The New Keynesian model incorporates price stickiness and imperfect competition to explain short-term economic fluctuations and the effectiveness of monetary policy. It emphasizes the role of expectations and nominal rigidities, providing a framework for analyzing inflation dynamics and output gaps. Explore the rest of the article to understand how this model applies to current economic challenges and policy decisions.

Table of Comparison

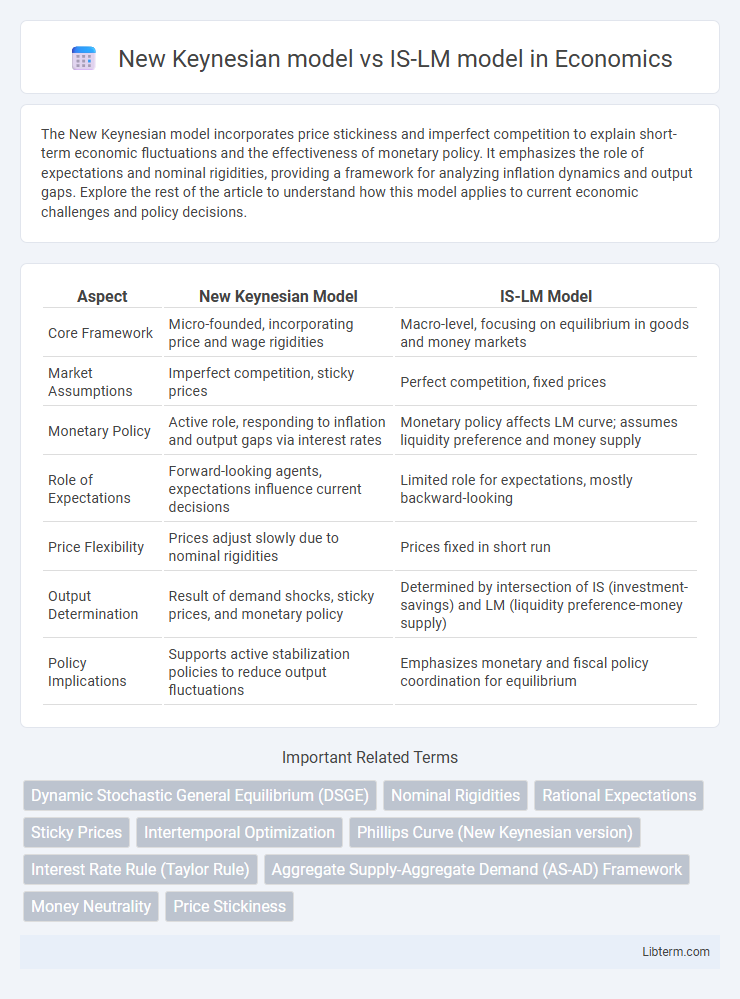

| Aspect | New Keynesian Model | IS-LM Model |

|---|---|---|

| Core Framework | Micro-founded, incorporating price and wage rigidities | Macro-level, focusing on equilibrium in goods and money markets |

| Market Assumptions | Imperfect competition, sticky prices | Perfect competition, fixed prices |

| Monetary Policy | Active role, responding to inflation and output gaps via interest rates | Monetary policy affects LM curve; assumes liquidity preference and money supply |

| Role of Expectations | Forward-looking agents, expectations influence current decisions | Limited role for expectations, mostly backward-looking |

| Price Flexibility | Prices adjust slowly due to nominal rigidities | Prices fixed in short run |

| Output Determination | Result of demand shocks, sticky prices, and monetary policy | Determined by intersection of IS (investment-savings) and LM (liquidity preference-money supply) |

| Policy Implications | Supports active stabilization policies to reduce output fluctuations | Emphasizes monetary and fiscal policy coordination for equilibrium |

Introduction to Macroeconomic Models

The New Keynesian model incorporates microeconomic foundations, price stickiness, and rational expectations to analyze aggregate demand and supply dynamics, refining the traditional IS-LM framework by emphasizing real rigidities and monetary policy effectiveness. The IS-LM model, developed for the Keynesian short run, represents equilibrium in goods and money markets through the interaction of the investment-savings (IS) curve and liquidity preference-money supply (LM) curve, assuming price and wage rigidity. Both models serve as foundational tools in macroeconomic analysis, with the New Keynesian model offering a more comprehensive approach to monetary policy and output determination under nominal rigidities.

