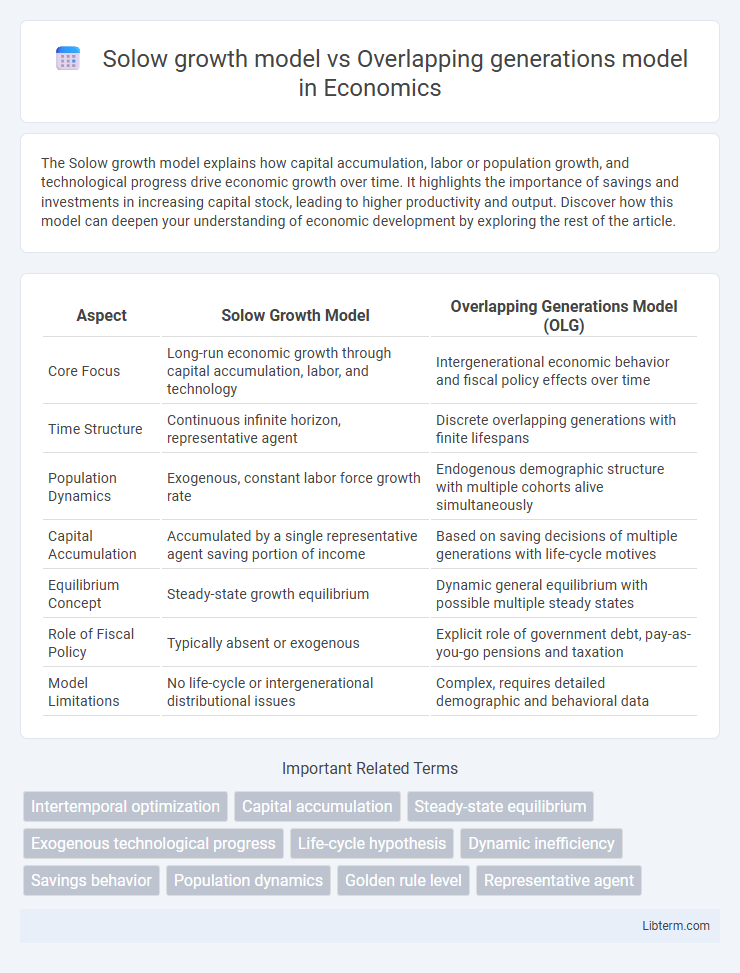

The Solow growth model explains how capital accumulation, labor or population growth, and technological progress drive economic growth over time. It highlights the importance of savings and investments in increasing capital stock, leading to higher productivity and output. Discover how this model can deepen your understanding of economic development by exploring the rest of the article.

Table of Comparison

| Aspect | Solow Growth Model | Overlapping Generations Model (OLG) |

|---|---|---|

| Core Focus | Long-run economic growth through capital accumulation, labor, and technology | Intergenerational economic behavior and fiscal policy effects over time |

| Time Structure | Continuous infinite horizon, representative agent | Discrete overlapping generations with finite lifespans |

| Population Dynamics | Exogenous, constant labor force growth rate | Endogenous demographic structure with multiple cohorts alive simultaneously |

| Capital Accumulation | Accumulated by a single representative agent saving portion of income | Based on saving decisions of multiple generations with life-cycle motives |

| Equilibrium Concept | Steady-state growth equilibrium | Dynamic general equilibrium with possible multiple steady states |

| Role of Fiscal Policy | Typically absent or exogenous | Explicit role of government debt, pay-as-you-go pensions and taxation |

| Model Limitations | No life-cycle or intergenerational distributional issues | Complex, requires detailed demographic and behavioral data |

Introduction to Economic Growth Models

The Solow growth model emphasizes long-term economic growth driven by capital accumulation, labor force expansion, and technological progress, highlighting steady-state convergence. The Overlapping Generations (OLG) model incorporates intertemporal decisions of agents across different time periods, capturing age-structured populations and intergenerational transfers, which the Solow model abstracts from. These models provide foundational frameworks for analyzing economic growth dynamics, with Solow focusing on exogenous growth factors and OLG addressing demographic structure and fiscal policy implications.

Overview of the Solow Growth Model

The Solow Growth Model explains long-term economic growth by emphasizing capital accumulation, labor force growth, and technological progress as key drivers of output. It assumes a constant returns to scale production function and incorporates diminishing returns to individual inputs, predicting convergence to a steady-state equilibrium. The model's insights contrast with the Overlapping Generations Model, which focuses on intertemporal decisions and generational interactions in an economy.

