The Rational Expectations Hypothesis posits that individuals use all available information efficiently to forecast future economic variables, making systematic errors unlikely. This concept challenges traditional models by assuming that expectations are model-consistent and adapt quickly to any new data. Explore the rest of the article to understand how this theory impacts economic policy and market behavior.

Table of Comparison

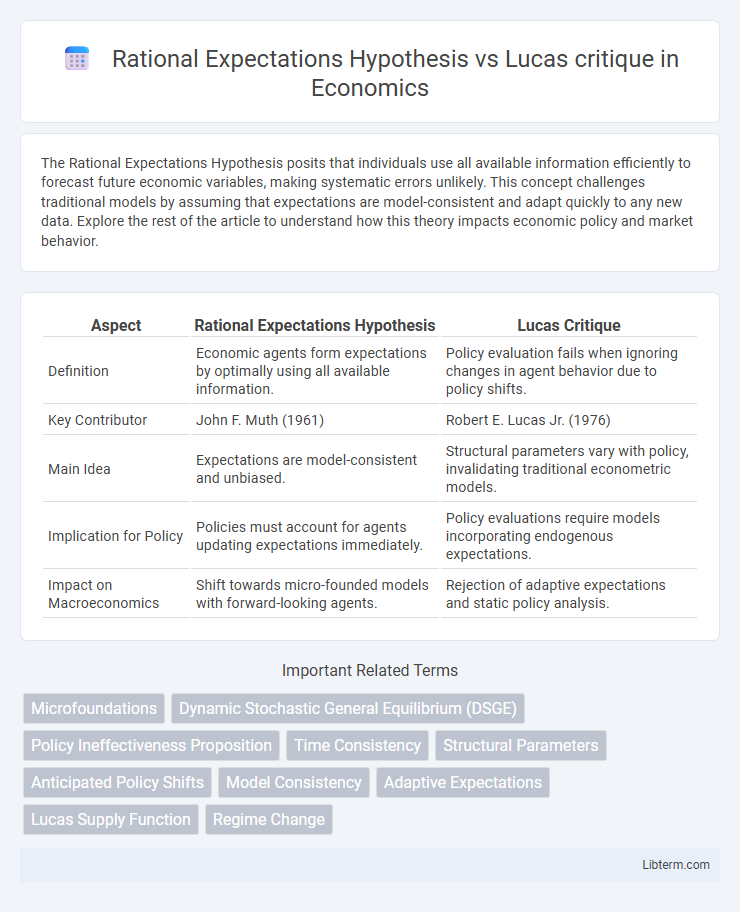

| Aspect | Rational Expectations Hypothesis | Lucas Critique |

|---|---|---|

| Definition | Economic agents form expectations by optimally using all available information. | Policy evaluation fails when ignoring changes in agent behavior due to policy shifts. |

| Key Contributor | John F. Muth (1961) | Robert E. Lucas Jr. (1976) |

| Main Idea | Expectations are model-consistent and unbiased. | Structural parameters vary with policy, invalidating traditional econometric models. |

| Implication for Policy | Policies must account for agents updating expectations immediately. | Policy evaluations require models incorporating endogenous expectations. |

| Impact on Macroeconomics | Shift towards micro-founded models with forward-looking agents. | Rejection of adaptive expectations and static policy analysis. |

Introduction to Rational Expectations Hypothesis

The Rational Expectations Hypothesis posits that economic agents use all available information efficiently to forecast future economic variables, making systematic forecasting errors unlikely. This hypothesis challenges traditional adaptive expectations by emphasizing model-consistent predictions rather than simple past data extrapolation. The Lucas critique argues that policy evaluations ignoring changes in agents' expectations and behavior lead to misleading conclusions, highlighting the importance of incorporating rational expectations into macroeconomic models.

Core Principles of the Rational Expectations Approach

The Rational Expectations Hypothesis posits that individuals form forecasts about the future based on all available information and consistent economic models, thereby minimizing systematic errors. Core principles emphasize that agents' expectations are model-consistent, meaning their predictions align with the true economic environment and policy frameworks. The Lucas critique challenges traditional policy evaluation methods by arguing that changes in policy alter agents' expectations and behavior, rendering historical data unreliable for predicting future outcomes.

