Credit cards offer a convenient way to manage your expenses while building credit history and earning rewards. Understanding interest rates, fees, and payment terms is essential to avoid debt and maximize benefits. Explore the full article to learn how to choose the best credit card for your financial goals.

Table of Comparison

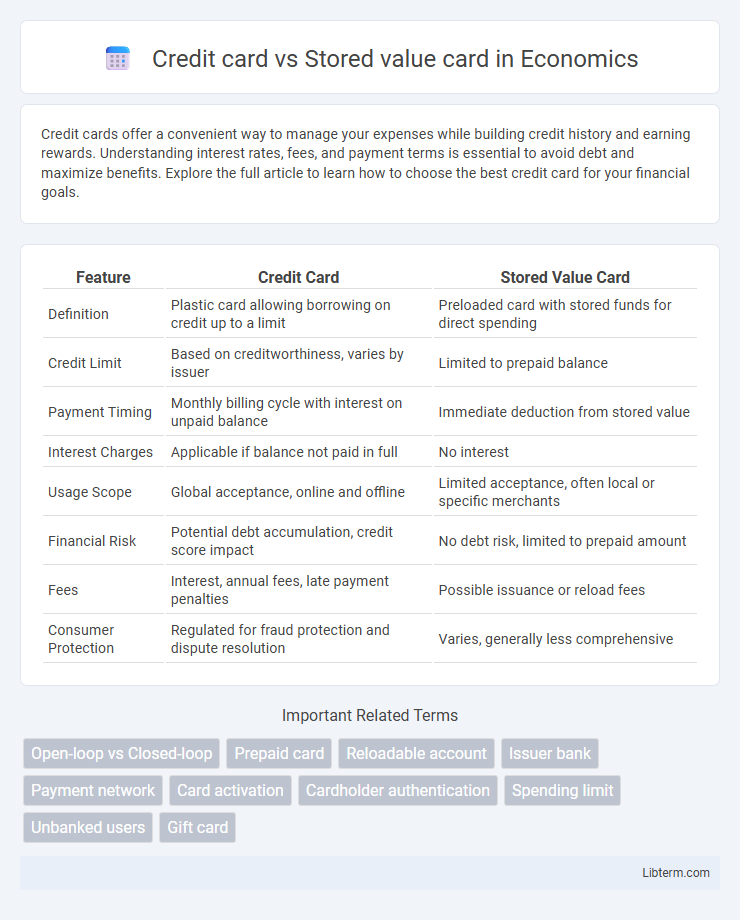

| Feature | Credit Card | Stored Value Card |

|---|---|---|

| Definition | Plastic card allowing borrowing on credit up to a limit | Preloaded card with stored funds for direct spending |

| Credit Limit | Based on creditworthiness, varies by issuer | Limited to prepaid balance |

| Payment Timing | Monthly billing cycle with interest on unpaid balance | Immediate deduction from stored value |

| Interest Charges | Applicable if balance not paid in full | No interest |

| Usage Scope | Global acceptance, online and offline | Limited acceptance, often local or specific merchants |

| Financial Risk | Potential debt accumulation, credit score impact | No debt risk, limited to prepaid amount |

| Fees | Interest, annual fees, late payment penalties | Possible issuance or reload fees |

| Consumer Protection | Regulated for fraud protection and dispute resolution | Varies, generally less comprehensive |

Understanding Credit Cards

Credit cards allow users to borrow funds up to a predetermined credit limit to make purchases, offering benefits like rewards points, fraud protection, and interest-free grace periods. They require timely payments to avoid high interest rates and potential credit score impacts, making financial discipline essential. Unlike stored value cards, credit cards are linked to a revolving line of credit rather than a pre-loaded balance, enabling flexible spending and credit building opportunities.

What Are Stored Value Cards?

Stored value cards are prepaid payment cards loaded with a specific monetary amount, allowing users to make purchases or access services until the balance is depleted. Unlike credit cards that rely on credit lines and monthly billing statements, stored value cards function as electronic wallets with funds directly available on the card itself. These cards are widely used for transit fares, gift cards, and prepaid phone credits, offering controlled spending without the risk of debt accumulation.

Key Differences Between Credit and Stored Value Cards

Credit cards provide a line of credit allowing users to borrow funds up to a preset limit, while stored value cards are preloaded with a fixed amount of money for spending. Unlike credit cards which require monthly repayments and often involve interest charges, stored value cards restrict spending to the available balance without any credit or debt accumulation. Credit cards typically offer features like rewards, fraud protection, and credit score impact, whereas stored value cards primarily focus on convenience and controlled spending without credit reporting.

How Credit Cards Work

Credit cards function by allowing users to borrow funds up to a predetermined credit limit to make purchases or withdraw cash, with the borrowed amount subject to interest if not repaid within the billing cycle. Transactions are authorized through a network that verifies available credit and securely processes payments between the cardholder, merchant, and issuing bank. Unlike stored value cards, which contain preloaded funds, credit cards provide a revolving line of credit that is billed monthly.

How Stored Value Cards Operate

Stored value cards operate by allowing users to load a specific monetary amount onto the card, which is then electronically stored and deducted with each transaction until the balance reaches zero. These cards do not require a direct connection to a bank account or credit line, enabling controlled spending and reducing the risk of debt accumulation. Stored value cards are commonly used in prepaid gift cards, transit passes, and employee expense accounts for efficient and secure payment processing.

Advantages of Credit Cards

Credit cards offer widespread acceptance and convenience for both online and in-store purchases, providing users with a flexible borrowing option that stored value cards lack. They often include rewards programs such as cashback, travel points, and purchase protection, enhancing the overall value for cardholders. Credit cards also provide access to credit lines, enabling users to manage cash flow and make larger purchases without immediate funds.

Benefits of Stored Value Cards

Stored value cards offer enhanced budgeting control by limiting spending to the prepaid amount, reducing the risk of debt accumulation common with credit cards. They provide increased security through limited liability if lost or stolen, as funds are confined to the card's balance rather than linked to a credit line. Stored value cards also facilitate easier access for unbanked individuals, enabling financial inclusion without the need for credit checks or bank accounts.

Security Features: Credit vs Stored Value Cards

Credit cards utilize advanced security features such as EMV chip technology, two-factor authentication, and real-time fraud monitoring to protect against unauthorized transactions. Stored value cards offer limited protection, often relying on PINs or passwords without robust fraud detection systems, making them more vulnerable to theft or loss. The integration of secure encryption and fraud alert systems in credit cards provides a higher level of security compared to the simpler safeguards found in stored value cards.

Typical Use Cases for Each Card Type

Credit cards are commonly used for larger purchases, online shopping, travel bookings, and building credit history due to their credit limits and interest-free grace periods. Stored value cards are ideal for budgeting daily expenses, gifting, or prepaid services like transit and campus dining because they allow users to load a specific amount of money in advance. Businesses often prefer stored value cards for employee incentives or loyalty rewards, while consumers rely on credit cards for credit benefits and fraud protection.

Choosing Between a Credit Card and a Stored Value Card

Choosing between a credit card and a stored value card depends on spending habits and financial goals. Credit cards offer revolving credit, rewards, and fraud protection but may lead to debt and interest charges if not managed carefully. Stored value cards limit spending to the prepaid amount, providing better budgeting control and reducing the risk of overspending, making them ideal for short-term or controlled use.

Credit card Infographic

libterm.com

libterm.com