In a competitive market, businesses constantly strive to differentiate their products and services to attract consumers. Understanding market dynamics and consumer behavior is essential for staying ahead and achieving sustainable growth. Discover key strategies that can help you navigate and succeed in this challenging environment by reading the rest of the article.

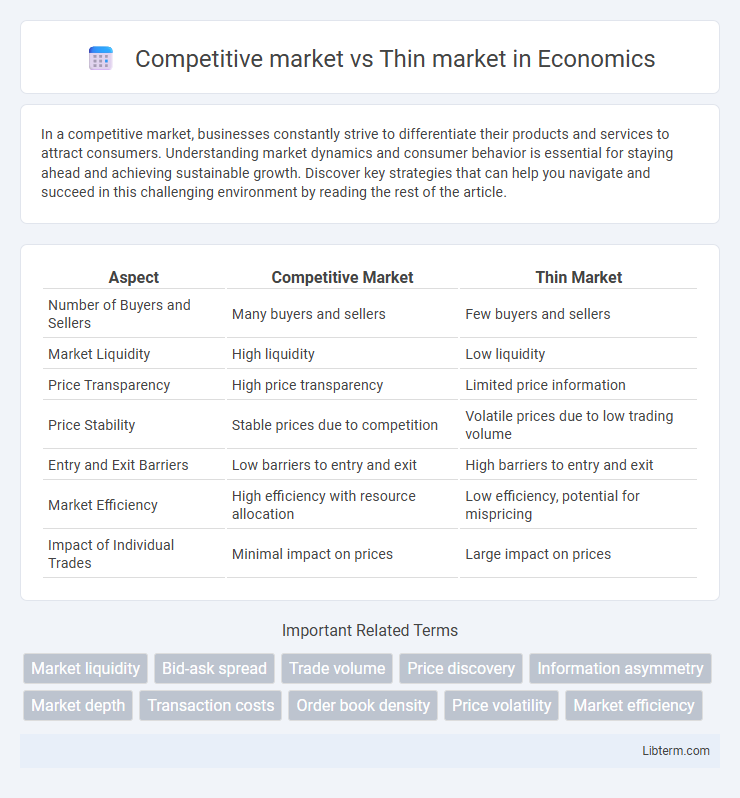

Table of Comparison

| Aspect | Competitive Market | Thin Market |

|---|---|---|

| Number of Buyers and Sellers | Many buyers and sellers | Few buyers and sellers |

| Market Liquidity | High liquidity | Low liquidity |

| Price Transparency | High price transparency | Limited price information |

| Price Stability | Stable prices due to competition | Volatile prices due to low trading volume |

| Entry and Exit Barriers | Low barriers to entry and exit | High barriers to entry and exit |

| Market Efficiency | High efficiency with resource allocation | Low efficiency, potential for mispricing |

| Impact of Individual Trades | Minimal impact on prices | Large impact on prices |

Introduction to Competitive and Thin Markets

Competitive markets feature numerous buyers and sellers, ensuring prices reflect true supply and demand with high liquidity and transparent information flow. Thin markets, by contrast, have fewer participants and lower transaction volumes, leading to greater price volatility, wider bid-ask spreads, and less information symmetry. Understanding these market structures is crucial for investors and traders to assess liquidity risks and price efficiency.

Defining Competitive Markets

Competitive markets are characterized by numerous buyers and sellers, ensuring no single participant can control prices, with high transparency and ease of entry or exit. Price mechanisms in such markets reflect real-time supply and demand, promoting efficiency and consumer welfare. In contrast, thin markets have few participants, resulting in less liquidity, greater price volatility, and potential barriers to market entry.

Understanding Thin Markets

Thin markets exhibit low trading volumes and limited participants, causing wider bid-ask spreads and increased price volatility compared to competitive markets. These conditions lead to less liquidity, making it challenging for buyers and sellers to execute large transactions without significant price impact. Understanding thin markets is crucial for investors as it affects market efficiency, price discovery, and risk assessment in trading strategies.

Key Differences Between Competitive and Thin Markets

Competitive markets feature numerous buyers and sellers generating high liquidity, resulting in tight spreads and efficient price discovery. Thin markets exhibit fewer participants, leading to lower liquidity, wider spreads, and increased price volatility. These differences impact market efficiency, transaction costs, and the ease of entering or exiting positions.

Impact on Pricing and Liquidity

Competitive markets feature numerous buyers and sellers, leading to high liquidity and price efficiency as market prices closely reflect supply and demand dynamics. In contrast, thin markets have few participants, resulting in lower liquidity and increased price volatility, as large transactions can disproportionately impact prices. This lack of market depth often causes wider bid-ask spreads and challenges in executing trades at stable prices.

Market Efficiency in Both Market Types

Competitive markets maximize market efficiency by facilitating numerous buyers and sellers, ensuring transparent pricing and optimal resource allocation through high liquidity and low transaction costs. Thin markets exhibit reduced efficiency due to limited participants, which causes wider bid-ask spreads, price volatility, and slower information dissemination, hindering accurate price discovery. Market efficiency in competitive environments leads to rapid adjustment of prices to new information, whereas thin markets often experience delayed or distorted price signals, impacting overall market performance.

Risks Associated with Thin Markets

Thin markets pose significant risks due to low liquidity, causing price volatility and difficulty in executing large trades without substantial slippage. The limited number of buyers and sellers can lead to wider bid-ask spreads, increasing transaction costs and impacting market efficiency. Unlike competitive markets, thin markets heighten the potential for price manipulation and reduce the reliability of price discovery mechanisms.

Opportunities in Competitive Markets

Competitive markets present numerous opportunities for businesses to innovate, differentiate their products, and capture diverse customer segments due to high consumer demand and intense rivalry. Companies can leverage economies of scale and advanced market analytics to optimize pricing strategies and enhance customer experience. The presence of multiple competitors fosters a dynamic environment encouraging continuous improvement and rapid adaptation to emerging trends.

Real-World Examples and Case Studies

Competitive markets, such as the U.S. technology sector, feature numerous buyers and sellers with high liquidity and transparent pricing, exemplified by companies like Apple and Microsoft continuously innovating and competing. Thin markets, like the rare art market or specialized agricultural commodities, have few participants and limited transactions, often leading to price volatility and challenges in asset valuation, demonstrated by fluctuating auction results for rare collectibles. Case studies of the London real estate market reveal segments transitioning from thin to more competitive states as new buyers enter, increasing liquidity and stabilizing prices.

Conclusion: Navigating Market Structures

Navigating market structures requires understanding that competitive markets offer numerous buyers and sellers, ensuring price transparency and efficient resource allocation, while thin markets have limited participants, leading to higher price volatility and less liquidity. Effective strategies in competitive markets leverage abundant information and stable pricing, whereas thin market navigation demands careful risk management and adaptive tactics to handle unpredictability. Recognizing these characteristics enables businesses and investors to optimize decisions based on market depth and participant behavior.

Competitive market Infographic

libterm.com

libterm.com