The relative income hypothesis suggests that an individual's consumption and saving behaviors depend on their income relative to others, rather than on absolute income levels. This theory emphasizes social comparisons and the desire to maintain a lifestyle comparable to peers, influencing your spending habits and financial decisions. Explore the rest of the article to understand how this hypothesis impacts economic policy and personal finance strategies.

Table of Comparison

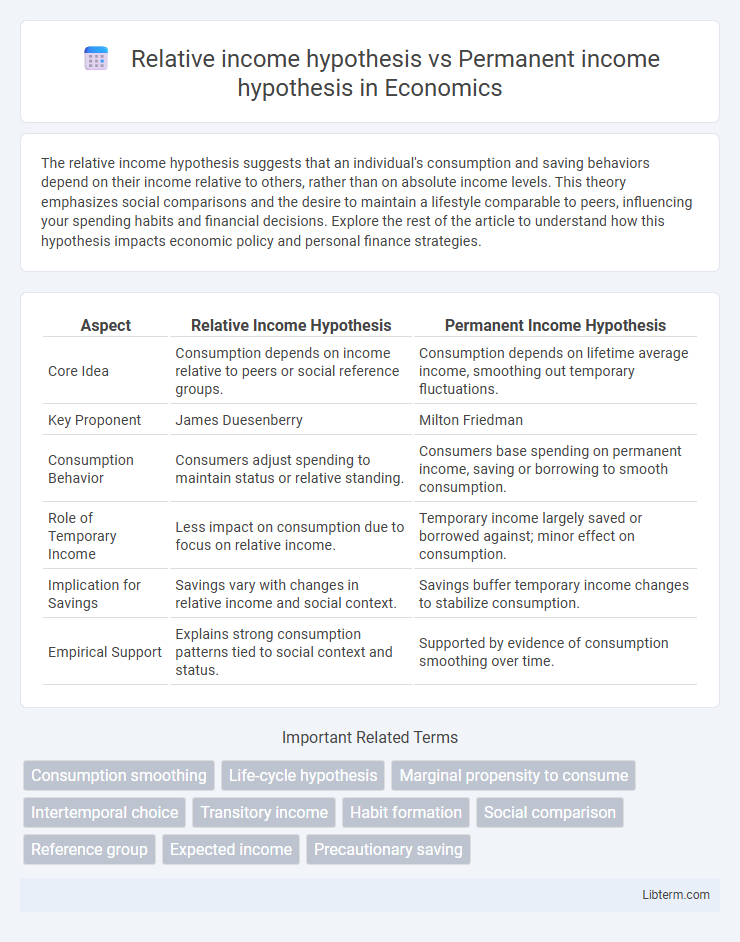

| Aspect | Relative Income Hypothesis | Permanent Income Hypothesis |

|---|---|---|

| Core Idea | Consumption depends on income relative to peers or social reference groups. | Consumption depends on lifetime average income, smoothing out temporary fluctuations. |

| Key Proponent | James Duesenberry | Milton Friedman |

| Consumption Behavior | Consumers adjust spending to maintain status or relative standing. | Consumers base spending on permanent income, saving or borrowing to smooth consumption. |

| Role of Temporary Income | Less impact on consumption due to focus on relative income. | Temporary income largely saved or borrowed against; minor effect on consumption. |

| Implication for Savings | Savings vary with changes in relative income and social context. | Savings buffer temporary income changes to stabilize consumption. |

| Empirical Support | Explains strong consumption patterns tied to social context and status. | Supported by evidence of consumption smoothing over time. |

Introduction to Income Hypotheses

The Relative Income Hypothesis suggests individuals base consumption on their income relative to others, emphasizing social comparisons and status. The Permanent Income Hypothesis asserts that consumption depends on long-term average income rather than current income fluctuations, focusing on lifetime resources. Both models explain consumer behavior by linking income perceptions to spending patterns, but they differ in considering social context versus income stability.

Defining Relative Income Hypothesis

The Relative Income Hypothesis, developed by James Duesenberry, suggests that an individual's consumption and saving behavior is influenced by their income relative to others rather than their absolute income level. This theory emphasizes the social context of income, proposing that people compare their earnings to peers and adjust their spending to maintain social status. In contrast, the Permanent Income Hypothesis by Milton Friedman focuses on consumption based on expected long-term average income, highlighting the difference between transient and persistent income changes.

