The simple spending multiplier measures how a change in autonomous spending leads to a proportionally larger change in overall economic output, amplifying the initial expenditure impact. It is calculated as the reciprocal of the marginal propensity to save (MPS), highlighting the relationship between saving habits and economic growth. Discover more about how understanding this concept can influence Your financial decisions and economic policies in the rest of the article.

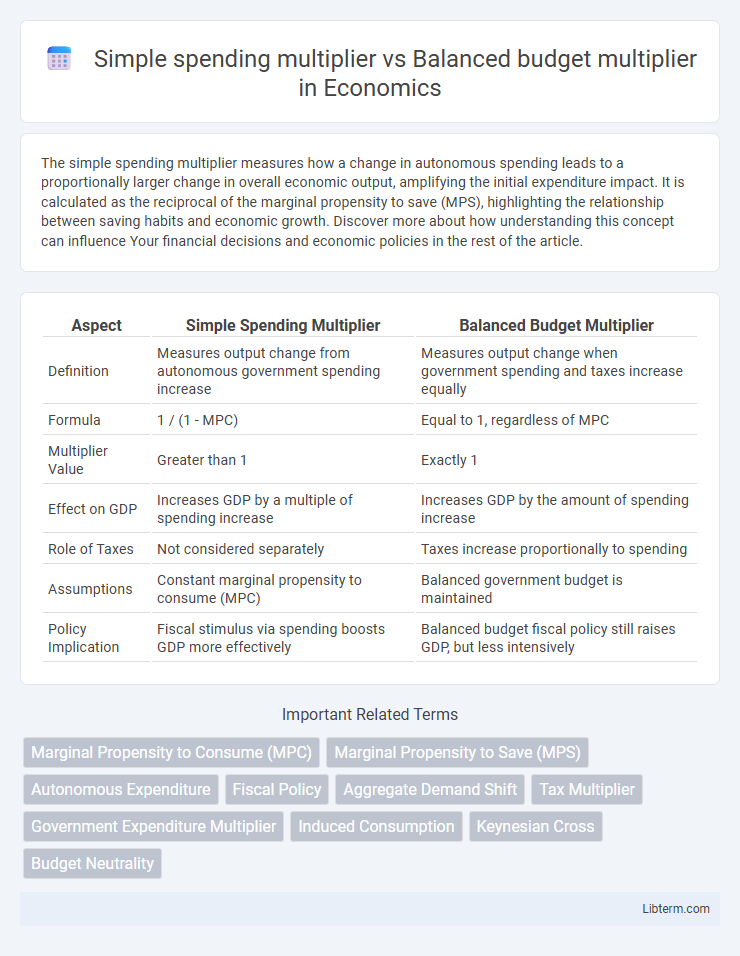

Table of Comparison

| Aspect | Simple Spending Multiplier | Balanced Budget Multiplier |

|---|---|---|

| Definition | Measures output change from autonomous government spending increase | Measures output change when government spending and taxes increase equally |

| Formula | 1 / (1 - MPC) | Equal to 1, regardless of MPC |

| Multiplier Value | Greater than 1 | Exactly 1 |

| Effect on GDP | Increases GDP by a multiple of spending increase | Increases GDP by the amount of spending increase |

| Role of Taxes | Not considered separately | Taxes increase proportionally to spending |

| Assumptions | Constant marginal propensity to consume (MPC) | Balanced government budget is maintained |

| Policy Implication | Fiscal stimulus via spending boosts GDP more effectively | Balanced budget fiscal policy still raises GDP, but less intensively |

Introduction to Fiscal Multipliers

Fiscal multipliers measure the impact of government spending and taxation on national income, with the simple spending multiplier quantifying the effect of changes in government expenditure alone. The balanced budget multiplier evaluates the effect when government spending and taxes increase by the same amount, typically resulting in a multiplier of one. Understanding these multipliers is essential for assessing fiscal policy effectiveness in influencing economic output and aggregate demand.

Understanding the Simple Spending Multiplier

The simple spending multiplier measures the effect of an initial change in autonomous spending on the overall national income, calculated as 1/(1-MPC), where MPC is the marginal propensity to consume. This multiplier highlights how an increase in government expenditure or investment can lead to a more than proportional increase in GDP due to induced consumption. Understanding the simple spending multiplier is essential for analyzing fiscal policy impacts without considering tax changes, unlike the balanced budget multiplier, which factors in simultaneous government spending and taxation adjustments.

