The Pigou effect describes the real balance effect where a decrease in the price level increases the real value of money holdings, leading to higher consumer spending and aggregate demand. This phenomenon highlights how deflation can boost consumption by enhancing individuals' purchasing power, potentially stabilizing the economy during downturns. Explore the rest of the article to understand how the Pigou effect influences economic policy and market dynamics.

Table of Comparison

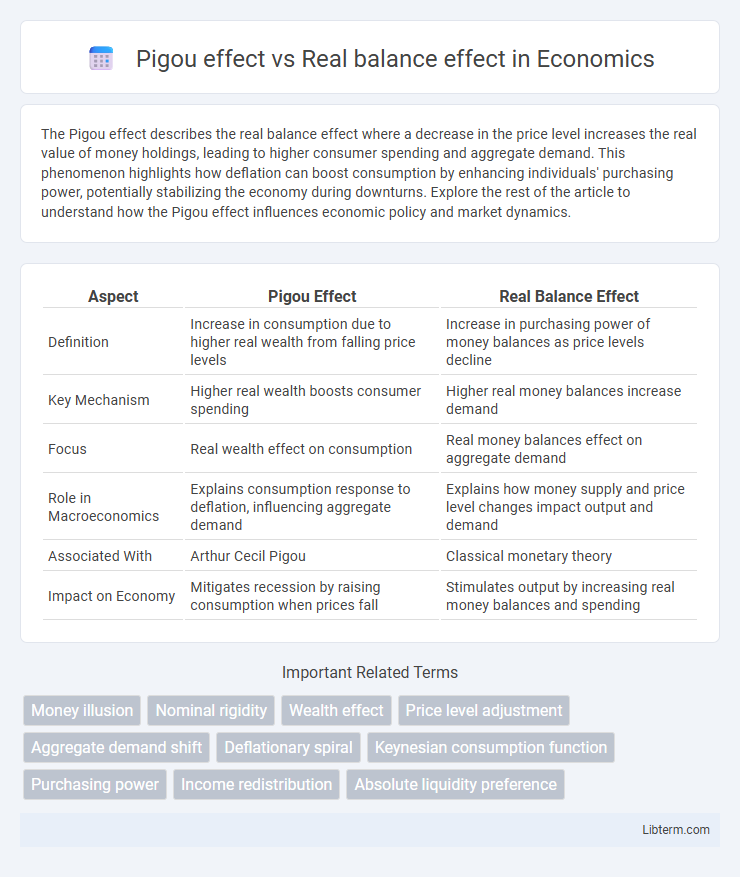

| Aspect | Pigou Effect | Real Balance Effect |

|---|---|---|

| Definition | Increase in consumption due to higher real wealth from falling price levels | Increase in purchasing power of money balances as price levels decline |

| Key Mechanism | Higher real wealth boosts consumer spending | Higher real money balances increase demand |

| Focus | Real wealth effect on consumption | Real money balances effect on aggregate demand |

| Role in Macroeconomics | Explains consumption response to deflation, influencing aggregate demand | Explains how money supply and price level changes impact output and demand |

| Associated With | Arthur Cecil Pigou | Classical monetary theory |

| Impact on Economy | Mitigates recession by raising consumption when prices fall | Stimulates output by increasing real money balances and spending |

Introduction to Pigou Effect and Real Balance Effect

The Pigou effect describes how a rise in real wealth, due to a decrease in the price level, boosts consumer spending by increasing the real value of money holdings. The Real Balance effect similarly explains that lower price levels enhance the purchasing power of money balances, encouraging greater consumption and increasing aggregate demand. Both concepts highlight the relationship between price levels and consumer behavior but the Pigou effect specifically emphasizes wealth effects on consumption through the real value of monetary assets.

Historical Background and Key Economists

The Pigou effect, named after economist Arthur Cecil Pigou, emphasizes the increase in consumption resulting from higher real wealth due to falling price levels, and was introduced in the early 20th century as a critique of Keynesian underconsumption theory. The Real Balance effect, linked closely to Pigou's ideas, is grounded in Irving Fisher's quantity theory of money and highlights how changes in the real value of money balances impact aggregate demand. Key economists Arthur Pigou and Irving Fisher pioneered these concepts during the 1910s to 1930s, contributing significantly to monetary economics and influencing debates on price level changes and economic output.