Historical Context: Rise of Rational Expectations

The Rational Expectations Hypothesis emerged in the 1960s as economists sought to address the limitations of traditional Keynesian models, emphasizing that individuals form forecasts using all available information and model-consistent expectations. This shift challenged the effectiveness of policy interventions, directly leading to Robert Lucas's 1976 critique, which argued that empirical policy evaluations fail when agents anticipate policy actions, thus altering economic outcomes. The historical context of the post-war era's economic volatility and the failure of Keynesian policies to predict stagflation fueled the rise of rational expectations and the subsequent Lucas critique in macroeconomic theory.

An Overview of the Lucas Critique

The Lucas Critique argues that traditional macroeconomic models fail to account for changes in policy expectations, rendering predictions unreliable when policies shift. It emphasizes that agents form rational expectations based on structural parameters, which alter their behavior in response to policy changes, invalidating fixed-coefficient models. This critique revolutionized economic modeling by promoting the inclusion of micro-founded, expectation-consistent frameworks that adapt to policy-induced behavioral changes.

The Rational Expectations Hypothesis in Macroeconomic Models

The Rational Expectations Hypothesis asserts that economic agents use all available information efficiently to predict future economic variables, ensuring that forecasts on average are accurate and unbiased. This hypothesis challenges traditional macroeconomic models by implying that systematic policy interventions cannot systematically manipulate real economic outcomes, as agents anticipate and counteract such policies. The Lucas critique builds on this by highlighting that macroeconomic models must account for changes in agents' behavior when policies change, as rational expectations alter the structural relationships within the economy.

Lucas Critique: Challenging Traditional Policy Evaluation

The Lucas Critique fundamentally challenges traditional policy evaluation by arguing that economic agents adjust their expectations based on anticipated policy changes, rendering historical data unreliable for predicting policy outcomes. Unlike the Rational Expectations Hypothesis, which assumes agents form unbiased forecasts using all available information, the Lucas Critique highlights that structural parameters in econometric models shift when policies change, invalidating static model predictions. This insight revolutionized macroeconomic modeling by emphasizing the need for policy evaluations to incorporate changes in agent behavior and expectations.

Key Differences Between Rational Expectations and Lucas Critique

Rational Expectations Hypothesis assumes individuals use all available information to predict future economic variables accurately, forming unbiased forecasts that influence policy outcomes. The Lucas Critique argues that traditional policy evaluation methods fail because they neglect changes in agents' behavior in response to new policies, emphasizing the need to model expectations within structural economic models. Key differences lie in the scope: Rational Expectations focuses on forecasting accuracy, while the Lucas Critique highlights the structural shifts in behavior and policy effectiveness due to revised expectations.

Policy Implications of Both Frameworks

The Rational Expectations Hypothesis asserts that economic agents use all available information to forecast future policies, rendering systematic policy interventions ineffective in altering real economic outcomes. In contrast, the Lucas critique highlights that traditional econometric models fail to account for changes in agents' behavior when policy parameters shift, urging policymakers to design strategies that consider structural adjustments in expectations. Policy implications emphasize the necessity for credible, consistent policies under Rational Expectations, while Lucas advocates for models incorporating expectation formation to avoid policy ineffectiveness or unintended consequences.

Criticisms and Limitations of Each Theory

The Rational Expectations Hypothesis faces criticism for assuming that all agents have perfect foresight and access to all relevant information, which is often unrealistic in practice, leading to potential model misspecification. The Lucas critique highlights the limited validity of traditional policy evaluations by emphasizing that economic agents adjust their behavior in response to policy changes, thereby undermining models that do not account for expectation-driven structural shifts. Both frameworks struggle with empirical validation due to complexities in measuring expectations and adapting models to dynamic policy environments, which restricts their practical policy application.

Conclusion: Rational Expectations Hypothesis vs Lucas Critique

The Rational Expectations Hypothesis asserts that economic agents use all available information efficiently to forecast future economic variables, making systematic policy errors less likely. In contrast, the Lucas Critique emphasizes that traditional policy evaluation models fail when agents alter their behavior in response to changes in economic policy, thus invalidating predictions derived from historical data. Consequently, effective policy design must incorporate models with forward-looking agents whose expectations adjust to policy shifts, aligning with the Lucas Critique's call for more robust macroeconomic frameworks.

Rational Expectations Hypothesis Infographic

libterm.com

libterm.com