The discount rate is a critical financial metric used to determine the present value of future cash flows by reflecting the time value of money and risk factors. It plays a key role in investment decisions, loan evaluations, and valuing projects or assets by influencing cost assessments and profitability forecasts. Explore the rest of this article to understand how the discount rate impacts your financial strategy and decision-making.

Table of Comparison

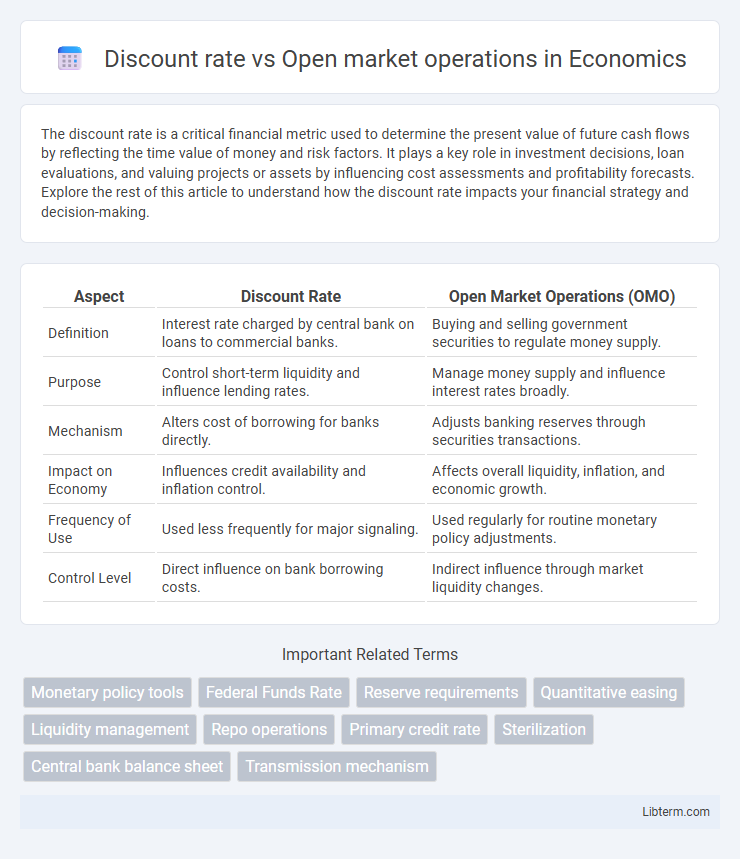

| Aspect | Discount Rate | Open Market Operations (OMO) |

|---|---|---|

| Definition | Interest rate charged by central bank on loans to commercial banks. | Buying and selling government securities to regulate money supply. |

| Purpose | Control short-term liquidity and influence lending rates. | Manage money supply and influence interest rates broadly. |

| Mechanism | Alters cost of borrowing for banks directly. | Adjusts banking reserves through securities transactions. |

| Impact on Economy | Influences credit availability and inflation control. | Affects overall liquidity, inflation, and economic growth. |

| Frequency of Use | Used less frequently for major signaling. | Used regularly for routine monetary policy adjustments. |

| Control Level | Direct influence on bank borrowing costs. | Indirect influence through market liquidity changes. |

Introduction to Monetary Policy Tools

Discount rate and open market operations are fundamental monetary policy tools used by central banks to regulate money supply and control inflation. The discount rate is the interest rate charged to commercial banks for borrowing funds directly from the central bank, influencing liquidity and lending behaviors. Open market operations involve the buying and selling of government securities in the open market to adjust the level of bank reserves, thereby affecting short-term interest rates and overall economic activity.

Understanding Discount Rate

The discount rate is the interest rate set by central banks for lending directly to commercial banks, influencing liquidity and short-term borrowing costs. Understanding the discount rate is crucial because it serves as a primary tool for monetary policy, signaling central bank intentions and affecting overall economic activity. Unlike open market operations, which adjust money supply by buying or selling government securities, the discount rate directly impacts bank reserves and credit availability.