Definition of Pigou Effect

The Pigou effect, also known as the real balance effect, describes how changes in the real value of money balances influence consumer spending and aggregate demand. It occurs when inflation lowers the real value of cash holdings, reducing purchasing power and leading consumers to cut back on consumption, thereby decreasing aggregate demand. This concept highlights the role of real money balances in stabilizing the economy by encouraging spending when prices fall and real balances increase.

Definition of Real Balance Effect

The Real Balance Effect refers to the change in consumption resulting from a change in the real value of money balances, which occurs when a change in the price level alters the purchasing power of nominal money holdings. Unlike the Pigou effect, which emphasizes increased consumption due to higher real wealth during deflation, the Real Balance Effect specifically highlights how lower price levels increase real wealth by boosting the value of money balances, thereby stimulating aggregate demand. This effect plays a crucial role in macroeconomic models by illustrating the link between price level changes and consumer spending behavior.

Mechanisms Behind Each Effect

The Pigou effect operates through changes in real wealth as price levels shift, where a decrease in the price level raises the real value of money holdings, encouraging increased consumer spending and boosting aggregate demand. The Real balance effect similarly hinges on the purchasing power of nominal money balances, but emphasizes how lower price levels increase real balances, prompting higher consumption due to increased wealth. Both effects underscore the influence of price-level changes on real wealth, yet the Pigou effect explicitly integrates consumer wealth perception, while the Real balance effect concentrates more on the direct impact of money's purchasing power.

Similarities Between Pigou and Real Balance Effects

Both the Pigou effect and the Real balance effect emphasize how changes in the real value of money balances influence consumer spending and aggregate demand. They highlight the role of wealth perception in driving consumption, where increases in real money balances lead to higher purchasing power and thus stimulate economic activity. Both effects operate through the interaction between the price level and real wealth, underscoring the importance of money's real value in macroeconomic adjustment mechanisms.

Key Differences and Distinctions

The Pigou effect emphasizes the impact of changes in real wealth on consumer spending, highlighting how higher price levels reduce real balances and lower consumption, thus influencing aggregate demand. The Real balance effect specifically describes the change in purchasing power of nominal money holdings due to price level fluctuations, affecting consumption patterns. While both address the relationship between price levels and consumption, the Pigou effect integrates psychological wealth perception, whereas the Real balance effect is strictly tied to the monetary value of cash balances.

Implications for Macroeconomic Theory

The Pigou effect emphasizes how changes in real wealth, due to price level fluctuations, influence consumer spending and aggregate demand, highlighting the role of real balances in restoring macroeconomic equilibrium. The Real balance effect similarly considers wealth effects but is often integrated within the Keynesian framework to explain adjustments in consumption with varying price levels. Both concepts underscore the importance of real money balances in macroeconomic theory, affecting interpretations of fiscal and monetary policy effectiveness during demand fluctuations.

Criticisms and Limitations

The Pigou effect, which posits increased consumption due to higher real wealth from declining price levels, faces criticism for its limited empirical support and assumption of perfect liquidity and instant adjustment. The real balance effect, emphasizing changes in consumption driven by changes in the real value of money holdings, is limited by the assumption that money balances significantly influence consumer spending, potentially overlooking credit and wealth effects. Both concepts struggle to account for rigidities in wage and price adjustments and fail to fully explain consumption behavior during deflationary periods.

Conclusion: Relevance in Modern Economics

The Pigou effect highlights how increased real wealth from lower price levels can boost consumption and aggregate demand, emphasizing the role of real balances in economic stability. The real balance effect similarly underlines the impact of purchasing power changes on consumer behavior but is often considered more general in macroeconomic contexts. Both effects remain relevant in modern economics by explaining demand-side responses to price fluctuations, influencing monetary policy effectiveness and inflation management.

Pigou effect Infographic

libterm.com

libterm.com