Credit risk refers to the probability that a borrower will default on their financial obligations, leading to potential losses for lenders or investors. Effective credit risk management involves assessing creditworthiness, monitoring outstanding debts, and implementing strategies to mitigate potential defaults. Explore the rest of this article to understand how managing credit risk can protect your investments and ensure financial stability.

Table of Comparison

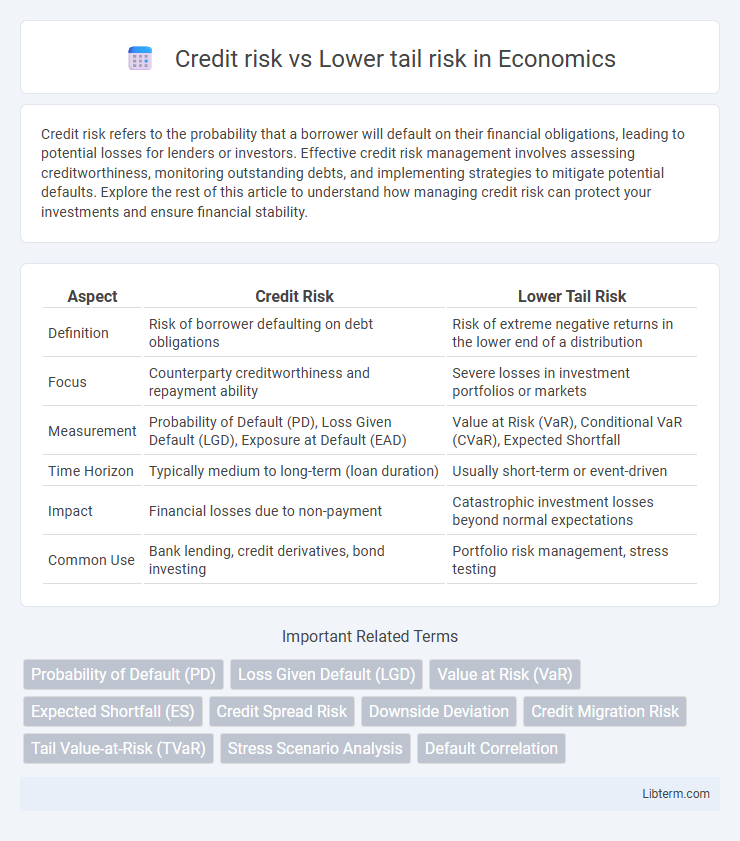

| Aspect | Credit Risk | Lower Tail Risk |

|---|---|---|

| Definition | Risk of borrower defaulting on debt obligations | Risk of extreme negative returns in the lower end of a distribution |

| Focus | Counterparty creditworthiness and repayment ability | Severe losses in investment portfolios or markets |

| Measurement | Probability of Default (PD), Loss Given Default (LGD), Exposure at Default (EAD) | Value at Risk (VaR), Conditional VaR (CVaR), Expected Shortfall |

| Time Horizon | Typically medium to long-term (loan duration) | Usually short-term or event-driven |

| Impact | Financial losses due to non-payment | Catastrophic investment losses beyond normal expectations |

| Common Use | Bank lending, credit derivatives, bond investing | Portfolio risk management, stress testing |

Understanding Credit Risk: Definition and Key Components

Credit risk refers to the potential loss a lender or investor faces when a borrower defaults on debt obligations, encompassing the probability of default, exposure at default, and loss given default as key components. Lower tail risk focuses on the probability and impact of extreme negative outcomes in a distribution, often representing severe credit events or financial crises that lead to significant losses. Understanding credit risk involves evaluating borrower creditworthiness, monitoring market conditions, and incorporating lower tail risk analysis to anticipate rare but catastrophic credit failures.

Defining Lower Tail Risk in Financial Markets

Lower tail risk in financial markets refers to the probability of extreme negative returns that fall in the worst-performing segment of an investment's distribution, often measured by metrics like Value at Risk (VaR) or Conditional Value at Risk (CVaR). Unlike credit risk, which specifically addresses the likelihood of a borrower defaulting on debt obligations, lower tail risk captures broader market downturns impacting asset prices and portfolio values. Effective risk management requires differentiating lower tail risk from credit risk to optimize strategies that protect against severe financial losses during adverse market conditions.

