Monetary drag occurs when rising inflation and interest rates reduce the real value of investment returns, eroding your portfolio's purchasing power. This economic phenomenon can slow growth and decrease overall wealth accumulation by increasing borrowing costs and diminishing asset values. Explore the rest of this article to understand how monetary drag impacts your finances and strategies to mitigate its effects.

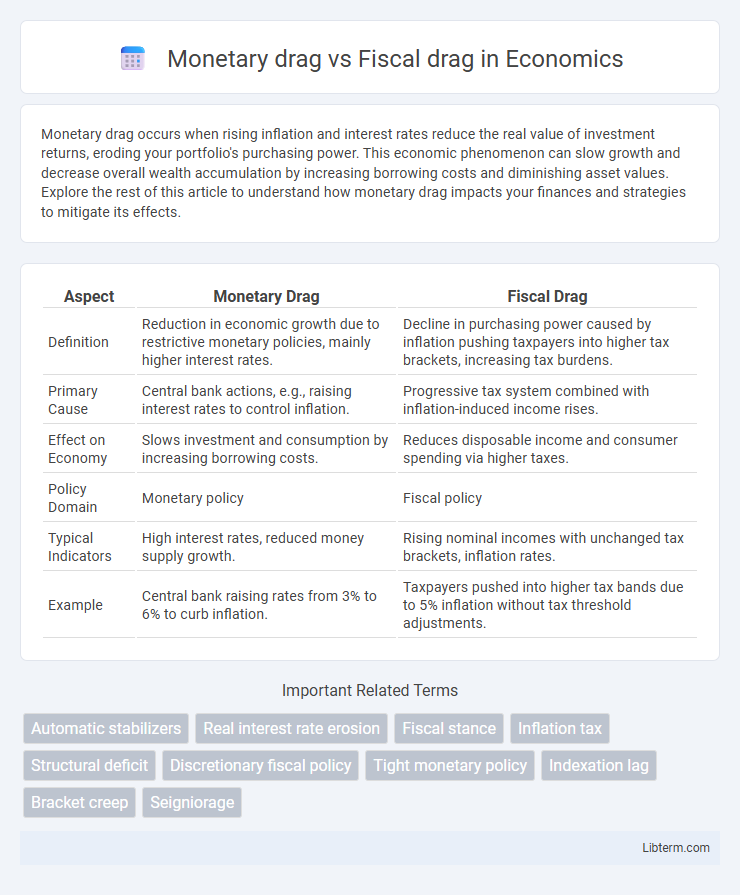

Table of Comparison

| Aspect | Monetary Drag | Fiscal Drag |

|---|---|---|

| Definition | Reduction in economic growth due to restrictive monetary policies, mainly higher interest rates. | Decline in purchasing power caused by inflation pushing taxpayers into higher tax brackets, increasing tax burdens. |

| Primary Cause | Central bank actions, e.g., raising interest rates to control inflation. | Progressive tax system combined with inflation-induced income rises. |

| Effect on Economy | Slows investment and consumption by increasing borrowing costs. | Reduces disposable income and consumer spending via higher taxes. |

| Policy Domain | Monetary policy | Fiscal policy |

| Typical Indicators | High interest rates, reduced money supply growth. | Rising nominal incomes with unchanged tax brackets, inflation rates. |

| Example | Central bank raising rates from 3% to 6% to curb inflation. | Taxpayers pushed into higher tax bands due to 5% inflation without tax threshold adjustments. |

Introduction to Monetary Drag and Fiscal Drag

Monetary drag refers to the economic slowdown caused by central banks raising interest rates to control inflation, which increases borrowing costs and reduces consumer spending and investment. Fiscal drag occurs when government tax thresholds are not adjusted for inflation, causing taxpayers to move into higher tax brackets and reducing disposable income, thus lowering aggregate demand. Both forms of drag impact economic growth by constraining spending power but operate through different mechanisms--monetary policy versus tax policy.

