Constant returns to scale occur when increasing all input factors by a certain proportion results in an equal proportional increase in output, reflecting efficient production processes. This concept is crucial for understanding long-term production and cost behaviors within firms. Explore the rest of the article to learn how constant returns to scale impact your business decisions and economic analysis.

Table of Comparison

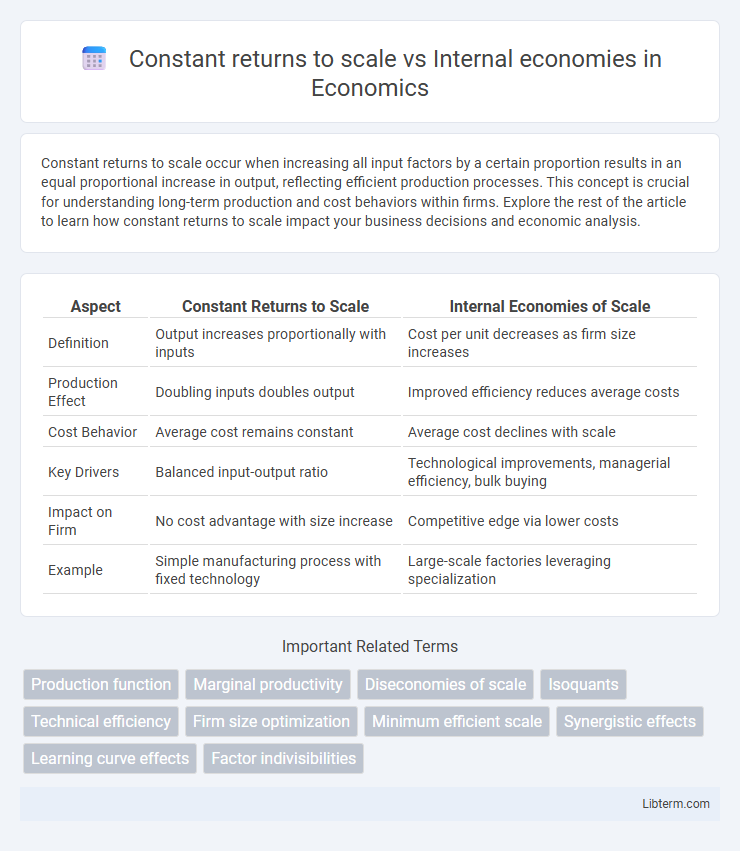

| Aspect | Constant Returns to Scale | Internal Economies of Scale |

|---|---|---|

| Definition | Output increases proportionally with inputs | Cost per unit decreases as firm size increases |

| Production Effect | Doubling inputs doubles output | Improved efficiency reduces average costs |

| Cost Behavior | Average cost remains constant | Average cost declines with scale |

| Key Drivers | Balanced input-output ratio | Technological improvements, managerial efficiency, bulk buying |

| Impact on Firm | No cost advantage with size increase | Competitive edge via lower costs |

| Example | Simple manufacturing process with fixed technology | Large-scale factories leveraging specialization |

Understanding Constant Returns to Scale

Constant returns to scale occur when increasing all input factors by a certain proportion leads to an equal proportional increase in output, maintaining efficiency levels. This concept contrasts with internal economies of scale, where a firm's average costs decrease as production expands due to operational improvements or technological advancements. Understanding constant returns to scale is crucial for analyzing production functions and long-term growth potential without changes in cost structure.

Defining Internal Economies of Scale

Internal economies of scale refer to cost advantages that a firm experiences as it increases production, resulting from factors within the company such as improved labor efficiency, advanced technology, and better management. Constant returns to scale occur when increasing input proportions leads to a proportional increase in output, meaning the firm's long-run average costs remain unchanged as production scales. Unlike constant returns to scale, internal economies of scale cause a decrease in per-unit costs, enhancing competitive advantage and profitability.

Key Differences Between Constant Returns and Internal Economies

Constant returns to scale occur when output increases proportionally with input, maintaining a constant average cost, while internal economies refer to cost advantages firms gain as their scale of production expands, leading to decreased average costs. Constant returns indicate a linear relationship between input and output without efficiency gains, whereas internal economies result from improved operational efficiencies, such as specialization, bulk purchasing, and technological advancements. The key difference lies in constant returns reflecting no change in per-unit cost despite scaling, whereas internal economies signify cost reductions due to internal factors within the firm's control.

Causes of Constant Returns to Scale

Constant returns to scale occur when proportional increases in all inputs lead to an equal proportional increase in output, reflecting balanced productivity growth without efficiency gains or losses. The main causes include fixed technology, unchanged production methods, and absence of scale-related cost advantages or disadvantages. Firms operating under constant returns to scale experience no significant benefits from expanding their production scale beyond existing input combinations.

Factors Leading to Internal Economies

Internal economies of scale arise from firm-specific factors such as technological advancements, improved managerial skills, specialized labor, and efficient capital utilization, all of which reduce average costs as production expands. Unlike constant returns to scale where output increases proportionally with inputs, internal economies enable cost reductions beyond proportional input increases by leveraging expertise and innovation. Investment in research and development, automation, and organizational restructuring also play critical roles in driving internal economies within a firm.

Production Efficiency: CRS vs Internal Economies

Constant returns to scale (CRS) maintain proportional input-output relationships, where doubling inputs leads to doubling outputs, ensuring consistent production efficiency across varying scales. Internal economies of scale arise from factors like improved labor specialization, better technology, and managerial efficiency, enhancing production efficiency as the firm's size increases. While CRS indicates uniform efficiency levels, internal economies enable a reduction in average production costs and heightened efficiency when scaling up operations.

Impact on Firm Size and Growth

Constant returns to scale indicate that a firm's output increases proportionally with input, which limits significant advantages from scaling and often results in moderate firm size and growth. Internal economies of scale arise from factors like improved production techniques or better management within the firm, enabling cost reductions as the firm expands, thus promoting larger firm size and faster growth. Firms experiencing strong internal economies tend to grow more rapidly by leveraging efficiency gains, whereas those under constant returns to scale face more constrained expansion opportunities.

Real-World Examples: CRS and Internal Economies

Constant returns to scale (CRS) occur when a firm doubles its inputs and outputs increase proportionally, exemplified by a large-scale bakery maintaining efficiency as it expands production. In contrast, internal economies of scale arise when a firm's average costs decrease due to factors like improved technology or better management, as seen in automobile manufacturers such as Toyota leveraging automation to reduce per-unit costs. Real-world cases highlight that CRS ensures stable efficiency during scaling, while internal economies drive cost advantages that enhance competitiveness during growth.

Implications for Cost Structures

Constant returns to scale imply that doubling inputs results in a proportional doubling of output, leading to a linear cost structure where average costs remain unchanged as production scales. Internal economies of scale occur when increasing production reduces average costs due to efficiencies within the firm, such as improved technology or specialization. While constant returns to scale maintain stable cost behavior, internal economies shift the cost curve downward, enabling larger firms to achieve competitive cost advantages.

Choosing the Right Scale Strategy

Choosing the right scale strategy requires understanding the distinction between constant returns to scale and internal economies. Constant returns to scale occur when output increases proportionally with all inputs, maintaining steady efficiency, while internal economies reflect cost advantages gained through expanding production within a firm, such as improved technology or specialization. Firms aiming for optimal growth must analyze whether scaling up maintains consistent productivity or unlocks significant cost reductions through internal efficiencies.

Constant returns to scale Infographic

libterm.com

libterm.com