Loss aversion is a psychological principle where individuals feel the pain of losses more intensely than the pleasure of equivalent gains, significantly impacting decision-making and risk assessment. This bias can lead to overly cautious behavior, hindering potential opportunities for growth or success. Discover how loss aversion influences your choices and strategies by exploring the detailed insights in the rest of this article.

Table of Comparison

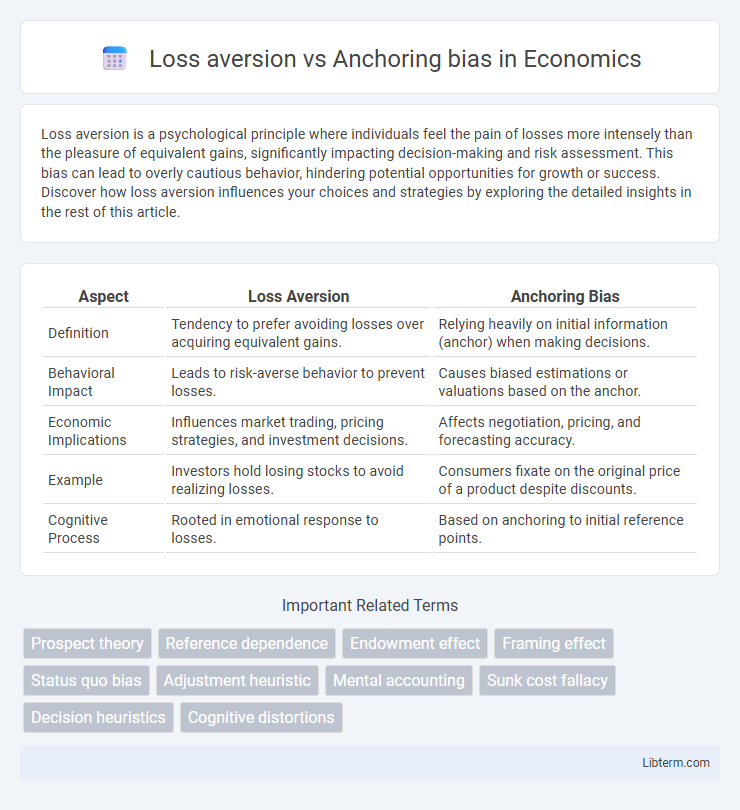

| Aspect | Loss Aversion | Anchoring Bias |

|---|---|---|

| Definition | Tendency to prefer avoiding losses over acquiring equivalent gains. | Relying heavily on initial information (anchor) when making decisions. |

| Behavioral Impact | Leads to risk-averse behavior to prevent losses. | Causes biased estimations or valuations based on the anchor. |

| Economic Implications | Influences market trading, pricing strategies, and investment decisions. | Affects negotiation, pricing, and forecasting accuracy. |

| Example | Investors hold losing stocks to avoid realizing losses. | Consumers fixate on the original price of a product despite discounts. |

| Cognitive Process | Rooted in emotional response to losses. | Based on anchoring to initial reference points. |

Introduction to Loss Aversion and Anchoring Bias

Loss aversion describes the psychological phenomenon where individuals prefer avoiding losses over acquiring equivalent gains, significantly influencing decision-making under risk. Anchoring bias occurs when people rely heavily on the first piece of information encountered (the "anchor") when making judgments, often leading to skewed estimations or choices. Both cognitive biases play crucial roles in behavioral economics and impact financial decisions, consumer behavior, and negotiation outcomes.

Defining Loss Aversion: Fear of Losses Explained

Loss aversion is a cognitive bias where individuals experience the pain of losses more intensely than the pleasure of equivalent gains, leading to risk-averse behavior. This psychological phenomenon causes people to prefer avoiding losses over acquiring comparable benefits, significantly influencing financial decisions and investment strategies. Understanding loss aversion highlights how fear of losses can override rational decision-making, often resulting in missed opportunities or suboptimal choices.