Defining Monetary Drag

Monetary drag refers to the reduction in economic growth caused by restrictive monetary policies such as higher interest rates, which increase borrowing costs and reduce consumer spending and investment. This phenomenon slows down inflation and curtails demand, impacting overall economic activity. Unlike fiscal drag, which results from tax bracket inflation and reduced disposable income, monetary drag directly affects liquidity and credit availability within the economy.

Understanding Fiscal Drag

Fiscal drag occurs when inflation and income growth push taxpayers into higher tax brackets, increasing government revenue without changes in tax rates. This automatic rise in tax liabilities can slow economic growth by reducing consumers' disposable income and dampening demand. Unlike monetary drag, which stems from restrictive monetary policies affecting interest rates, fiscal drag is primarily driven by the tax system's structure and its interaction with wage inflation.

Key Differences Between Monetary and Fiscal Drag

Monetary drag refers to the reduced economic growth caused by tight monetary policies, such as high interest rates that decrease consumer spending and investment. Fiscal drag occurs when government tax brackets are not adjusted for inflation, leading to higher tax burdens and reduced disposable income despite stable real earnings. The key difference lies in their sources: monetary drag arises from central bank actions affecting liquidity and cost of borrowing, while fiscal drag results from government tax policies impacting take-home pay and consumption.

Causes of Monetary Drag

Monetary drag occurs when central banks maintain interest rates above the economic growth rate, leading to a slowdown in aggregate demand and inflation control. This causes reduced consumer spending and business investment as borrowing costs rise, thereby restraining economic expansion. Unlike fiscal drag, monetary drag is primarily driven by tight monetary policies designed to curb inflation rather than tax bracket effects on personal incomes.

Causes of Fiscal Drag

Fiscal drag occurs when government revenues increase due to inflation pushing taxpayers into higher income tax brackets without corresponding tax rate changes, effectively raising the tax burden. This phenomenon is often caused by bracket creep, where nominal income growth outpaces adjustments in tax thresholds. Unlike monetary drag, which results from central bank policies affecting interest rates and inflation, fiscal drag stems primarily from the structure and lack of indexation in the tax system.

Economic Impacts of Monetary Drag

Monetary drag occurs when central bank policies, such as high interest rates, restrict consumer spending and business investment, leading to slower economic growth and reduced inflationary pressures. This contractionary effect can increase unemployment as reduced demand decreases production requirements. Persistent monetary drag may undermine long-term economic stability by limiting capital formation and innovation.

Economic Impacts of Fiscal Drag

Fiscal drag reduces disposable income by increasing tax revenues through bracket creep during inflation, leading to lower consumer spending and suppressed aggregate demand. This erosion of purchasing power dampens economic growth and can increase unemployment by constraining business revenues and investment. The resulting contraction in economic activity often necessitates counterbalancing fiscal or monetary policies to restore equilibrium.

Policy Responses to Address Monetary and Fiscal Drag

Monetary policy responses to monetary drag typically involve adjusting interest rates to influence aggregate demand and control inflation, with central banks lowering rates to stimulate growth or raising them to cool an overheated economy. Fiscal policy responses to fiscal drag include modifying tax brackets, increasing government spending, or implementing targeted tax relief to boost disposable income and economic activity. Coordinated monetary and fiscal policies can effectively counteract drag by balancing demand management and structural incentives.

Conclusion: Balancing Monetary and Fiscal Policies

Balancing monetary and fiscal policies requires recognizing that monetary drag, caused by central banks' interest rate hikes to control inflation, can slow economic growth, while fiscal drag, resulting from increased taxes or reduced government spending, contracts aggregate demand. Effective policy coordination ensures that tightening monetary policy to stabilize prices does not excessively suppress growth due to simultaneous fiscal tightening. A harmonious approach mitigates inflation without triggering recessions, maintaining sustainable economic expansion.

Monetary drag Infographic

libterm.com

libterm.com