Inflation targeting is a monetary policy strategy where central banks set explicit inflation rate goals to stabilize the economy and anchor expectations. This approach helps maintain price stability and supports sustainable economic growth by guiding interest rate decisions and controlling inflation volatility. Explore this article to understand how inflation targeting impacts your financial well-being and economic outlook.

Table of Comparison

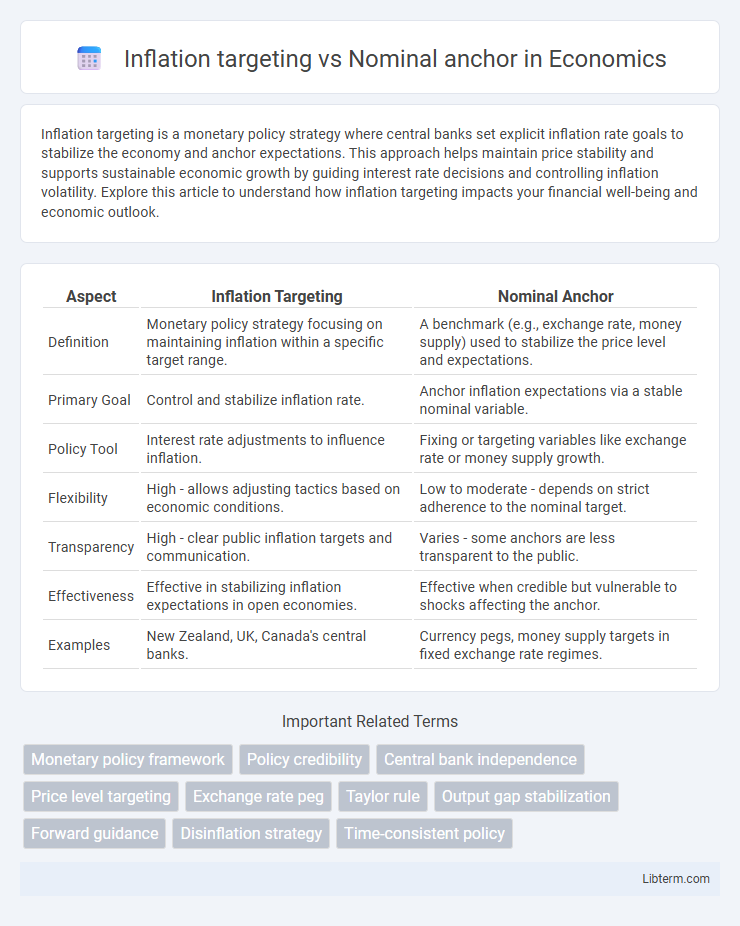

| Aspect | Inflation Targeting | Nominal Anchor |

|---|---|---|

| Definition | Monetary policy strategy focusing on maintaining inflation within a specific target range. | A benchmark (e.g., exchange rate, money supply) used to stabilize the price level and expectations. |

| Primary Goal | Control and stabilize inflation rate. | Anchor inflation expectations via a stable nominal variable. |

| Policy Tool | Interest rate adjustments to influence inflation. | Fixing or targeting variables like exchange rate or money supply growth. |

| Flexibility | High - allows adjusting tactics based on economic conditions. | Low to moderate - depends on strict adherence to the nominal target. |

| Transparency | High - clear public inflation targets and communication. | Varies - some anchors are less transparent to the public. |

| Effectiveness | Effective in stabilizing inflation expectations in open economies. | Effective when credible but vulnerable to shocks affecting the anchor. |

| Examples | New Zealand, UK, Canada's central banks. | Currency pegs, money supply targets in fixed exchange rate regimes. |

Introduction to Inflation Targeting and Nominal Anchors

Inflation targeting is a monetary policy framework where central banks set explicit inflation rate goals to stabilize prices and manage expectations. Nominal anchors, such as inflation targets or exchange rate pegs, serve as reference points to guide monetary policy and anchor inflation expectations. Effective inflation targeting relies on credible nominal anchors to enhance transparency and accountability in economic management.

Defining Inflation Targeting: Concepts and Objectives

Inflation targeting is a monetary policy framework that aims to maintain price stability by setting explicit, publicly announced inflation rate goals, typically around 2%, to anchor inflation expectations. This approach contrasts with nominal anchors, such as fixed exchange rates or money supply targets, which provide indirect constraints on inflation by stabilizing a nominal variable. Central banks adopting inflation targeting use interest rate adjustments and transparent communication to influence economic behavior and achieve predictable inflation outcomes.