Open Market Operations Explained

Open Market Operations (OMO) involve the buying and selling of government securities by central banks to regulate money supply and control short-term interest rates. OMOs directly influence liquidity in the banking system, affecting lending rates and overall economic activity more dynamically than the discount rate, which is the interest rate charged on direct loans from the central bank. By adjusting the volume of securities traded, OMOs provide a flexible and immediate tool for monetary policy implementation, crucial for stabilizing inflation and promoting economic growth.

Key Differences: Discount Rate vs. Open Market Operations

The discount rate is the interest rate charged by central banks on short-term loans to commercial banks, serving as a monetary policy tool to influence liquidity and borrowing costs. Open market operations involve the buying and selling of government securities by the central bank to regulate money supply and control inflation or stimulate economic growth. Unlike the discount rate, which directly affects borrowing costs for banks, open market operations impact the broader financial market by adjusting the reserves within the banking system.

Impact on Money Supply and Interest Rates

The discount rate directly influences the cost of borrowing for banks from the central bank, altering short-term interest rates and affecting the money supply by making credit more or less expensive. Open market operations involve the buying and selling of government securities, which injects or withdraws liquidity from the banking system, thus impacting the overall money supply and influencing interest rates across the economy. Changes in the discount rate typically signal monetary policy directions, while open market operations provide precise control over money supply and market interest rates.

Advantages and Limitations of Discount Rate

The discount rate influences the cost of borrowing directly for commercial banks by setting the interest rate at which they can obtain short-term loans from the central bank, providing a clear tool for monetary policy implementation. Advantages include its direct impact on money supply and liquidity control, making it effective for signaling policy intentions and stabilizing the banking sector during financial stress. Limitations involve its reliance on banks' willingness to borrow, potential lag in influencing broader economic activity, and less frequent adjustments compared to open market operations, which offer more precise and immediate control over liquidity conditions.

Benefits and Drawbacks of Open Market Operations

Open market operations (OMO) provide central banks with a flexible and immediate tool to regulate liquidity by buying or selling government securities, which helps stabilize short-term interest rates and control inflation. Their benefits include precise market influence and the ability to signal monetary policy stance without direct impact on credit rates. However, drawbacks involve potential market volatility, dependency on active securities markets, and limited effectiveness during liquidity traps or when interest rates are near zero.

Practical Applications in Central Banking

Discount rate adjustments directly influence the cost of borrowing for commercial banks, allowing central banks to manage liquidity and control short-term interest rates efficiently. Open market operations, involving the buying and selling of government securities, are utilized to regulate money supply, stabilize inflation, and guide economic growth by affecting reserve balances in the banking system. In practice, central banks often combine these tools to fine-tune monetary policy responses during economic fluctuations and maintain overall financial stability.

Historical Examples and Case Studies

Historical examples reveal that the discount rate and open market operations serve distinct monetary policy roles: during the 2008 financial crisis, the Federal Reserve sharply lowered the discount rate to provide emergency liquidity to banks, while simultaneously conducting large-scale open market purchases to stabilize the financial system. In the early 1980s, the Fed used open market operations aggressively to combat inflation by selling government securities, tightening money supply, whereas discount rate adjustments played a secondary role. Case studies from Japan's prolonged recession illustrate reliance on open market purchases (quantitative easing) to stimulate the economy, with discount rate cuts proving less effective due to already near-zero rates.

Choosing the Right Tool: Policy Considerations

Selecting the appropriate monetary policy tool hinges on the central bank's goals and market conditions; the discount rate directly influences borrowing costs for banks, encouraging or discouraging liquidity access, while open market operations adjust the money supply through buying or selling government securities. The discount rate is more suitable for signaling monetary policy stance and providing emergency liquidity, whereas open market operations offer precise control over short-term interest rates and overall market liquidity. Policymakers must evaluate the immediacy, scale, and market impact of each tool to optimize financial stability and economic growth.

Discount rate Infographic

libterm.com

libterm.com