Overview of the IS-LM Model

The IS-LM model represents the interaction between the goods market (Investment-Saving, IS curve) and the money market (Liquidity preference-Money supply, LM curve), determining equilibrium interest rates and output in the short run. It primarily assumes fixed price levels and highlights how fiscal and monetary policies influence aggregate demand. The model serves as a foundational tool in macroeconomics, offering insights into output fluctuations before the incorporation of expectations and price adjustments found in New Keynesian frameworks.

Fundamentals of the New Keynesian Model

The New Keynesian model builds on the IS-LM framework by incorporating microeconomic foundations such as price stickiness and rational expectations to explain short-run economic fluctuations. It emphasizes the role of nominal rigidities and real rigidities, allowing monetary policy to influence output and employment in the short term. Unlike the IS-LM model, the New Keynesian approach integrates forward-looking behavior and dynamic optimization, enhancing its ability to analyze monetary policy effects in modern economies.

Assumptions in IS-LM vs. New Keynesian Models

The IS-LM model assumes fixed prices and wages, leading to equilibrium determined by the interaction of goods and money markets, while the New Keynesian model incorporates price stickiness and nominal rigidities allowing for dynamic adjustments in inflation and output. The New Keynesian framework embeds microfoundations with rational expectations and incorporates imperfect competition, contrasting the IS-LM model's simpler aggregate demand and supply representation. Policy implications differ as the IS-LM assumes monetary neutrality in the long run, whereas New Keynesian models highlight the role of monetary and fiscal policy under rigid prices in influencing real economic activity.

Role of Price Stickiness

The New Keynesian model emphasizes price stickiness as a central feature that causes short-term economic fluctuations and allows monetary policy to influence real output. In contrast, the traditional IS-LM model assumes fixed prices and focuses on equilibrium in goods and money markets without explicitly incorporating price rigidity. Price stickiness in the New Keynesian framework leads to delayed adjustment of wages and prices, explaining persistent unemployment and output gaps during demand shocks.

Monetary Policy Transmission Mechanisms

The New Keynesian model emphasizes forward-looking expectations and price stickiness, capturing how monetary policy influences real interest rates and output through intertemporal consumption decisions. In contrast, the IS-LM model relies on fixed prices and depicts monetary policy transmission via shifts in the LM curve affecting liquidity preference and interest rates, subsequently influencing investment and aggregate demand. New Keynesian analysis integrates microfoundations and nominal rigidities, offering a richer framework for understanding how policy changes alter inflation and output dynamics over time.

Incorporating Expectations: Rational vs. Static

The New Keynesian model incorporates rational expectations, allowing economic agents to form forecasts based on all available information, which leads to forward-looking behavior in consumption and investment. In contrast, the IS-LM model typically assumes static or adaptive expectations, where agents base decisions primarily on past information without anticipating future policy changes. This fundamental difference in expectation formation significantly affects the models' predictions on monetary and fiscal policy effectiveness.

Real-World Applications and Limitations

The New Keynesian model incorporates price and wage rigidities, making it more suitable for analyzing real-world monetary policy effects and inflation dynamics than the traditional IS-LM model, which assumes fixed prices and focuses on short-run equilibrium in goods and money markets. The IS-LM framework simplifies economic interactions but struggles to capture expectations and dynamic adjustments, limiting its applicability in modern macroeconomic policy analysis. Central banks and policymakers often prefer New Keynesian models for forecasting and policy design due to their microfoundations and ability to model forward-looking behavior.

Empirical Evidence and Model Performance

Empirical evidence indicates that the New Keynesian model better captures short-run price stickiness and monetary policy effects compared to the IS-LM model, which assumes fixed prices and lacks microfoundations. The New Keynesian framework, incorporating forward-looking expectations and nominal rigidities, aligns more closely with observed fluctuations in output and inflation during business cycles. Model performance assessments highlight the New Keynesian model's superior ability to explain real-world monetary policy transmission and predict economic dynamics under various shocks.

Conclusion: Comparative Insights and Policy Implications

The New Keynesian model incorporates microfoundations and price stickiness, offering a more dynamic and realistic framework for analyzing monetary and fiscal policy effects compared to the traditional IS-LM model, which assumes fixed prices and focuses primarily on goods and money markets equilibrium. New Keynesian insights emphasize the importance of expectations and nominal rigidities, predicting that monetary policy can influence real output in the short run without causing inflation in the long run. Policymakers benefit from the New Keynesian framework by understanding the trade-offs between inflation and output stabilization, leading to more effective interventions in response to economic shocks.

New Keynesian model Infographic

libterm.com

libterm.com