A floating exchange rate is determined by the foreign exchange market through supply and demand without direct government or central bank intervention. This system allows currencies to fluctuate freely, reflecting economic conditions, trade balances, and investor sentiment. Explore the rest of the article to understand how floating exchange rates impact your financial decisions.

Table of Comparison

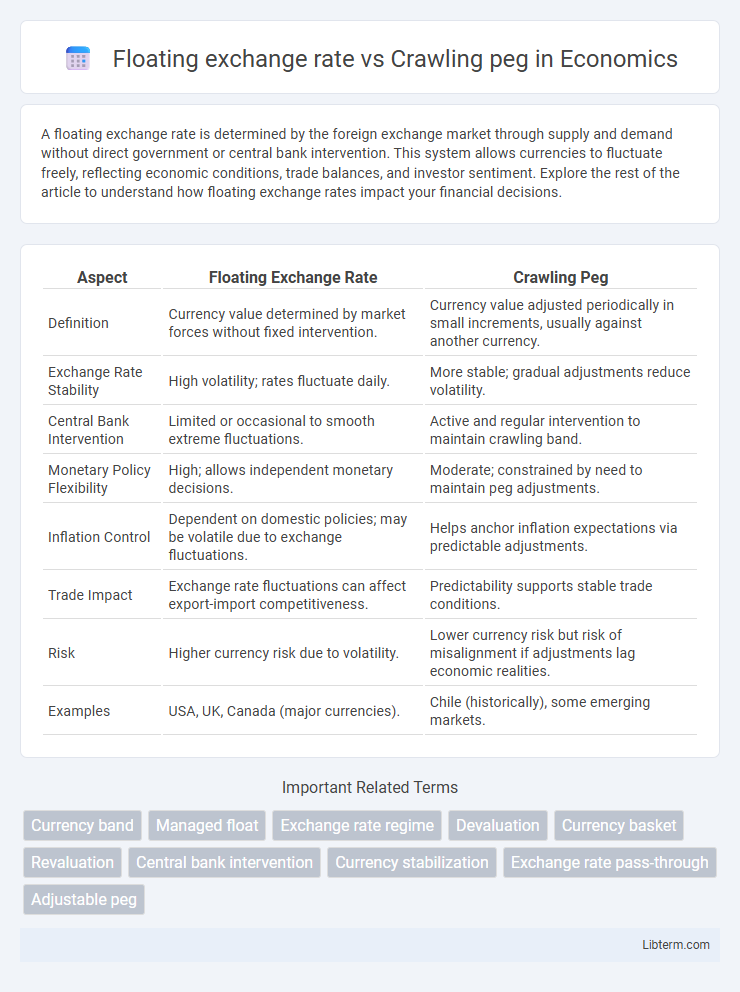

| Aspect | Floating Exchange Rate | Crawling Peg |

|---|---|---|

| Definition | Currency value determined by market forces without fixed intervention. | Currency value adjusted periodically in small increments, usually against another currency. |

| Exchange Rate Stability | High volatility; rates fluctuate daily. | More stable; gradual adjustments reduce volatility. |

| Central Bank Intervention | Limited or occasional to smooth extreme fluctuations. | Active and regular intervention to maintain crawling band. |

| Monetary Policy Flexibility | High; allows independent monetary decisions. | Moderate; constrained by need to maintain peg adjustments. |

| Inflation Control | Dependent on domestic policies; may be volatile due to exchange fluctuations. | Helps anchor inflation expectations via predictable adjustments. |

| Trade Impact | Exchange rate fluctuations can affect export-import competitiveness. | Predictability supports stable trade conditions. |

| Risk | Higher currency risk due to volatility. | Lower currency risk but risk of misalignment if adjustments lag economic realities. |

| Examples | USA, UK, Canada (major currencies). | Chile (historically), some emerging markets. |

Introduction to Exchange Rate Regimes

A floating exchange rate regime allows currency values to fluctuate freely based on market supply and demand, promoting automatic adjustment to economic conditions. In contrast, a crawling peg system adjusts the currency's fixed rate periodically in small increments to stabilize trade competitiveness and inflation rates. These exchange rate regimes provide distinct approaches to balancing currency stability and flexibility in international finance.

