Currency substitution occurs when residents of a country use a foreign currency alongside or instead of the domestic currency, often to protect against inflation or economic instability. This practice can impact monetary policy effectiveness and influence the overall economy. Explore the rest of the article to understand how currency substitution might affect your financial decisions.

Table of Comparison

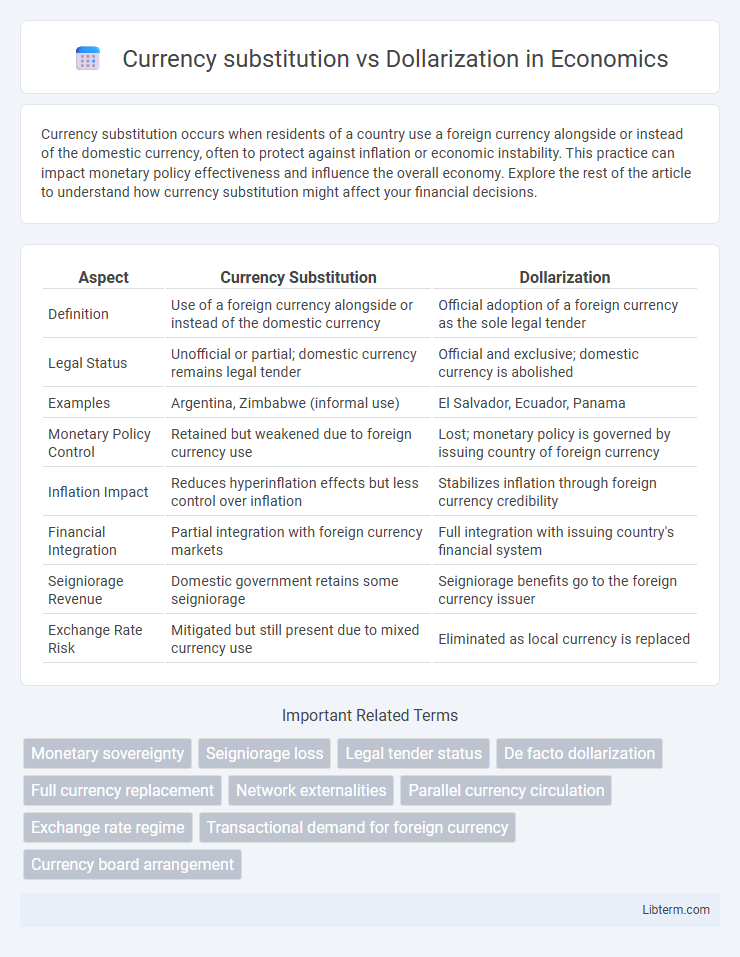

| Aspect | Currency Substitution | Dollarization |

|---|---|---|

| Definition | Use of a foreign currency alongside or instead of the domestic currency | Official adoption of a foreign currency as the sole legal tender |

| Legal Status | Unofficial or partial; domestic currency remains legal tender | Official and exclusive; domestic currency is abolished |

| Examples | Argentina, Zimbabwe (informal use) | El Salvador, Ecuador, Panama |

| Monetary Policy Control | Retained but weakened due to foreign currency use | Lost; monetary policy is governed by issuing country of foreign currency |

| Inflation Impact | Reduces hyperinflation effects but less control over inflation | Stabilizes inflation through foreign currency credibility |

| Financial Integration | Partial integration with foreign currency markets | Full integration with issuing country's financial system |

| Seigniorage Revenue | Domestic government retains some seigniorage | Seigniorage benefits go to the foreign currency issuer |

| Exchange Rate Risk | Mitigated but still present due to mixed currency use | Eliminated as local currency is replaced |

Understanding Currency Substitution: Definition and Basics

Currency substitution occurs when residents of a country use a foreign currency alongside or instead of the domestic currency for transactions, savings, or pricing. This phenomenon typically arises due to inflation, currency instability, or lack of trust in the local monetary system, leading to partial use of foreign currency without legal adoption. In contrast, dollarization refers to the complete or official adoption of a foreign currency, often the U.S. dollar, as the primary legal tender within a country's economy.

