Capital gains tax applies to the profit you make from selling assets such as property, stocks, or investments. Understanding the rates, exemptions, and reporting requirements can help you minimize your tax liability efficiently. Explore the rest of this article to learn how to manage your capital gains tax effectively.

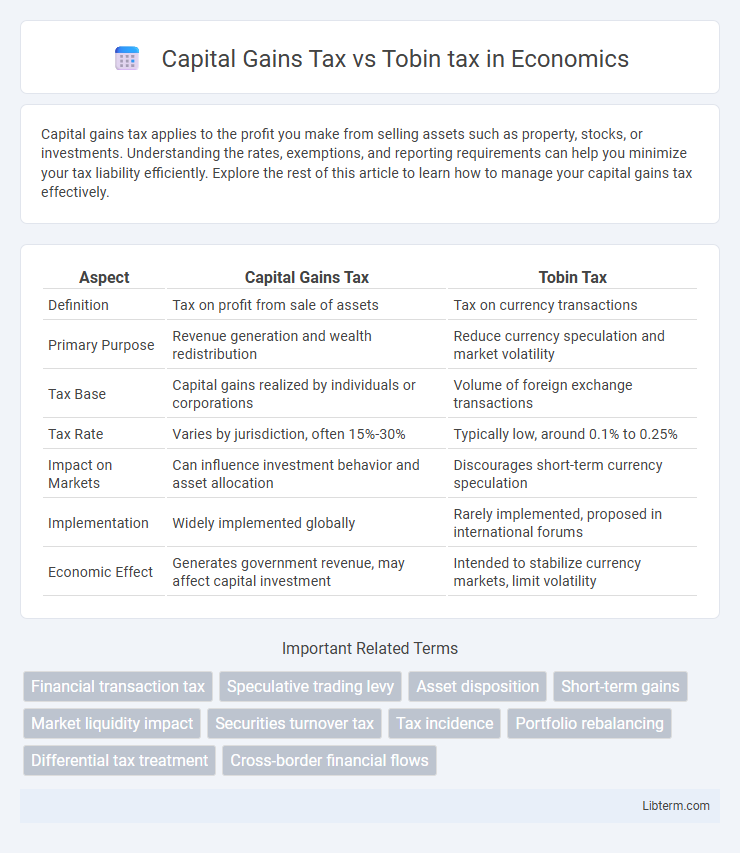

Table of Comparison

| Aspect | Capital Gains Tax | Tobin Tax |

|---|---|---|

| Definition | Tax on profit from sale of assets | Tax on currency transactions |

| Primary Purpose | Revenue generation and wealth redistribution | Reduce currency speculation and market volatility |

| Tax Base | Capital gains realized by individuals or corporations | Volume of foreign exchange transactions |

| Tax Rate | Varies by jurisdiction, often 15%-30% | Typically low, around 0.1% to 0.25% |

| Impact on Markets | Can influence investment behavior and asset allocation | Discourages short-term currency speculation |

| Implementation | Widely implemented globally | Rarely implemented, proposed in international forums |

| Economic Effect | Generates government revenue, may affect capital investment | Intended to stabilize currency markets, limit volatility |

Introduction to Capital Gains Tax and Tobin Tax

Capital Gains Tax (CGT) is a government-imposed levy on the profit realized from the sale of assets such as stocks, bonds, or real estate, designed to generate revenue and moderate speculative investment. Tobin Tax is a proposed levy on currency transactions aimed at reducing short-term speculation in foreign exchange markets to promote financial stability. Both taxes serve distinct economic objectives, with CGT targeting asset appreciation and Tobin Tax focusing on currency market volatility.

Definitions and Key Concepts

Capital Gains Tax is a levy on the profit realized from the sale of assets such as stocks, bonds, or real estate, calculated as the difference between the sale price and the original purchase price. Tobin Tax is a proposed tax on currency transactions aimed at reducing exchange rate volatility and speculative trading in foreign exchange markets. Understanding both taxes involves recognizing that Capital Gains Tax targets investment profits, while Tobin Tax focuses on stabilizing financial markets by discouraging short-term currency speculation.