Overview of the Overlapping Generations (OLG) Model

The Overlapping Generations (OLG) Model captures economic dynamics by modeling multiple cohorts of agents who live for two periods, typically as workers in the first and retirees in the second. Unlike the Solow growth model, which emphasizes aggregate capital accumulation with a representative agent, the OLG framework integrates individual life-cycle behavior affecting savings, capital formation, and intergenerational transfers. This allows for richer analysis of fiscal policy impacts, debt sustainability, and demographic changes on long-term economic growth and welfare.

Key Assumptions: Solow vs OLG

The Solow growth model assumes a representative infinitely-lived agent, perfect competition, and exogenous technological progress driving steady-state growth. In contrast, the Overlapping Generations (OLG) model features finitely-lived agents overlapping across periods, allowing for intergenerational transfers and pay-as-you-go pension systems with endogenous capital accumulation. Key distinctions include the OLG model's ability to analyze intertemporal distribution and dynamic inefficiencies, which the Solow model's representative agent framework cannot capture.

Capital Accumulation Mechanisms

The Solow growth model emphasizes capital accumulation through exogenous savings rates and diminishing returns to capital, driving long-term economic growth until reaching a steady-state equilibrium. The Overlapping Generations (OLG) model incorporates intertemporal decisions by multiple cohorts, where capital accumulation is endogenously determined by individual savings behavior across generations, allowing for richer dynamics such as potential multiple equilibria and debt sustainability issues. While Solow assumes a representative agent optimizing in a single period, OLG captures the complex interplay between overlapping agents' saving and investment choices affecting capital stock evolution.

Demographics and Population Dynamics

The Solow growth model assumes a constant population growth rate, which simplifies analysis by treating labor supply as an exogenous factor without age structure considerations. In contrast, the Overlapping Generations (OLG) model explicitly incorporates demographic heterogeneity and age cohorts, allowing for dynamic analysis of population aging, fertility rates, and intergenerational transfers. This demographic realism in the OLG framework provides deeper insights into how shifts in population dynamics impact capital accumulation, savings behavior, and long-term economic growth.

Savings Behavior: Exogenous vs Endogenous

The Solow growth model treats savings behavior as exogenous, assuming a fixed savings rate that drives capital accumulation and economic growth without individual optimization. In contrast, the Overlapping Generations (OLG) model endogenizes savings decisions, where agents optimize consumption and savings across their lifetimes based on intertemporal preferences and income constraints. This endogenous savings mechanism in the OLG framework allows for richer dynamics in capital accumulation, emphasizing the role of demographic factors and intergenerational transfers.

Policy Implications and Government Intervention

The Solow growth model emphasizes long-term economic growth driven by capital accumulation, labor force growth, and technological progress, suggesting government policies should prioritize investments in technology and education to enhance productivity. In contrast, the Overlapping Generations (OLG) model highlights intergenerational resource allocation and the effects of government debt, implying policies must address social security design and sustainable fiscal management to prevent potential economic inefficiencies or generational inequities. Both models guide government intervention, with Solow focusing on fostering innovation and OLG on balancing current and future welfare through prudent fiscal policy.

Strengths and Limitations of Each Model

The Solow growth model excels in its simplicity and ability to explain long-term economic growth through capital accumulation, technological progress, and labor growth, but it assumes exogenous technology and lacks microeconomic foundations. The Overlapping Generations (OLG) model offers a richer framework for intertemporal choices, generational transfers, and asset dynamics, incorporating heterogeneity and allowing for the analysis of fiscal policy and social security systems. However, the OLG model can be mathematically complex, sensitive to assumptions about population growth and preferences, and may yield multiple equilibria, complicating predictive power.

Comparative Analysis and Real-World Applications

The Solow growth model emphasizes long-term economic growth driven by capital accumulation, labor force growth, and technological progress, providing a macroeconomic baseline for understanding steady-state equilibrium. In contrast, the Overlapping Generations (OLG) model incorporates intergenerational dynamics and heterogeneous agents, allowing analysis of savings, pensions, and fiscal policy impacts over different cohorts. Real-world applications of the Solow model primarily influence growth policy and productivity analysis, while the OLG model offers valuable insights for pension reform, debt sustainability, and intertemporal resource allocation within public finance.

Solow growth model Infographic

libterm.com

libterm.com