What is Dollarization? Scope and Key Concepts

Dollarization refers to the process whereby a country adopts a foreign currency, typically the US dollar, as its official legal tender either fully or partially, replacing its domestic currency in everyday transactions. This phenomenon can be categorized into official dollarization, where the foreign currency is legally recognized and circulated alongside or instead of the local currency, and unofficial dollarization, where residents prefer holding and transacting in foreign currency without formal government endorsement. Key concepts include monetary sovereignty loss, reduced exchange rate risk, enhanced price stability, and potential impacts on seigniorage revenue and monetary policy effectiveness.

Core Differences: Currency Substitution vs Dollarization

Currency substitution occurs when residents use a foreign currency alongside the domestic currency for transactions and savings without the foreign currency being official legal tender. Dollarization refers to the complete or partial adoption of the US dollar as the official currency of a country, replacing the national currency. The core difference lies in legality and extent: currency substitution is informal and dual-currency based, while dollarization is formalized and often involves relinquishing monetary policy control.

Historical Context: Major Episodes of Each Practice

Currency substitution emerged in Latin America during the 1980s debt crisis, as citizens favored stable foreign currencies to protect savings from hyperinflation, especially in countries like Argentina and Brazil. Dollarization took a formal shape in Ecuador in 2000 after severe economic instability, leading the government to adopt the U.S. dollar as the official legal tender to restore monetary stability. Both practices indicate responses to macroeconomic uncertainty but differ in legality and central bank control over monetary policy.

Economic Drivers Behind Adopting Foreign Currencies

Currency substitution occurs when residents use foreign currencies alongside the local currency to protect against volatility and inflation, often driven by economic instability and loss of confidence in the national currency. Dollarization takes this process further by officially adopting the US dollar as the sole legal tender to stabilize the economy, reduce transaction costs, and attract foreign investment. Key economic drivers include hyperinflation, fiscal mismanagement, and lack of credible monetary policy, prompting countries to seek monetary stability through foreign currency use.

Impacts on Monetary Policy and Inflation Control

Currency substitution reduces the effectiveness of a country's monetary policy by limiting the central bank's ability to control money supply and interest rates, leading to diminished inflation control. Dollarization, where a foreign currency like the US dollar is officially adopted, eliminates currency risk and can stabilize inflation but removes independent monetary policy tools entirely. Both phenomena constrain monetary sovereignty and complicate inflation targeting efforts, often requiring fiscal discipline and external economic adjustments.

Effects on Financial Stability and Banking Systems

Currency substitution often weakens domestic financial stability by reducing demand for local currency deposits, leading to diminished monetary policy effectiveness and increased banking sector vulnerability. Dollarization, representing full adoption of a foreign currency like the US dollar, can enhance confidence and reduce inflation risk but limits central banks' ability to act as lenders of last resort, potentially constraining crisis management. Both phenomena alter banking system dynamics, with currency substitution exposing banks to foreign exchange risks, while dollarization may lead to asset-liability mismatches and dependence on external monetary conditions.

Policy Responses: Managing and Reversing Substitution

Policy responses to currency substitution and dollarization involve strengthening domestic monetary and fiscal frameworks to restore confidence in the national currency. Central banks often implement measures such as improving inflation targeting, enhancing financial sector stability, and promoting exchange rate flexibility to encourage re-dollarization. Structural reforms, foreign exchange interventions, and legal restrictions on foreign currency use serve as tools to manage or reverse currency substitution effectively.

Case Studies: Successes and Failures Worldwide

Currency substitution and dollarization have been implemented with varied outcomes globally, highlighting nuanced economic impacts. In Ecuador and El Salvador, official dollarization stabilized inflation and attracted foreign investment, while Zimbabwe's hyperinflation-driven currency substitution led to economic instability and loss of monetary policy control. Argentina's partial dollarization shows mixed results, with dollar usage cushioning inflation but complicating fiscal management and competitiveness.

Future Trends: Digital Currencies and De-Dollarization

Emerging digital currencies, including central bank digital currencies (CBDCs) like China's digital yuan, are reshaping currency substitution by offering secure, efficient alternatives to traditional foreign currencies in cross-border trade. De-dollarization trends, driven by geopolitical shifts and sanctions, are accelerating the adoption of regional payment systems and local currencies, reducing reliance on the U.S. dollar in global markets. Forecasts indicate increased integration of blockchain technology and decentralized finance (DeFi), further promoting currency diversification and challenging dollar dominance in the international financial system.

Currency substitution Infographic

libterm.com

libterm.com