Initial incidence refers to the number of new cases of a disease or condition occurring in a specific population during a defined time period. Understanding initial incidence is crucial for identifying risk factors and implementing early intervention strategies to prevent further spread. Discover how analyzing initial incidence can impact your approach to public health and disease management by reading the full article.

Table of Comparison

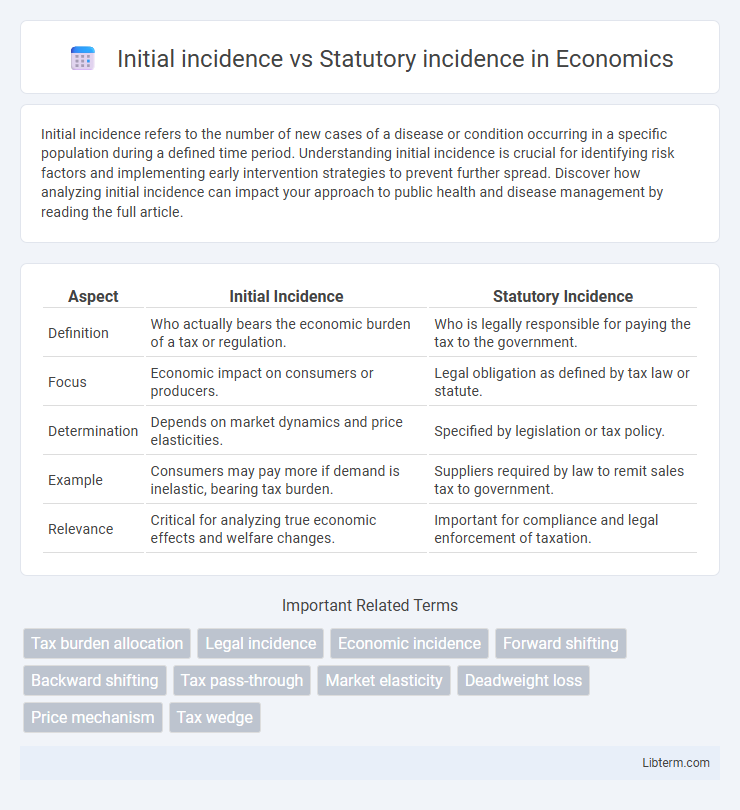

| Aspect | Initial Incidence | Statutory Incidence |

|---|---|---|

| Definition | Who actually bears the economic burden of a tax or regulation. | Who is legally responsible for paying the tax to the government. |

| Focus | Economic impact on consumers or producers. | Legal obligation as defined by tax law or statute. |

| Determination | Depends on market dynamics and price elasticities. | Specified by legislation or tax policy. |

| Example | Consumers may pay more if demand is inelastic, bearing tax burden. | Suppliers required by law to remit sales tax to government. |

| Relevance | Critical for analyzing true economic effects and welfare changes. | Important for compliance and legal enforcement of taxation. |

Understanding Tax Incidence: A Brief Overview

Initial incidence refers to the party legally obligated to pay a tax, such as consumers or producers, whereas statutory incidence determines who bears the economic burden after market adjustments. Understanding tax incidence involves analyzing how the tax burden is divided between buyers and sellers depending on price elasticity of demand and supply. This distinction is crucial for evaluating the real impact of taxation on market behavior and resource allocation.

Defining Initial (Economic) Incidence

Initial (economic) incidence refers to the party who ultimately bears the cost of a tax, regardless of who is legally responsible for paying it to the government (statutory incidence). It reflects the true economic burden shifted through market mechanisms, such as changes in prices or wages. Understanding initial incidence is crucial for analyzing tax efficiency and distributional effects in economic policy.

Statutory Incidence: What the Law Specifies

Statutory incidence refers to the legal assignment of a tax burden as defined by law, indicating who is obligated to pay the tax to the government. This legal designation determines the formal taxpayer, such as consumers or producers, regardless of who actually bears the economic cost. Understanding statutory incidence is crucial for analyzing tax policies and their implications on market behavior and economic efficiency.

Key Differences Between Initial and Statutory Incidence

Initial incidence refers to the party who first bears the economic burden of a tax, typically the seller or producer. Statutory incidence, on the other hand, concerns the entity legally obligated to remit the tax to the government, which may differ from the initial bearer. The key difference lies in economic impact versus legal responsibility, influencing how taxes affect market behavior and distribution of tax burdens.

How Taxes Are Levied: The Statutory Perspective

Initial incidence refers to the economic entity--such as producers, consumers, or property owners--upon whom the tax is first imposed, reflecting the actual burden before market adjustments. Statutory incidence describes the legal obligation to pay the tax, determining which party the law mandates to remit tax revenues to the government, typically sellers in the case of sales tax or employers for payroll taxes. The statutory perspective emphasizes the legislated assignment of tax payment responsibility, regardless of the final economic burden distribution influenced by market behavior.

Economic Burden: Who Ultimately Pays?

Initial incidence refers to the entity legally responsible for paying a tax or bearing its immediate cost, such as producers or employers, while statutory incidence identifies the party designated by law to remit the tax to the government. Economic burden, however, depends on tax incidence analysis, revealing who ultimately bears the cost after market adjustments, which often shifts away from the entity with initial or statutory responsibility due to supply and demand elasticity. Consumers frequently shoulder the economic burden through higher prices, or producers absorb it via lower revenues, illustrating that statutory obligations do not necessarily align with the true economic incidence of taxation.

Role of Market Forces in Shifting Tax Incidence

Initial incidence refers to the entity legally responsible for paying a tax, such as a seller or producer, while statutory incidence represents the legal assignment of the tax burden. Market forces play a critical role in shifting tax incidence as supply and demand elasticities determine whether the tax burden moves toward consumers or producers. When demand is inelastic, consumers bear more of the tax, whereas with elastic demand, producers absorb a larger share, illustrating the dynamic redistribution beyond the statutory assignment.

Examples Illustrating Initial and Statutory Incidence

Initial incidence refers to the party that legally bears the tax burden when it is first levied, such as employers paying payroll taxes or sellers charging sales taxes to consumers. Statutory incidence involves the party who actually bears the economic burden of the tax after market adjustments, for instance, consumers facing higher prices due to a sales tax or workers accepting lower wages because of employer payroll taxes. Examples include cigarette taxes where the government levies the tax on producers (initial incidence), but smokers ultimately pay the higher retail prices (statutory incidence), and corporate income taxes where firms may initially bear the tax, but shareholders and employees share the economic burden.

Policy Implications of Tax Incidence Distinctions

Initial incidence refers to who is legally obligated to pay a tax, while statutory incidence focuses on the formal assignment of tax liability. Policy implications of distinguishing these incidences are critical because the economic burden of a tax may shift from the entity with statutory liability to another party, affecting market behavior and income distribution. Accurate understanding of tax incidence helps policymakers design taxes that minimize economic distortions and ensure equitable revenue generation.

Initial vs Statutory Incidence: Why the Distinction Matters

Initial incidence refers to who legally bears the tax burden when it is first imposed, while statutory incidence indicates which party is responsible for remitting the tax to the government. Distinguishing between initial and statutory incidence matters because economic incidence--who ultimately bears the tax burden--may differ due to market adjustments, such as price changes and behavioral responses. Understanding this distinction is crucial for policymakers aiming to evaluate the true impact of taxation on consumers, producers, and overall market efficiency.

Initial incidence Infographic

libterm.com

libterm.com