The market price of risk represents the extra return an investor expects for taking on additional risk compared to a risk-free asset, serving as a critical factor in asset pricing models. Understanding this concept helps you make informed investment decisions by balancing potential rewards against inherent uncertainties. Explore the rest of the article to uncover how the market price of risk impacts your portfolio strategy and financial goals.

Table of Comparison

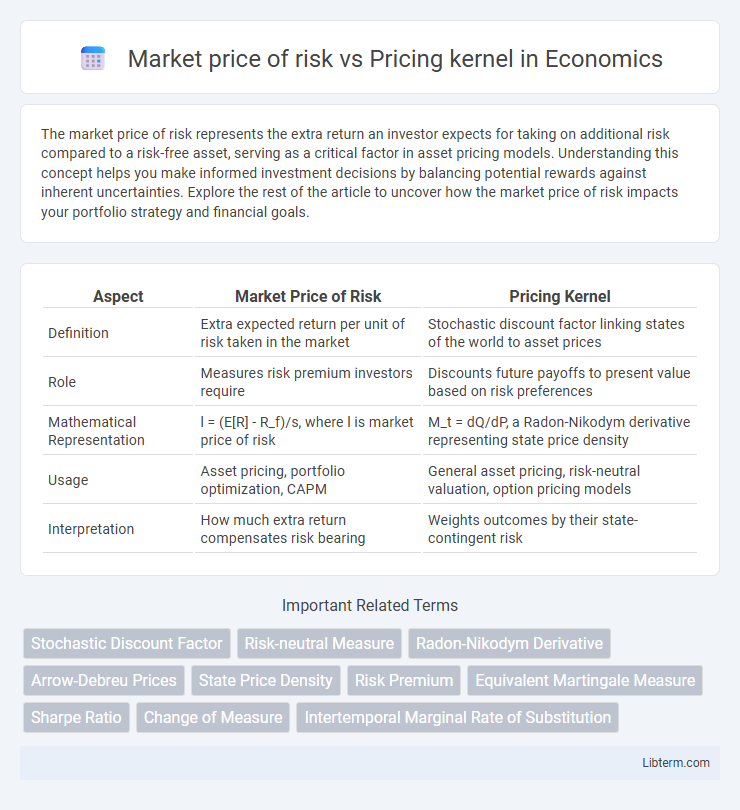

| Aspect | Market Price of Risk | Pricing Kernel |

|---|---|---|

| Definition | Extra expected return per unit of risk taken in the market | Stochastic discount factor linking states of the world to asset prices |

| Role | Measures risk premium investors require | Discounts future payoffs to present value based on risk preferences |

| Mathematical Representation | l = (E[R] - R_f)/s, where l is market price of risk | M_t = dQ/dP, a Radon-Nikodym derivative representing state price density |

| Usage | Asset pricing, portfolio optimization, CAPM | General asset pricing, risk-neutral valuation, option pricing models |

| Interpretation | How much extra return compensates risk bearing | Weights outcomes by their state-contingent risk |

Introduction to Market Price of Risk and Pricing Kernel

Market price of risk quantifies the extra return investors demand for bearing additional risk in a financial asset, serving as a crucial metric in asset pricing models like the CAPM. Pricing kernel, also known as the stochastic discount factor, adjusts future payoffs to present values by capturing state-dependent valuation, effectively linking risk preferences and probability distributions. Both concepts are fundamental in understanding how risk is priced in financial markets and determining asset prices under uncertainty.

Defining the Market Price of Risk

The market price of risk quantifies the extra expected return an investor demands for bearing one unit of risk, often represented by the Sharpe ratio in financial models. It is closely linked to the pricing kernel, also known as the stochastic discount factor, which transforms future payoffs into present values by adjusting for risk preferences and probabilities. Defining the market price of risk involves identifying the sensitivity of the pricing kernel to underlying state variables, capturing how risk affects asset prices across different economic scenarios.