Understanding Anchoring Bias: The Power of Initial Information

Anchoring bias occurs when individuals rely heavily on the first piece of information encountered (the "anchor") when making decisions, often causing subsequent judgments to be skewed toward that initial reference point. This cognitive bias impacts financial decisions, negotiations, and consumer behavior by limiting objective evaluation of new data. Understanding how anchoring bias affects perception helps in developing strategies to mitigate its influence and improve decision-making accuracy.

Psychological Foundations Behind Both Biases

Loss aversion stems from the psychological principle that individuals experience the pain of losses more intensely than the pleasure of equivalent gains, rooted in prospect theory developed by Kahneman and Tversky. Anchoring bias arises from the cognitive heuristic where initial information disproportionately influences decision-making and subsequent judgments, often due to the brain's reliance on reference points to reduce uncertainty. Both biases reflect the human tendency to simplify complex decisions but diverge in that loss aversion emphasizes negative emotional responses to potential losses, whereas anchoring bias focuses on the disproportionate weight given to initial stimuli or information.

Real-World Examples: Loss Aversion in Decision Making

Loss aversion significantly influences financial decisions such as investors holding onto declining stocks to avoid realizing losses, leading to suboptimal portfolio performance. In marketing, consumers often perceive discounts framed as avoiding a loss (e.g., "Save $20") more favorably than equivalent gains, driving purchasing behavior. This cognitive bias also impacts negotiation tactics, where individuals prioritize preventing losses over acquiring equivalent gains, affecting agreement outcomes.

Real-World Examples: Anchoring Bias in Everyday Life

Anchoring bias heavily influences consumer behavior, such as when shoppers perceive a $50 item as cheap after seeing an original price of $150, despite the actual value being closer to $50. Real estate pricing demonstrates anchoring bias when buyers fixate on the listing price as a reference, often disregarding other market data or home conditions. In salary negotiations, initial offers set anchors that skew expectations and outcomes, causing candidates to accept lower pay than their skills might warrant.

Comparing Impact: Loss Aversion vs Anchoring Bias

Loss aversion causes individuals to disproportionately fear losses relative to equivalent gains, often leading to risk-averse decisions that prioritize avoiding loss over potential reward. Anchoring bias influences decision-making by fixating individuals on an initial reference point, even when irrelevant, skewing judgments and valuations. While loss aversion primarily impacts emotional responses to potential outcomes, anchoring bias affects cognitive evaluations by distorting perceptions based on initial information.

Strategies to Overcome Loss Aversion and Anchoring Bias

To overcome loss aversion, individuals should reframe decisions by focusing on potential gains rather than potential losses and use pre-commitment strategies to reduce emotional bias. Addressing anchoring bias involves deliberately seeking diverse data points and performing independent analyses before making decisions to prevent initial information from disproportionately influencing outcomes. Combining mindfulness techniques with structured decision frameworks enhances objectivity and minimizes the impact of these cognitive biases on financial and business decisions.

Loss Aversion and Anchoring in Financial and Consumer Behavior

Loss aversion significantly impacts financial and consumer behavior by causing individuals to prefer avoiding losses rather than acquiring equivalent gains, leading to risk-averse decision-making and market reluctance during downturns. Anchoring bias influences consumers and investors by causing an overreliance on initial information, such as a stock's past price or the first quoted price, which skews subsequent judgments and can result in suboptimal financial choices. Understanding the interplay between loss aversion and anchoring helps explain phenomena like holding losing stocks too long or overpaying based on initial price perceptions in consumer markets.

Conclusion: Navigating Cognitive Biases for Better Choices

Understanding loss aversion and anchoring bias is crucial for improving decision-making by recognizing how fear of losses and initial information skew judgments. Mitigating these biases involves critically evaluating reference points and emotional responses to potential losses, leading to more rational and balanced choices. Employing strategies such as seeking diverse perspectives and reframing problems enhances cognitive flexibility, ultimately fostering better decision outcomes.

Loss aversion Infographic

libterm.com

libterm.com