Economic modeling simplifies complex financial systems into understandable frameworks, enabling better decision-making and forecasting. By applying mathematical and statistical techniques, it helps predict market trends, assess policy impacts, and optimize resource allocation. Discover how economic modeling can transform your understanding of economic dynamics by exploring the details in the rest of this article.

Table of Comparison

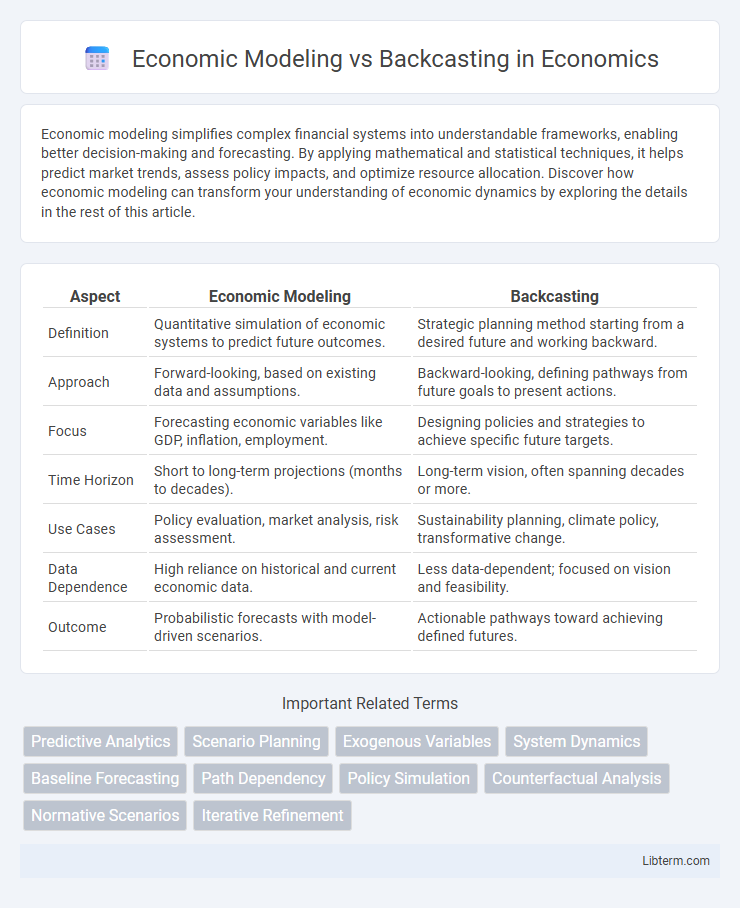

| Aspect | Economic Modeling | Backcasting |

|---|---|---|

| Definition | Quantitative simulation of economic systems to predict future outcomes. | Strategic planning method starting from a desired future and working backward. |

| Approach | Forward-looking, based on existing data and assumptions. | Backward-looking, defining pathways from future goals to present actions. |

| Focus | Forecasting economic variables like GDP, inflation, employment. | Designing policies and strategies to achieve specific future targets. |

| Time Horizon | Short to long-term projections (months to decades). | Long-term vision, often spanning decades or more. |

| Use Cases | Policy evaluation, market analysis, risk assessment. | Sustainability planning, climate policy, transformative change. |

| Data Dependence | High reliance on historical and current economic data. | Less data-dependent; focused on vision and feasibility. |

| Outcome | Probabilistic forecasts with model-driven scenarios. | Actionable pathways toward achieving defined futures. |

Introduction to Economic Modeling and Backcasting

Economic modeling uses mathematical frameworks and quantitative data to simulate economic behaviors and forecast future trends, aiding policymakers in decision-making processes. Backcasting starts with defining a desired future outcome and works backward to identify necessary steps and policies to achieve that goal, emphasizing strategic planning over prediction. Both approaches provide valuable insights, with economic modeling focusing on scenario analysis and backcasting prioritizing goal-oriented pathways.