The Mechanism Behind the Simple Spending Multiplier

The simple spending multiplier operates through the marginal propensity to consume (MPC), amplifying initial changes in autonomous spending into larger shifts in overall economic output. As households spend a portion of additional income, subsequent rounds of consumption stimulate further income generation, creating a ripple effect throughout the economy. This mechanism contrasts with the balanced budget multiplier, where simultaneous increases in government spending and taxation yield a net impact equal to the initial spending change due to offsetting effects on aggregate demand.

What is the Balanced Budget Multiplier?

The Balanced Budget Multiplier measures the impact on national income when government spending and taxation increase by the same amount, resulting in a net fiscal effect on aggregate demand. Unlike the simple spending multiplier that amplifies changes in autonomous government spending alone, the balanced budget multiplier reflects the simultaneous adjustment in taxes, typically equaling one, meaning total output rises by the amount of the spending increase without causing a budget deficit. This multiplier highlights the unique fiscal policy tool where the government can stimulate economic activity without increasing the budget deficit.

Key Differences Between Simple and Balanced Budget Multipliers

The simple spending multiplier measures the change in aggregate demand resulting from an initial change in government spending, typically greater than one, while the balanced budget multiplier equals one, indicating that equal changes in government spending and taxes have a neutral net impact on the budget deficit. A key difference lies in their fiscal policy effects; the simple spending multiplier amplifies economic output through direct government expenditure, whereas the balanced budget multiplier reflects simultaneous tax adjustments, maintaining budget neutrality. The balanced budget multiplier specifically captures the crowding-in effect where increased spending is offset by increased taxation, contrasting with the simple spending multiplier's isolation of spending impact without considering tax changes.

Mathematical Formulas and Calculations

The simple spending multiplier is calculated using the formula 1/(1-MPC), where MPC represents the marginal propensity to consume, indicating the total change in output resulting from an initial change in autonomous spending. The balanced budget multiplier equals 1, derived from simultaneous changes in government spending and taxation of equal amounts, reflecting a direct one-to-one impact on aggregate demand despite no change in the budget deficit. These formulas reveal that while the simple spending multiplier amplifies fiscal stimulus effects, the balanced budget multiplier demonstrates how matched government expenditure and tax adjustments produce a stable but positive aggregate output effect.

Determinants Influencing Multiplier Effects

Determinants influencing the simple spending multiplier include the marginal propensity to consume (MPC), which directly affects the magnitude of total output increase from an initial spending injection, and the marginal tax rate that reduces disposable income and thus spending. The balanced budget multiplier hinges on the simultaneous changes in government spending and taxation, with its effectiveness depending on how these changes alter aggregate demand without distorting consumption patterns or saving behavior. Both multipliers are influenced by factors such as consumer confidence, interest rates, and the state of the economy, which shape the responsiveness of consumption and investment to fiscal policy adjustments.

Real-world Examples and Applications

The simple spending multiplier measures the total increase in GDP resulting from an initial change in autonomous spending, such as government investment in infrastructure projects that spur multiple rounds of consumer and business spending. The balanced budget multiplier, typically equal to one, reflects the impact on GDP when the government increases spending and taxes by the same amount, as seen in stimulus packages where government expenditures are matched by tax hikes to avoid deficits. Real-world applications include fiscal policy decisions during recessions, where governments evaluate whether to increase spending alone or simultaneously raise taxes to stabilize economic output without increasing debt.

Policy Implications for Government Spending

The simple spending multiplier quantifies the effect of a change in government expenditure on aggregate demand, typically resulting in a multiplied increase in GDP. The balanced budget multiplier, however, demonstrates that equal increases in government spending and taxes lead to a net positive impact on economic output, often close to one. Policymakers leverage the simple spending multiplier to stimulate growth during recessions, while the balanced budget multiplier guides strategies that avoid deficits by offsetting spending increases with tax hikes.

Conclusion: Choosing the Appropriate Multiplier

Selecting the appropriate multiplier depends on fiscal policy goals and economic context, as the simple spending multiplier amplifies changes in autonomous spending, driving stronger short-term GDP responses. The balanced budget multiplier, equal to one, ensures fiscal neutrality by offsetting government spending increases with equivalent tax rises, producing a moderate impact on aggregate demand without increasing deficits. Policymakers targeting rapid economic stimulus favor the simple spending multiplier, while those aiming for balanced budgets and controlled inflation prefer the balanced budget multiplier.

Simple spending multiplier Infographic

libterm.com

libterm.com