency, where "bad money" drives out "good money," highlighting behaviors in monetary economics and currency valuation. Engel's law focuses on consumer expenditure patterns, showing that as income rises, the proportion spent on food decreases, emphasizing household budgeting and demand elasticity. These principles differ fundamentally, with Gresham's law addressing money circulation and Engel's law analyzing income-related consumption changes, providing critical insights into economic behavior and policy implications.

Gresham’s law Infographic

libterm.com

libterm.com