Understanding Permanent Income Hypothesis

Permanent Income Hypothesis (PIH) posits that individuals base consumption decisions on expected long-term average income rather than current income, smoothing consumption over time despite temporary income fluctuations. This hypothesis contrasts with the Relative Income Hypothesis, which emphasizes consumption patterns influenced by one's income relative to others, highlighting social comparison effects. Empirical evidence supporting PIH shows consumption correlates more strongly with permanent income components, underscoring the role of future income expectations in economic behavior.

Core Assumptions of Each Model

The Relative Income Hypothesis assumes individuals base consumption on income relative to others in their social group, emphasizing social comparisons as a core driver of spending behavior. The Permanent Income Hypothesis posits that consumers plan their consumption based on their expected long-term average income rather than current income, highlighting income smoothing over time. These core assumptions lead to different predictions on consumption patterns and savings behavior in response to income changes.

Behavioral Implications for Consumers

The Relative Income Hypothesis suggests consumers' spending is influenced by their income compared to others, driving behavior aimed at maintaining social status through conspicuous consumption, often leading to increased savings to smooth consumption relative to peers. The Permanent Income Hypothesis posits that consumers base spending on an expected long-term average income, promoting stable consumption patterns and reducing impulsive expenditures driven by short-term income fluctuations. These differing behavioral implications highlight how social comparison under the Relative Income Hypothesis can cause consumption volatility, whereas the Permanent Income Hypothesis encourages consumption smoothing and financial planning.

Empirical Evidence and Key Studies

Empirical evidence comparing the Relative Income Hypothesis and the Permanent Income Hypothesis highlights diverse consumer behavior patterns regarding income and consumption. Key studies by Duesenberry emphasize the influence of relative income and social comparisons on consumption, while Friedman's Permanent Income Hypothesis finds support in long-term consumption smoothing despite short-term income fluctuations. Recent empirical analyses deploy panel data methods revealing that consumption decisions align more closely with permanent income concepts, but social context effects identified in relative income models remain significant in explaining observed consumption anomalies.

Policy Implications of Income Hypotheses

The Relative Income Hypothesis suggests that consumption patterns are heavily influenced by social comparisons, implying policies should address income inequality to stabilize aggregate demand. The Permanent Income Hypothesis, which emphasizes consumption based on expected lifetime income rather than current income, supports policies that enhance long-term income stability and savings incentives. Policymakers aiming to boost consumption must balance short-term support with strategies fostering sustainable economic growth and reducing income volatility.

Criticisms and Limitations

The Relative Income Hypothesis faces criticism for its overemphasis on social comparison, neglecting factors like individual preferences and credit constraints that affect consumption behavior. The Permanent Income Hypothesis is limited by its assumption of rational expectations and perfect capital markets, which do not account for liquidity constraints and income uncertainty faced by many households. Both theories often struggle to explain short-term consumption fluctuations and the heterogeneity observed across different income groups.

Comparative Analysis: Relative vs Permanent

The Relative Income Hypothesis emphasizes consumption based on income relative to peers, suggesting individuals derive utility not just from absolute income but from social comparisons, impacting spending patterns and savings behavior. The Permanent Income Hypothesis asserts that consumption depends on expected long-term average income rather than current income, promoting smooth consumption over time despite short-term fluctuations. Comparative analysis reveals that the Relative Income Hypothesis accounts for social status effects in consumption, while the Permanent Income Hypothesis focuses on intertemporal optimization and income expectations, influencing policy implications for savings and welfare.

Conclusion and Future Research Directions

The Relative Income Hypothesis emphasizes consumption influenced by social comparisons and relative standing, while the Permanent Income Hypothesis asserts that consumption depends on long-term average income rather than current earnings. Future research could explore integrating behavioral insights and social network effects into these models to better predict consumption patterns under economic uncertainty. Investigating the impact of digital economies and real-time income tracking may also refine understanding of consumption dynamics in modern contexts.

Relative income hypothesis Infographic

libterm.com

libterm.com