Cash remains a vital asset for managing everyday expenses and unexpected emergencies, providing instant liquidity without the need for digital transactions. Holding cash allows you to maintain control over your finances and avoid fees associated with electronic payments. Explore the rest of the article to discover strategic tips for optimizing your cash management.

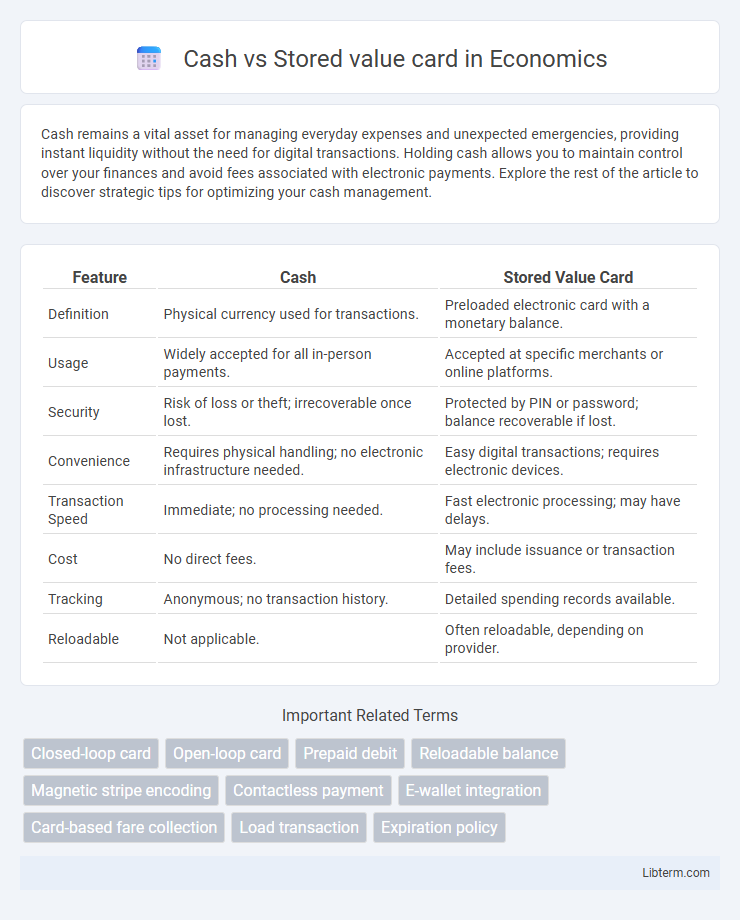

Table of Comparison

| Feature | Cash | Stored Value Card |

|---|---|---|

| Definition | Physical currency used for transactions. | Preloaded electronic card with a monetary balance. |

| Usage | Widely accepted for all in-person payments. | Accepted at specific merchants or online platforms. |

| Security | Risk of loss or theft; irrecoverable once lost. | Protected by PIN or password; balance recoverable if lost. |

| Convenience | Requires physical handling; no electronic infrastructure needed. | Easy digital transactions; requires electronic devices. |

| Transaction Speed | Immediate; no processing needed. | Fast electronic processing; may have delays. |

| Cost | No direct fees. | May include issuance or transaction fees. |

| Tracking | Anonymous; no transaction history. | Detailed spending records available. |

| Reloadable | Not applicable. | Often reloadable, depending on provider. |

Introduction to Cash and Stored Value Cards

Cash, a physical currency issued by governments, enables direct, anonymous transactions without relying on electronic systems, making it universally accepted and immediate for payments. Stored value cards, such as prepaid cards or gift cards, hold a preloaded monetary value electronically, offering consumers convenience, security, and controlled spending without linking to a bank account. These cards function through digital balances that decrease with each use, bridging the gap between traditional cash and digital payment methods.

Defining Cash: Features and Usage

Cash represents physical currency, including coins and banknotes, used as a direct and universally accepted medium of exchange for goods and services. It offers immediate liquidity without the need for electronic processing, making it ideal for small, everyday transactions and situations lacking digital payment infrastructure. The anonymity and instant settlement of cash transactions distinguish it from stored value cards, which rely on preloaded digital balances and electronic validation.

What Are Stored Value Cards?

Stored value cards are prepaid payment cards that store a specific monetary value electronically, allowing users to make transactions without the need for a bank account or credit check. These cards include gift cards, transit cards, and prepaid debit cards, offering convenience and security by limiting spending to the card's loaded balance. Unlike cash, stored value cards can be reloaded, tracked for spending, and often provide fraud protection features.

Comparing Security: Cash vs Stored Value Cards

Stored value cards offer enhanced security compared to cash by requiring personal identification numbers (PINs) or biometric verification, reducing the risk of unauthorized use. Unlike cash, which can be lost or stolen without recourse, stored value cards often include fraud protection and the ability to freeze or deactivate the balance if compromised. Digital transaction records provide added security and traceability absent in cash payments.

Convenience and Accessibility

Stored value cards offer greater convenience by enabling quick, contactless payments without the need to carry physical cash. They are widely accepted at retail stores, online platforms, and public transport systems, enhancing accessibility for everyday transactions. Cash requires physical presence and can be cumbersome to manage, especially for remote or digital purchases.

Costs and Fees Involved

Cash transactions involve no direct fees, making them cost-effective for everyday expenses, but they may incur indirect costs such as ATM withdrawal fees or currency exchange charges. Stored value cards often include upfront purchase fees, monthly maintenance charges, and reload fees, which can accumulate over time and increase overall expenses. Users should evaluate these cost factors carefully to choose between the fee-free convenience of cash and the potentially higher, but more secure, costs associated with stored value cards.

Acceptance and Usability

Cash is universally accepted for all types of transactions, providing seamless usability anywhere physical payments are allowed without requiring electronic infrastructure. Stored value cards depend on network acceptance and merchant compatibility, which can vary widely by region and vendor, sometimes limiting their usability to specific stores or online platforms. This difference in acceptance directly impacts convenience, with cash offering broader immediate usability while stored value cards deliver enhanced security and digital integration where accepted.

Risks of Loss and Fraud

Cash is vulnerable to physical theft and loss, offering no recourse for recovery once misplaced or stolen. Stored value cards provide enhanced security features such as PIN protection, transaction tracking, and the ability to block or replace lost or stolen cards, reducing the risk of financial loss. However, stored value cards can still be susceptible to fraud through hacking or unauthorized access if security measures are compromised.

Suitability for Different Users

Cash remains suitable for users who prefer anonymity and immediate accessibility without reliance on technology or accounts. Stored value cards cater to tech-savvy individuals seeking convenience, budget control, and secure digital payments within specific ecosystems, such as transit or retail stores. Users with limited access to banking services or those looking for a prepaid option benefit most from stored value cards.

Future Trends: The Shift from Cash to Stored Value Cards

The future trend shows a significant shift from cash transactions to stored value cards driven by increasing digital payment adoption and enhanced security features. Consumers and businesses prioritize convenience, transaction speed, and real-time balance tracking, making stored value cards a preferred choice for everyday purchases and transit systems. Tech advancements, such as blockchain integration and mobile wallet compatibility, further accelerate the transition towards a cashless economy.

Cash Infographic

libterm.com

libterm.com