Defining Economic Modeling: Concepts and Applications

Economic modeling involves creating abstract representations of economic processes to analyze and predict the behavior of economies or markets under various scenarios. It applies mathematical equations, statistical methods, and computational algorithms to simulate economic dynamics, supporting decision-making in policy design, investment strategies, and resource allocation. Key applications include forecasting economic growth, assessing the impact of fiscal policies, and evaluating market interventions to optimize economic outcomes.

Understanding Backcasting: Principles and Methodology

Backcasting is a strategic planning methodology that starts with defining a desired future outcome and then works backward to identify the steps necessary to achieve that vision. It contrasts with traditional economic modeling, which typically projects future scenarios based on current trends and data patterns. Backcasting emphasizes long-term sustainability goals and incorporates stakeholder engagement to develop actionable pathways toward preferred futures.

Key Differences Between Economic Modeling and Backcasting

Economic modeling relies on quantitative data and mathematical frameworks to predict future economic outcomes based on current trends, while backcasting starts with defining a desired future scenario and works backward to identify necessary policies and actions. Economic modeling is predominantly forward-looking and data-driven, emphasizing economic indicators like GDP, inflation, and employment rates. In contrast, backcasting prioritizes long-term sustainability goals and stakeholder engagement to develop strategic pathways in uncertain or transformative contexts.

Historical Context and Evolution of Both Approaches

Economic modeling originated in the early 20th century with the development of Keynesian economics, emphasizing quantitative prediction of future economic behavior using mathematical frameworks and statistical tools. Backcasting emerged later in the 1970s within environmental planning and sustainability studies, focusing on defining a desirable future and working backward to identify policies and strategies necessary to achieve that future state. Over time, economic modeling evolved to incorporate dynamic systems and computational advances, while backcasting gained prominence for its normative approach, contrasting the predictive focus of traditional economic models.

Strengths and Limitations of Economic Modeling

Economic modeling excels in quantifying complex market dynamics and projecting economic impacts based on historical and current data, offering precise scenario analysis for policymaking. Its limitations include reliance on assumptions that may oversimplify real-world complexities, potential biases in data input, and difficulty accounting for unpredictable behavioral responses or external shocks. While powerful for forecasting and policy evaluation, economic models may struggle with long-term uncertainty and structural changes in the economy.

Advantages and Challenges of Backcasting

Backcasting offers the advantage of starting with a desired future scenario, enabling precise goal-setting and strategic planning aligned with long-term sustainability targets. It facilitates stakeholder engagement by visualizing clear outcomes, which improves consensus-building and policy design. Challenges include the reliance on accurate assumptions about future conditions and potential difficulties in addressing complex, dynamic variables that may evolve unpredictably over time.

Case Studies Comparing Economic Modeling and Backcasting

Case studies comparing economic modeling and backcasting reveal distinct approaches to forecasting and planning, with economic modeling relying on complex equations and quantitative data to predict market trends, while backcasting starts with a desired future outcome and works backward to identify necessary steps. In urban planning and climate policy, economic models quantify impacts of various scenarios, whereas backcasting supports strategic goal-setting and pathway development. These case studies highlight that combining economic modeling's precision with backcasting's visionary framework enhances decision-making efficacy for sustainable development.

Integrating Economic Modeling and Backcasting for Policy Design

Integrating economic modeling and backcasting enhances policy design by combining forward-looking economic forecasts with goal-oriented scenario planning. Economic models quantify impacts of policy changes on variables such as GDP, employment, and emissions, while backcasting defines desired futures and identifies necessary steps to achieve them. This integration supports robust decision-making by aligning long-term sustainability goals with economic feasibility and adaptability.

Future Trends in Scenario Planning and Economic Analysis

Future trends in scenario planning highlight economic modeling's strength in quantifying complex variables through predictive analytics and econometric techniques, enabling robust forecasts of market behaviors and policy impacts. Backcasting offers a strategic advantage by starting with desired future outcomes and working backward to identify necessary steps, making it especially valuable for sustainable development goals and long-term economic resilience planning. Integrating both approaches enhances scenario analysis accuracy by combining data-driven forecasts with normative visioning, improving decision-making in uncertain economic environments.

Economic Modeling Infographic

libterm.com

libterm.com