Currency risk affects international investments and business transactions by causing fluctuations in exchange rates that impact the value of assets and liabilities. Managing this risk involves strategies such as hedging with forward contracts, options, or diversifying currency exposure to protect against unexpected losses. Explore the rest of the article to understand how you can safeguard your financial interests from currency volatility.

Table of Comparison

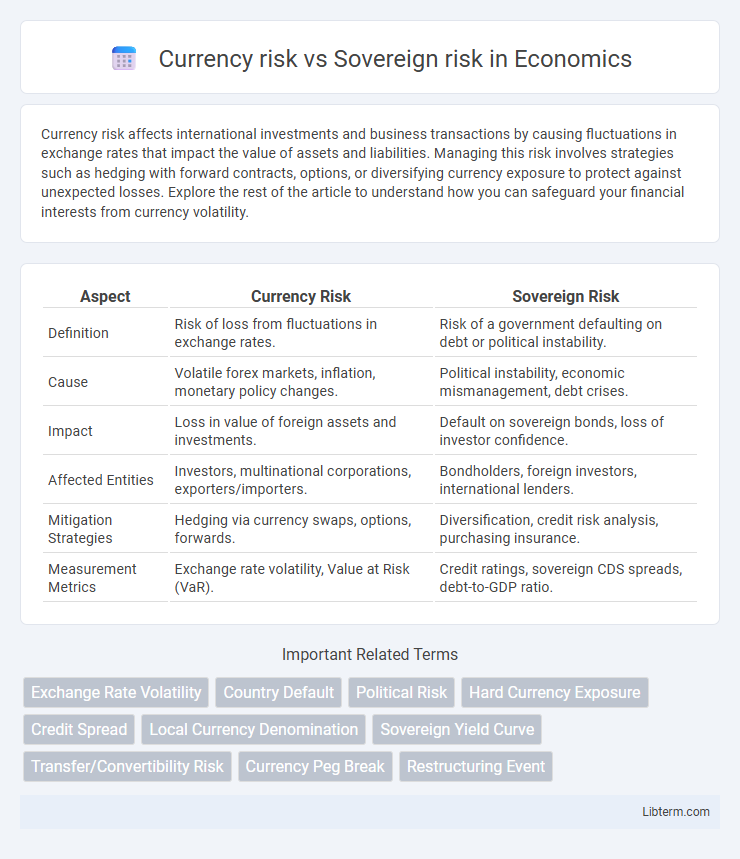

| Aspect | Currency Risk | Sovereign Risk |

|---|---|---|

| Definition | Risk of loss from fluctuations in exchange rates. | Risk of a government defaulting on debt or political instability. |

| Cause | Volatile forex markets, inflation, monetary policy changes. | Political instability, economic mismanagement, debt crises. |

| Impact | Loss in value of foreign assets and investments. | Default on sovereign bonds, loss of investor confidence. |

| Affected Entities | Investors, multinational corporations, exporters/importers. | Bondholders, foreign investors, international lenders. |

| Mitigation Strategies | Hedging via currency swaps, options, forwards. | Diversification, credit risk analysis, purchasing insurance. |

| Measurement Metrics | Exchange rate volatility, Value at Risk (VaR). | Credit ratings, sovereign CDS spreads, debt-to-GDP ratio. |

Introduction to Currency Risk and Sovereign Risk

Currency risk arises from fluctuations in exchange rates that can affect the value of international investments, impacting profits and cash flows. Sovereign risk refers to the possibility that a government will default on its debt or enact policies that negatively influence foreign investors' assets. Both risks are critical considerations for investors engaging in global markets, as they directly influence investment stability and returns.

Defining Currency Risk: Key Concepts

Currency risk, also known as exchange rate risk, refers to the potential for financial loss due to fluctuations in the value of one currency relative to another, impacting investments and international transactions. It involves the uncertainty stemming from changes in exchange rates that can affect the returns on assets denominated in foreign currencies. Sovereign risk, by contrast, relates to the possibility that a government may default on its debt obligations or impose currency controls, which can exacerbate currency risk but fundamentally concerns creditworthiness rather than exchange rate movements alone.

What is Sovereign Risk?

Sovereign risk refers to the potential for a government to default on its debt obligations or to enact policies that negatively impact foreign investors and lenders. This risk encompasses economic instability, political turmoil, and changes in regulatory or tax frameworks that affect a country's ability to meet debt payments. Understanding sovereign risk is crucial for investors managing exposure in foreign bonds, loans, and international financial markets.

Main Differences: Currency Risk vs Sovereign Risk

Currency risk arises from fluctuations in exchange rates impacting the value of investments denominated in foreign currencies, while sovereign risk refers to a government's potential inability or unwillingness to meet its debt obligations. Currency risk primarily affects international investors exposed to currency volatility, whereas sovereign risk concerns the financial stability and creditworthiness of a nation. Understanding these distinctions is crucial for assessing investment risks in global markets and managing exposure effectively.

Factors Influencing Currency Risk

Currency risk is influenced by factors such as exchange rate volatility, interest rate differentials, and inflation rates in the involved countries. Political stability, monetary policy decisions, and economic indicators like GDP growth also play crucial roles in determining currency fluctuations. Market sentiment and external shocks like geopolitical events or trade disputes further exacerbate currency risk for investors and businesses.

Factors Contributing to Sovereign Risk

Sovereign risk arises from a country's potential inability or unwillingness to meet its debt obligations, influenced by political instability, economic mismanagement, and adverse fiscal policies. Factors such as government default history, inflation rates, foreign debt levels, and geopolitical tensions amplify sovereign risk. Unlike currency risk, which is driven by exchange rate fluctuations, sovereign risk encompasses broader issues related to a nation's overall creditworthiness and governance.

Impact of Currency and Sovereign Risks on Investments

Currency risk affects investments by causing fluctuations in returns due to changes in exchange rates, which can erode the value of foreign-denominated assets. Sovereign risk involves the possibility that a government may default on its debt or implement policies that adversely affect investors, leading to financial losses. Both risks significantly impact international portfolios, as currency volatility can amplify losses and sovereign instability can undermine market confidence and investment security.

Measuring and Assessing Currency Risk

Measuring currency risk involves analyzing exchange rate volatility and its potential impact on international investments through metrics such as Value at Risk (VaR) and scenario analysis. Tools like forward contracts and currency options can hedge against adverse movements, while assessing exposure requires evaluating transaction, translation, and economic risks tied to foreign currency fluctuations. Sovereign risk assessment complements this by examining a country's political stability, fiscal health, and likelihood of default, which indirectly affect currency stability.

Evaluating Sovereign Risk: Indicators and Tools

Sovereign risk evaluation relies heavily on indicators such as a country's debt-to-GDP ratio, political stability, and foreign exchange reserves to gauge its ability to meet debt obligations. Tools like credit rating agencies' reports, sovereign credit default swap (CDS) spreads, and macroeconomic models provide quantitative assessments of sovereign risk exposure. Continuous monitoring of fiscal policies and external economic shocks enhances the precision of sovereign risk analysis compared to currency risk, which primarily centers on exchange rate volatility.

Strategies to Mitigate Currency and Sovereign Risks

Effective strategies to mitigate currency risk include using forward contracts, options, and currency swaps to hedge against unpredictable exchange rate fluctuations. Sovereign risk can be reduced by diversifying investments across multiple countries, purchasing political risk insurance, and closely monitoring government policies and economic indicators. Combining these approaches helps investors protect portfolios from both currency volatility and adverse government actions.

Currency risk Infographic

libterm.com

libterm.com