Historical Background of Both Taxes

Capital Gains Tax originated in the early 20th century as governments sought to tax profits from asset sales, initially introduced in the United States in 1913 with the Revenue Act. The Tobin tax, proposed by economist James Tobin in 1972, was designed specifically to curb speculative currency trading and stabilize exchange rates. While Capital Gains Tax targets profits from investments across various asset classes, the Tobin tax focuses exclusively on taxing short-term financial transactions in foreign exchange markets.

Purpose and Objectives of Each Tax

Capital Gains Tax is designed to tax profits earned from the sale of assets, aiming to generate government revenue and discourage short-term speculative investments by encouraging long-term holding. Tobin Tax targets currency transactions specifically, intending to reduce excessive volatility in foreign exchange markets and stabilize international financial systems by imposing a small levy on currency trades. Both taxes serve to regulate market behavior but focus on different financial activities and economic objectives.

Mechanism of Capital Gains Tax

Capital Gains Tax functions by taxing the profit earned from the sale of an asset, such as stocks or real estate, calculated as the difference between the purchase price and the selling price. This tax is typically applied at varying rates depending on the holding period, distinguishing short-term gains from long-term gains to incentivize longer investments. Unlike the Tobin tax, which targets currency transactions to reduce volatility, Capital Gains Tax directly impacts investor behavior by influencing the timing and nature of asset disposals.

Mechanism of Tobin Tax

The Tobin tax operates as a small levy on currency conversions aimed at reducing excessive volatility in foreign exchange markets by discouraging short-term speculative trading. Unlike Capital Gains Tax, which applies to the profit realized from the sale of assets, the Tobin tax specifically targets cross-border currency transactions at a fixed rate, typically a fraction of a percent. This mechanism stabilizes exchange rates by imposing transaction costs that disincentivize rapid currency swings and encourage longer-term investments.

Economic Impact: Capital Gains Tax vs Tobin Tax

Capital Gains Tax affects economic behavior by discouraging short-term investments and encouraging long-term asset holding, which can stabilize markets but potentially reduce liquidity. Tobin Tax aims to curb speculative currency trading and reduce exchange rate volatility, potentially decreasing market efficiency but generating government revenue. Both taxes impact capital flows differently, with Capital Gains Tax influencing investment strategies and Tobin Tax targeting currency market speculation.

Effects on Investors and Financial Markets

Capital Gains Tax impacts investors by reducing after-tax returns on asset sales, which can discourage short-term trading and influence portfolio allocation toward long-term investments. Tobin tax, a small levy on currency transactions, aims to reduce excessive market volatility and speculative trading, potentially increasing market stability but lowering liquidity and trading volumes. Both taxes alter investor behavior and market dynamics, with Capital Gains Tax affecting asset holding periods and Tobin tax targeting currency market speculation.

Global Implementation and Case Studies

Capital Gains Tax (CGT) is widely implemented across over 60 countries, including the United States, Canada, and the United Kingdom, targeting profits from asset sales to generate government revenue. The Tobin Tax, proposed by economist James Tobin, is a smaller levy on currency transactions aimed at reducing market volatility and speculation, with pilot implementations in countries like Sweden and attempts within the European Union. Case studies reveal CGT's effectiveness in balancing income redistribution and investment incentives, while Tobin Tax experiments faced challenges like market migration and enforcement, limiting widespread adoption despite its intended stabilizing goals.

Policy Debate: Pros, Cons, and Future Outlook

Capital Gains Tax generates government revenue by taxing profits from asset sales, encouraging long-term investment but potentially discouraging rapid capital turnover. Tobin tax targets currency transactions to reduce speculative trading, enhancing market stability but risking decreased liquidity and increased transaction costs. Policymakers debate balancing economic growth with financial market regulation, while future outlooks consider technological advances and global coordination for effective implementation.

Capital Gains Tax Infographic

libterm.com

libterm.com