The spot rate is the current market price at which a specific asset, such as a currency, commodity, or security, can be bought or sold for immediate delivery. Understanding the spot rate is crucial for making informed trading decisions and managing currency risk in international transactions. Discover how the spot rate affects your financial strategies by exploring the full article.

Table of Comparison

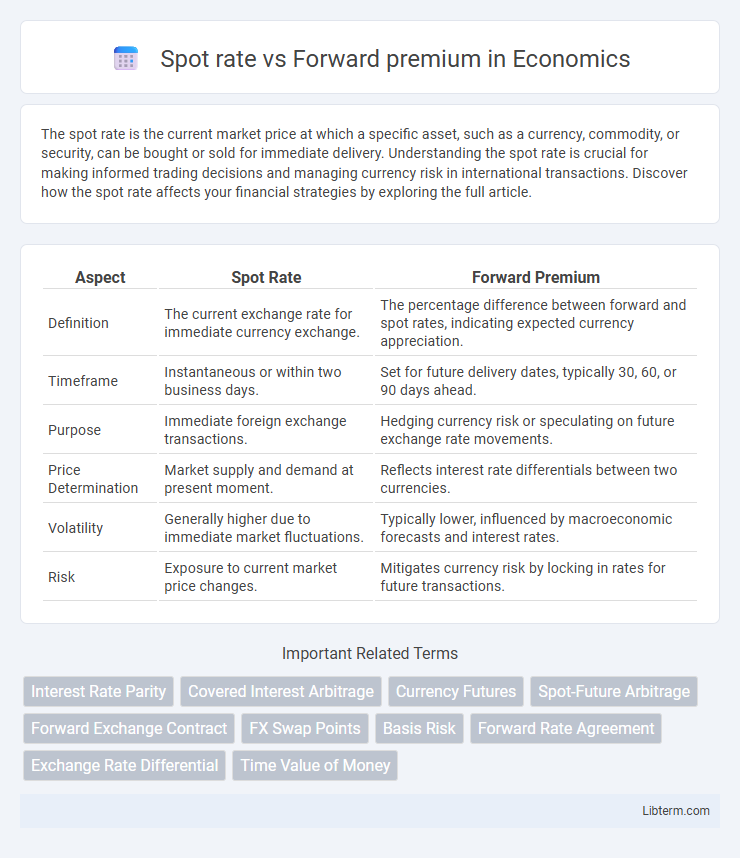

| Aspect | Spot Rate | Forward Premium |

|---|---|---|

| Definition | The current exchange rate for immediate currency exchange. | The percentage difference between forward and spot rates, indicating expected currency appreciation. |

| Timeframe | Instantaneous or within two business days. | Set for future delivery dates, typically 30, 60, or 90 days ahead. |

| Purpose | Immediate foreign exchange transactions. | Hedging currency risk or speculating on future exchange rate movements. |

| Price Determination | Market supply and demand at present moment. | Reflects interest rate differentials between two currencies. |

| Volatility | Generally higher due to immediate market fluctuations. | Typically lower, influenced by macroeconomic forecasts and interest rates. |

| Risk | Exposure to current market price changes. | Mitigates currency risk by locking in rates for future transactions. |

Understanding Spot Rate

The spot rate represents the current exchange rate at which a currency can be immediately exchanged for another currency in the foreign exchange market. It reflects real-time market conditions influenced by factors such as interest rates, inflation, and geopolitical events. Understanding the spot rate is crucial for businesses and investors to assess short-term currency value and make informed decisions in currency trading or international transactions.

What is Forward Premium?

Forward premium refers to the percentage by which the forward exchange rate exceeds the spot exchange rate, indicating the expected appreciation of a currency over a specific period. It reflects market expectations of future currency movements based on interest rate differentials between two countries. Traders use forward premiums to hedge against exchange rate risk or to speculate on currency trends in the foreign exchange market.

Key Differences Between Spot Rate and Forward Premium

The spot rate represents the current exchange rate at which a currency can be bought or sold for immediate delivery, reflecting real-time market conditions. The forward premium indicates the percentage difference between the forward exchange rate and the spot rate, signaling expected currency appreciation or depreciation over a specified future period. Key differences lie in timing--spot rate applies to immediate transactions while forward premium relates to contracts settled at a future date--and their roles in hedging foreign exchange risk versus reflecting market expectations.

Factors Influencing Spot Rates

Spot rates are influenced by immediate supply and demand dynamics in the foreign exchange market, interest rate differentials, and geopolitical events impacting currency stability. Central bank interventions and macroeconomic indicators, such as inflation rates and trade balances, also play a crucial role in determining spot rate fluctuations. Market sentiment and short-term capital flows further contribute to the volatility and movement of spot exchange rates.

Factors Leading to Forward Premium

Forward premium arises when the forward exchange rate exceeds the current spot rate, reflecting expectations of currency appreciation. Key factors driving a forward premium include interest rate differentials between two countries, where higher domestic interest rates typically increase the forward rate, and anticipated economic conditions that influence currency demand and inflation expectations. Market speculation and changes in political stability also significantly impact forward premiums by altering investor confidence and currency risk perceptions.

Calculating Forward Premium in Forex

Calculating forward premium in forex involves comparing the forward exchange rate to the spot exchange rate, expressed as an annualized percentage difference to determine potential currency appreciation or depreciation. The formula for forward premium is ((Forward Rate - Spot Rate) / Spot Rate) x (360 / Days Forward), which helps traders assess cost or benefit in currency hedging and speculate on exchange rate movements. Accurate calculation of forward premium is essential for informed decisions in foreign exchange risk management and arbitrage strategies.

Impact of Spot and Forward Rates on International Trade

Spot rates determine the immediate exchange cost for currency conversion, directly influencing the pricing and competitiveness of cross-border transactions. Forward premiums or discounts reflect market expectations of currency movements, allowing businesses to hedge against potential exchange rate volatility, thus stabilizing profit margins in international trade. Fluctuations in spot rates and forward premiums impact importers' and exporters' decisions on contract timing, pricing strategies, and risk management.

Spot Rate vs Forward Premium: Practical Examples

Spot rate represents the current exchange rate for immediate currency transactions, while the forward premium indicates the expected change in exchange rates for contracts set to mature in the future. For example, if the USD/EUR spot rate is 1.10 and the one-year forward rate is 1.12, the forward premium is approximately 1.82%, reflecting the cost or benefit of locking in a future exchange rate. Firms use forward premiums to hedge foreign exchange risk, ensuring predictable costs and revenues in international trade.

Risks Associated with Spot and Forward Contracts

Spot rate transactions expose parties to immediate currency exchange risk, as fluctuations can lead to unexpected losses when settling payments instantly. Forward contracts mitigate this risk by locking in exchange rates for future transactions, yet they introduce counterparty risk and potential opportunity costs if the market moves favorably after the contract is set. Both contract types require careful assessment of market volatility, credit risk, and the timing of cash flows to optimize foreign exchange risk management.

Choosing Between Spot Rate and Forward Premium

Choosing between the spot rate and forward premium depends on a firm's risk tolerance and market expectations. The spot rate offers immediate currency exchange at current market prices, ideal for straightforward transactions without future uncertainty. In contrast, the forward premium provides a hedge against currency fluctuations by locking in a future exchange rate, making it suitable for budgeting and protecting profit margins in volatile forex markets.

Spot rate Infographic

libterm.com

libterm.com