What is a Floating Exchange Rate?

A floating exchange rate is a currency valuation system where the exchange rate is determined by market forces of supply and demand without direct government or central bank intervention. This system allows the currency value to fluctuate freely in response to economic indicators, trade flows, and geopolitical events. Unlike the crawling peg, which adjusts the currency value periodically in small increments, a floating exchange rate provides more flexibility and reflects real-time market conditions.

Understanding the Crawling Peg System

The crawling peg system is a type of exchange rate regime where a currency's value is adjusted periodically in small increments at a fixed, pre-announced rate, providing more stability than a floating exchange rate. Unlike a floating exchange rate, which is determined by market forces of supply and demand, the crawling peg aims to combine the flexibility of gradual devaluation or appreciation with the predictability of a fixed rate. This mechanism helps countries manage inflation and maintain competitiveness while avoiding the volatility often associated with fully floating exchange rates.

Key Differences Between Floating and Crawling Peg

Floating exchange rates fluctuate freely based on market demand and supply without direct government intervention, enabling automatic adjustment to economic shocks. Crawling peg systems adjust the currency value gradually at pre-announced intervals or in response to specific indicators, combining fixed and flexible exchange rate advantages. Key differences include the degree of central bank control, with floating rates allowing full market-driven volatility and crawling pegs providing predictable, incremental adjustments to stabilize trade competitiveness.

Advantages of Floating Exchange Rates

Floating exchange rates offer enhanced flexibility by allowing currency values to adjust automatically based on market supply and demand, promoting more accurate reflection of economic conditions. This system helps absorb external shocks and reduces the risk of balance of payments crises compared to crawling pegs, which require frequent interventions and fixed adjustment schedules. Additionally, floating exchange rates support monetary policy independence, enabling central banks to focus on domestic economic objectives without maintaining exchange rate targets.

Benefits of the Crawling Peg Regime

The crawling peg exchange rate regime offers enhanced stability by adjusting the currency value gradually, reducing the risk of sudden shocks compared to floating exchange rates. It provides predictable currency movements, which benefit exporters and importers by facilitating planning and reducing exchange rate volatility. This controlled flexibility helps maintain competitiveness while curbing inflationary pressures prevalent in purely floating systems.

Disadvantages and Risks of Floating Rates

Floating exchange rates expose economies to high volatility and unpredictable currency fluctuations that can undermine trade stability and investment confidence. Sudden changes in exchange rates may lead to inflationary pressures and complicate monetary policy, especially in countries with less developed financial systems. This instability increases risks for businesses engaged in international trade, as currency value swings can significantly impact profits and costs.

Challenges Associated with Crawling Pegs

Crawling pegs present challenges such as limited flexibility in responding to rapid market fluctuations, leading to potential misalignments with fundamental economic indicators. Maintaining a fixed adjustment path requires substantial foreign exchange reserves, increasing vulnerability to speculative attacks and sudden capital outflows. Unlike floating exchange rates, crawling pegs may hinder automatic price level adjustments, causing persistent trade imbalances and inflationary pressures.

Real-World Examples of Both Currency Systems

Floating exchange rates are exemplified by the US dollar and the euro, where currency values fluctuate freely based on market demand and supply, allowing for automatic adjustments to economic shocks. In contrast, countries like Mexico have historically used a crawling peg system, gradually adjusting their currency value against the US dollar to maintain stability while managing inflation and external pressures. These systems highlight the trade-off between flexibility in floating rates and the controlled predictability offered by crawling pegs.

Choosing the Right Exchange Rate Regime for an Economy

Choosing the right exchange rate regime depends on an economy's stability, inflation control, and external shocks resilience. A floating exchange rate allows automatic adjustment to market forces, promoting flexibility but risking volatility in trade and investment. Conversely, a crawling peg offers gradual adjustments to the currency's value, balancing stability with responsiveness to inflation differentials and maintaining competitiveness in export markets.

Floating exchange rate Infographic

libterm.com

libterm.com