Understanding the Pricing Kernel (Stochastic Discount Factor)

The market price of risk quantifies the extra return investors demand for bearing additional risk, directly influencing asset pricing through risk premiums. The pricing kernel, or stochastic discount factor (SDF), acts as a fundamental tool that adjusts future payoffs to present values by incorporating investors' risk aversion and time preferences. Understanding the pricing kernel enables a comprehensive framework for evaluating asset prices, linking risk adjustments to expected returns within dynamic economic settings.

Mathematical Formulation: Market Price of Risk

The market price of risk is mathematically defined as the ratio of the excess expected return of a risky asset over the risk-free rate to the asset's volatility, often expressed as \(\lambda = \frac{\mu - r}{\sigma}\), where \(\mu\) is the asset's drift, \(r\) is the risk-free rate, and \(\sigma\) is the volatility. It represents the reward per unit of risk and plays a crucial role in risk-neutral pricing models by linking physical probability measures to risk-neutral ones. The pricing kernel, or stochastic discount factor, inversely relates to the market price of risk, adjusting asset payoffs to present values under the risk-neutral measure.

Mathematical Formulation: Pricing Kernel

The pricing kernel, also known as the stochastic discount factor, is mathematically formulated as the ratio of the marginal utility of consumption across states, capturing risk preferences and time value of money. It connects the market price of risk to asset pricing through the fundamental theorem of asset pricing, where the expected discounted payoff equals the current asset price under the risk-neutral measure. This formulation allows for deriving equilibrium asset prices by weighting possible payoffs using the pricing kernel, reflecting investors' attitude toward risk and consumption smoothing.

Relationship Between Market Price of Risk and Pricing Kernel

The market price of risk quantifies the excess return investors demand per unit of risk, while the pricing kernel represents the state-price density used to discount future payoffs. A fundamental relationship exists since the pricing kernel's stochastic discount factor inversely correlates with the market price of risk, linking risk preferences to asset prices. This duality allows asset returns to be expressed as functions of the pricing kernel, illustrating how changes in risk aversion impact equilibrium market prices.

Economic Interpretation of Each Concept

Market price of risk quantifies the extra expected return investors demand for bearing one unit of systematic risk, guiding portfolio selection and asset pricing in financial economics. The pricing kernel, or stochastic discount factor, represents the state-price density used to discount future uncertain payoffs to present value, reflecting marginal utility of consumption across states. Economically, the market price of risk links to risk preferences and equilibrium risk-return trade-offs, while the pricing kernel encodes investor marginal valuation of payoffs under uncertainty, serving as a fundamental tool for asset valuation.

Role in Asset Pricing Models

The market price of risk quantifies the extra return investors demand for bearing a unit of systematic risk, directly influencing asset expected returns and capital allocation decisions. The pricing kernel, or stochastic discount factor, functions as a fundamental tool in asset pricing models by discounting future payoffs to present value, encapsulating investors' risk preferences and time value of money. Together, these concepts enable equilibrium asset pricing models like the CAPM and consumption-based frameworks to relate risk factors to expected returns, ensuring consistent valuation across risky securities.

Practical Applications in Financial Markets

The market price of risk quantifies the extra return investors require for bearing risk and is essential in portfolio optimization and asset pricing models like the CAPM and APT. Pricing kernels, or stochastic discount factors, serve as fundamental tools in pricing securities by linking payoffs to present values under risk-neutral measures. Practical applications include risk management, derivative pricing, and performance evaluation, where the interplay between the market price of risk and pricing kernels enhances accurate valuation and strategic allocation decisions.

Key Differences and Summary Comparison

The market price of risk quantifies the extra return investors require for bearing systematic risk, expressed as the ratio of excess return to risk (usually volatility). The pricing kernel, or stochastic discount factor, adjusts the valuation of uncertain future cash flows by scaling payoffs with state-dependent weights reflecting marginal utility. Key differences include that the market price of risk is a risk premium measure derived from returns and variance, while the pricing kernel directly links to asset pricing and investor preferences through marginal utility, providing a more fundamental and comprehensive framework for asset valuation.

Market price of risk Infographic

libterm.com

libterm.com