What Is a Nominal Anchor? Types and Applications

A nominal anchor is a key monetary policy tool used by central banks to stabilize inflation expectations by targeting a specific financial variable such as the exchange rate, money supply, or inflation rate itself. Common types include inflation targeting, where the central bank commits to a fixed inflation rate, exchange rate targeting, which pegs the domestic currency to a foreign currency, and monetary aggregate targeting, focused on controlling growth in money supply. These anchors help reduce uncertainty in the economy, guide market expectations, and improve the effectiveness of monetary policy in achieving price stability.

Historical Evolution of Monetary Policy Frameworks

Inflation targeting emerged in the early 1990s as a clear nominal anchor, providing central banks like the Reserve Bank of New Zealand and the Bank of England with explicit inflation rate goals to stabilize prices and enhance policy transparency. Before this, monetary policy frameworks commonly relied on monetary aggregates or fixed exchange rate regimes as nominal anchors, emphasizing control over money supply or exchange rates to maintain price stability. The historical evolution shows a shift from rigid monetary targeting to flexible inflation targeting, reflecting growing recognition of the importance of managing inflation expectations and economic shocks in achieving macroeconomic stability.

Key Differences Between Inflation Targeting and Nominal Anchors

Inflation targeting involves setting explicit inflation rate goals to guide monetary policy, while nominal anchors use a fixed nominal variable such as the exchange rate or money supply to stabilize expectations. Inflation targeting provides transparency and flexibility by adjusting policies based on inflation forecasts, whereas nominal anchors rely on maintaining a predetermined nominal value to control inflation indirectly. The key difference lies in inflation targeting's forward-looking approach versus nominal anchors' reliance on fixed nominal benchmarks for macroeconomic stability.

Advantages and Limitations of Inflation Targeting

Inflation targeting offers advantages such as clear communication of monetary policy goals, enhanced credibility, and improved inflation expectations, which help stabilize prices and support economic growth. However, its limitations include vulnerability to supply shocks that may cause inflation deviations, potential neglect of output stabilization, and challenges in setting and adjusting the inflation target in response to changing economic conditions. While inflation targeting provides a transparent nominal anchor, reliance solely on inflation rates can limit flexibility in addressing broader economic objectives.

Strengths and Weaknesses of Nominal Anchors

Nominal anchors provide a clear and transparent framework for monetary policy, helping to stabilize inflation expectations and reduce uncertainty in the economy. Their strength lies in anchoring inflation targets to a specific nominal variable such as exchange rates, money supply, or price levels, facilitating policy credibility and discipline. However, nominal anchors may be rigid and less responsive to economic shocks, potentially leading to suboptimal outcomes when structural changes or external disturbances occur.

Case Studies: Global Implementation and Outcomes

Inflation targeting has been effectively implemented in countries such as New Zealand, Canada, and the United Kingdom, leading to improved price stability and anchored inflation expectations. In contrast, nominal anchors like exchange rate pegs in countries such as Argentina and Hong Kong have resulted in mixed outcomes, often vulnerable to speculative attacks and currency crises. Case studies highlight that inflation targeting provides greater flexibility and transparency, contributing to sustained macroeconomic stability globally.

Policy Implications for Emerging vs Developed Economies

Inflation targeting provides a clear, transparent framework for monetary policy that helps anchor expectations and stabilize inflation, which is particularly crucial for emerging economies facing volatile shocks and weaker institutional frameworks. Nominal anchors, such as fixed exchange rates or monetary aggregates, offer stronger commitment devices but may reduce policy flexibility, posing challenges for emerging markets susceptible to external shocks and capital flows. Developed economies benefit from inflation targeting due to their robust financial systems and credibility, allowing more effective management of inflation expectations without rigid constraints on monetary policy tools.

Future Trends in Monetary Policy Frameworks

Inflation targeting remains a dominant nominal anchor in monetary policy, emphasizing price stability through clear inflation rate objectives, while future trends suggest integrating digital currencies and real-time data analytics to enhance responsiveness. Central banks increasingly explore hybrid frameworks combining inflation targeting with nominal GDP targeting or price-level targeting to better address economic volatility and asymmetric shocks. Advances in technology and evolving economic conditions necessitate adaptive monetary policy frameworks that balance transparency, flexibility, and credibility to sustain long-term economic stability.

Inflation targeting Infographic

libterm.com

libterm.com