Key Differences Between Credit Risk and Lower Tail Risk

Credit risk specifically pertains to the possibility of a borrower defaulting on debt obligations, impacting lenders or investors' expected returns. Lower tail risk involves extreme negative outcomes in a portfolio or investment, representing the probability and impact of rare but severe losses beyond typical risk assessments. The key difference lies in credit risk centering on counterparty default likelihood, whereas lower tail risk encompasses broader, extreme adverse events affecting overall portfolio value.

Measuring and Assessing Credit Risk

Credit risk measurement involves quantifying the probability of default (PD), loss given default (LGD), and exposure at default (EAD) to assess potential financial losses in lending portfolios. Lower tail risk focuses on extreme negative outcomes, emphasizing the importance of stress testing and scenario analysis to capture rare but severe credit events. Effective credit risk assessment integrates quantifiable metrics with tail risk evaluation to ensure robust capital allocation and risk mitigation strategies.

Quantifying Lower Tail Risk: Methods and Metrics

Quantifying lower tail risk involves estimating the likelihood and impact of extreme negative financial outcomes, critical for managing credit risk exposure effectively. Common methods include Value at Risk (VaR), Conditional Value at Risk (CVaR), and Expected Shortfall (ES), which focus on the distribution's worst-case loss scenarios beyond a specific confidence level. Stress testing and scenario analysis further complement these metrics by simulating adverse market conditions to evaluate potential losses in the portfolio's lower tail region.

Common Sources of Credit Risk in Portfolios

Common sources of credit risk in portfolios include borrower default, credit rating downgrades, and deteriorating macroeconomic conditions impacting debt servicing ability. Lower tail risk captures extreme portfolio losses often driven by correlated defaults and widespread credit events during economic downturns. Effective credit risk management requires monitoring issuer creditworthiness, sector concentration, and exposure to leverage to mitigate adverse portfolio impacts.

Events and Factors Leading to Lower Tail Risk

Lower tail risk refers to the probability of extreme negative returns in a portfolio, often triggered by rare but severe events such as economic recessions, market crashes, or systemic financial crises. Credit risk contributes to lower tail risk when defaults or downgrades in credit quality cause abrupt declines in asset values, particularly during periods of high leverage or liquidity stress. Key factors leading to lower tail risk include interconnected financial institutions, high debt levels, inadequate diversification, and sharp shifts in investor sentiment that amplify losses beyond expected credit impairments.

Risk Management Strategies: Credit Risk vs. Lower Tail Risk

Credit risk management involves assessing the probability of borrower default and implementing strategies like credit scoring, diversification, and collateral requirements to mitigate potential losses. Lower tail risk focuses on extreme negative outcomes in the distribution of returns, prompting risk managers to use stress testing, scenario analysis, and tail risk hedging instruments such as options or credit default swaps (CDS). Effective risk management combines quantitative models and proactive monitoring to address credit risk's probability of default and lower tail risk's rare but severe financial impacts.

Implications for Investors and Financial Institutions

Credit risk, the probability of a borrower defaulting on debt obligations, directly impacts investors and financial institutions by increasing potential losses and necessitating higher capital reserves. Lower tail risk represents extreme negative outcomes in asset returns, requiring risk management strategies such as stress testing and portfolio diversification to protect against significant financial downturns. Understanding both risks is essential for optimizing credit pricing models, regulatory compliance, and maintaining systemic stability in financial markets.

Integrating Both Risks into Effective Portfolio Management

Integrating credit risk and lower tail risk into effective portfolio management enhances the ability to anticipate and mitigate potential severe losses from credit defaults and extreme market downturns. Utilizing advanced modeling techniques such as stress testing and scenario analysis captures the interplay between credit deterioration and tail risk events, enabling more robust risk assessment. A comprehensive approach balancing credit risk indicators with tail risk metrics improves portfolio resilience and supports optimized asset allocation under adverse conditions.

Credit risk Infographic

libterm.com

libterm.com