Bank transfer is a secure and efficient method for moving funds directly between bank accounts without needing cash or checks. This payment option is widely used for both personal and business transactions, offering reliability and convenience. Discover how mastering bank transfers can simplify your financial dealings by reading the rest of this article.

Table of Comparison

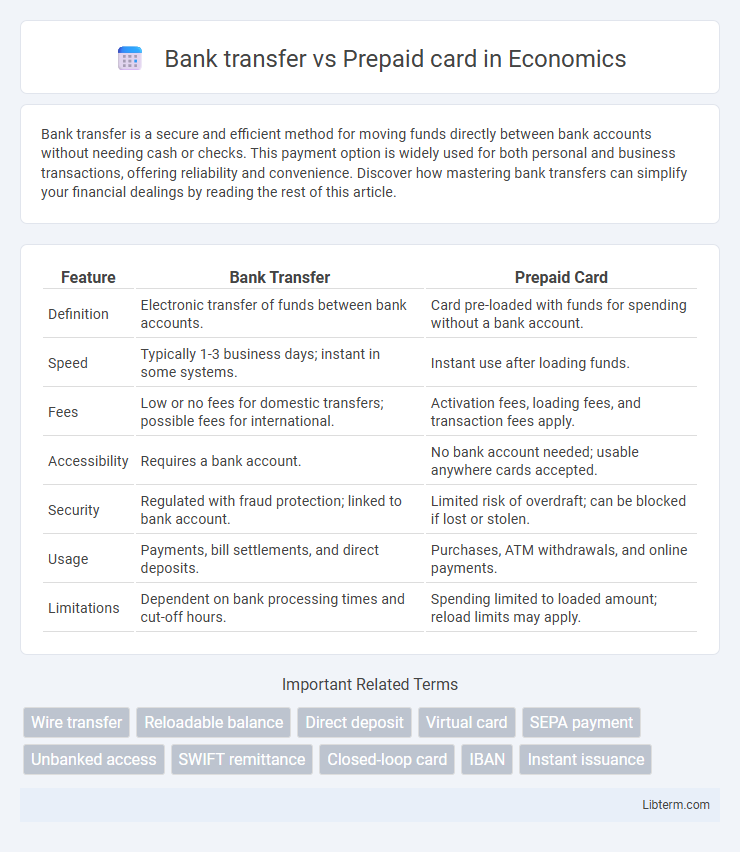

| Feature | Bank Transfer | Prepaid Card |

|---|---|---|

| Definition | Electronic transfer of funds between bank accounts. | Card pre-loaded with funds for spending without a bank account. |

| Speed | Typically 1-3 business days; instant in some systems. | Instant use after loading funds. |

| Fees | Low or no fees for domestic transfers; possible fees for international. | Activation fees, loading fees, and transaction fees apply. |

| Accessibility | Requires a bank account. | No bank account needed; usable anywhere cards accepted. |

| Security | Regulated with fraud protection; linked to bank account. | Limited risk of overdraft; can be blocked if lost or stolen. |

| Usage | Payments, bill settlements, and direct deposits. | Purchases, ATM withdrawals, and online payments. |

| Limitations | Dependent on bank processing times and cut-off hours. | Spending limited to loaded amount; reload limits may apply. |

Introduction to Bank Transfers and Prepaid Cards

Bank transfers enable direct electronic movement of funds between bank accounts, offering secure and efficient payment solutions widely used for both domestic and international transactions. Prepaid cards are loaded with a fixed amount of money prior to use, providing controlled spending options without the need for a bank account or credit check. Both payment methods cater to different financial needs, with bank transfers suited for larger transactions and prepaid cards ideal for budgeting and limited spending scenarios.

How Bank Transfers Work

Bank transfers operate by electronically moving funds directly from one bank account to another through a secure network, often using systems like ACH, SWIFT, or SEPA. These transfers require account details such as the recipient's IBAN or routing number and can take from seconds to several business days depending on the method and locations involved. Bank transfers provide a reliable and traceable way to send large sums without the need for physical cards or cash.

How Prepaid Cards Operate

Prepaid cards operate by allowing users to load a fixed amount of money onto the card before making transactions, functioning similarly to debit cards but without the need for a bank account. These cards are widely accepted for purchases online and in stores, offering a secure alternative to cash and reducing the risk of overspending since funds are limited to the prepaid balance. Unlike bank transfers that move funds between accounts, prepaid cards provide immediate access to loaded funds without requiring credit checks or linking to a traditional bank account.

Key Differences Between Bank Transfers and Prepaid Cards

Bank transfers involve directly moving funds from one bank account to another, offering high security and usually higher transaction limits, while prepaid cards access loaded funds without linking to a bank account, providing convenience and better control over spending. Bank transfers typically require both sender and receiver to have bank accounts, whereas prepaid cards allow users to make payments or withdraw cash independently of a bank. Transaction fees for bank transfers vary depending on banks and transfer types, whereas prepaid cards often charge activation, reload, or usage fees, influencing cost-effectiveness based on user needs.

Speed of Transactions: Bank Transfer vs Prepaid Card

Bank transfers typically take 1 to 3 business days to process, depending on the banks and countries involved, which can delay access to funds. Prepaid cards offer near-instant transaction speeds for purchases and ATM withdrawals, providing immediate access to loaded funds. The speed advantage of prepaid cards makes them ideal for quick spending and emergency use, while bank transfers are slower but suitable for larger, scheduled payments.

Security Considerations for Both Payment Methods

Bank transfers offer robust security through encryption protocols and direct bank-to-bank communication, reducing fraud risk but requiring careful verification to avoid phishing attacks. Prepaid cards limit exposure by capping spending and isolating funds from main accounts, but they can be vulnerable to physical loss or unauthorized usage if not safeguarded properly. Both methods demand vigilant monitoring and secure handling to ensure financial safety in transactions.

Costs and Fees Comparison

Bank transfers typically incur lower fees for domestic transactions compared to prepaid cards, which often charge activation fees, monthly maintenance fees, and reload fees, increasing overall costs. International bank transfers may involve currency conversion fees and receiving charges, while prepaid cards often apply foreign transaction fees and ATM withdrawal fees abroad. Evaluating these costs based on transaction frequency and destination is crucial for choosing the most cost-effective payment method.

Accessibility and User Convenience

Bank transfer offers broad accessibility by allowing direct movement of funds between bank accounts, often requiring only basic account details, ideal for users with established banking relationships. Prepaid cards provide enhanced user convenience by enabling immediate spending without the need for a bank account, supporting users who prefer or require a more flexible financial tool. Both methods cater to different user needs, with bank transfers suited for secure, larger transactions and prepaid cards favoring ease of use and rapid access to funds.

Use Cases: When to Choose Bank Transfer or Prepaid Card

Bank transfers are ideal for large, secure transactions like rent payments, salary disbursements, or business-to-business payments, offering traceability and minimal fees. Prepaid cards suit controlled spending scenarios such as travel expenses, gifting, and managing budgets for minors or employees, providing convenience without requiring a bank account. Selecting between them depends on transaction size, need for security, real-time access, and budget control priorities.

Conclusion: Which Payment Method Suits Your Needs?

Bank transfers offer secure, direct processing of large sums with minimal fees, ideal for business transactions and long-term payments. Prepaid cards provide convenient spending control, easy budgeting, and reduced fraud risk, making them perfect for daily expenses and travel. Selecting the right method depends on transaction size, frequency, and need for flexibility or security.

Bank transfer Infographic

libterm.com

libterm.com