The Real Business Cycle (RBC) model explains economic fluctuations through real shocks, such as technological innovations or changes in productivity, rather than monetary or demand-side factors. It emphasizes how individual decisions on labor supply and investment respond to these shocks, shaping overall economic cycles. Explore the article to understand how the RBC model offers insights into the dynamics of business cycles and their impact on Your economic environment.

Table of Comparison

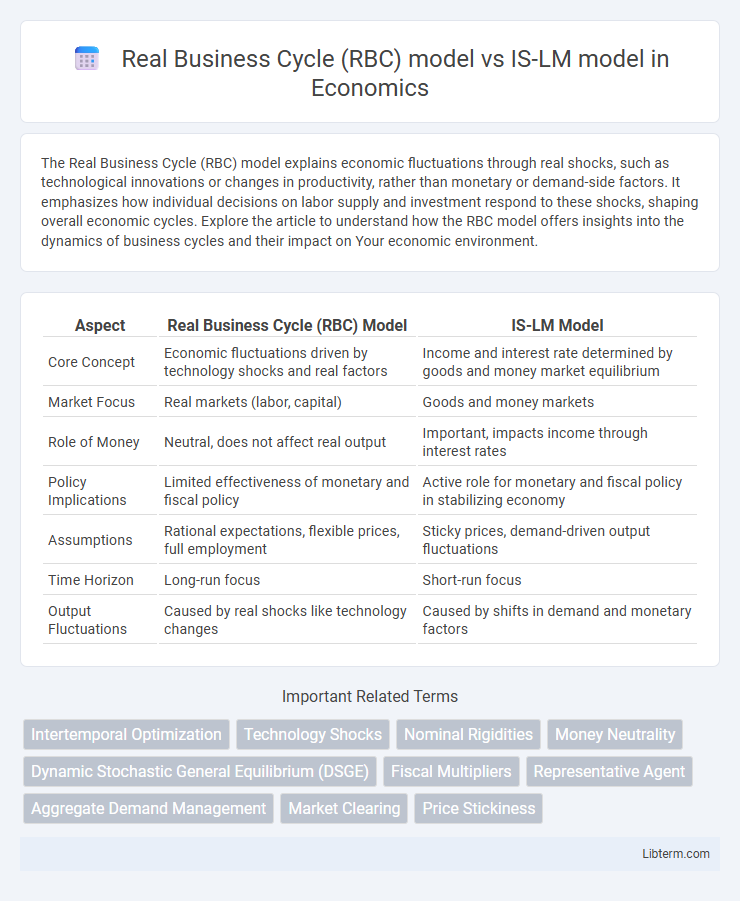

| Aspect | Real Business Cycle (RBC) Model | IS-LM Model |

|---|---|---|

| Core Concept | Economic fluctuations driven by technology shocks and real factors | Income and interest rate determined by goods and money market equilibrium |

| Market Focus | Real markets (labor, capital) | Goods and money markets |

| Role of Money | Neutral, does not affect real output | Important, impacts income through interest rates |

| Policy Implications | Limited effectiveness of monetary and fiscal policy | Active role for monetary and fiscal policy in stabilizing economy |

| Assumptions | Rational expectations, flexible prices, full employment | Sticky prices, demand-driven output fluctuations |

| Time Horizon | Long-run focus | Short-run focus |

| Output Fluctuations | Caused by real shocks like technology changes | Caused by shifts in demand and monetary factors |

Introduction to Real Business Cycle (RBC) Model

The Real Business Cycle (RBC) model explains macroeconomic fluctuations through technology shocks affecting productivity, emphasizing real rather than monetary factors. Unlike the IS-LM model, which centers on interest rates and money markets to analyze short-term economic equilibrium, the RBC model uses microeconomic foundations to highlight the role of labor supply decisions and intertemporal optimization. It accounts for business cycles as efficient responses to real shocks rather than market imperfections or monetary disturbances.

Core Assumptions of the RBC Model

The Real Business Cycle (RBC) model assumes that economic fluctuations result primarily from real shocks, such as changes in technology or productivity, rather than monetary factors emphasized in the IS-LM model. Core assumptions include rational expectations, perfectly competitive markets, and flexible prices and wages that quickly adjust to clear markets. Unlike the IS-LM framework, which highlights demand-side monetary and fiscal policies, the RBC model focuses on supply-side factors driving business cycles through intertemporal optimization by households and firms.

Overview of the IS-LM Model

The IS-LM model represents the interaction between the goods market (Investment-Savings) and the money market (Liquidity preference-Money supply), capturing the equilibrium levels of interest rates and output in the short run. It illustrates how fiscal policy, through shifts in the IS curve, and monetary policy, through shifts in the LM curve, influence economic activity and interest rates. This model is foundational in Keynesian economics, emphasizing demand-side factors and price rigidities, in contrast to the Real Business Cycle (RBC) model's supply-side focus and emphasis on real shocks and market clearing.

Key Assumptions of the IS-LM Model

The IS-LM model assumes fixed prices and wages in the short run, allowing for analysis of equilibrium in goods and money markets through the intersection of the Investment-Saving (IS) and Liquidity Preference-Money Supply (LM) curves. It posits that output and interest rates adjust to equate savings and investment, as well as money demand and supply, under given nominal prices. This contrasts with the Real Business Cycle (RBC) model, which assumes flexible prices and wages, emphasizing technology shocks as primary drivers of economic fluctuations.

Treatment of Shocks: RBC vs IS-LM

The Real Business Cycle (RBC) model treats economic fluctuations as results of real shocks, such as changes in technology or productivity, emphasizing supply-side factors and intertemporal optimization by agents. In contrast, the IS-LM model centers on demand shocks, especially variations in fiscal policy, money supply, and interest rates, highlighting how monetary and fiscal interventions affect output and interest rate equilibrium. While RBC attributes business cycles to optimal responses to real disturbances, IS-LM explains fluctuations through shifts in aggregate demand and liquidity preferences.

Role of Monetary and Fiscal Policy

The Real Business Cycle (RBC) model emphasizes technology shocks as primary drivers of economic fluctuations, treating monetary and fiscal policies as largely ineffective in influencing real output or employment. Conversely, the IS-LM model highlights the significant role of monetary policy through interest rate adjustments and fiscal policy via government spending in stabilizing aggregate demand and managing economic cycles. Empirical evidence suggests that while the IS-LM framework better captures short-term demand-side policy effects, the RBC model offers insights into supply-side factors and long-term economic growth dynamics.

Labor Market Dynamics in Both Models

The Real Business Cycle (RBC) model emphasizes labor market dynamics driven by technology shocks affecting labor supply incentives, resulting in fluctuations in hours worked without relying on nominal rigidities. In contrast, the IS-LM model incorporates labor market adjustments through wage and price rigidities, where unemployment arises from demand shocks and monetary policy influences labor demand. RBC models highlight voluntary labor supply responses to productivity changes, while IS-LM frameworks focus on involuntary unemployment caused by insufficient aggregate demand.

Empirical Performance and Critiques

The Real Business Cycle (RBC) model emphasizes technology shocks as primary drivers of economic fluctuations, showing strong empirical support in explaining output volatility without relying on monetary factors, contrasting with the IS-LM model, which integrates interest rate effects on investment and liquidity preference but faces challenges capturing real economic dynamics over business cycles. Empirical critiques of the RBC model highlight its limited ability to account for observed price stickiness and monetary policy impacts, while the IS-LM framework is criticized for oversimplifying dynamic adjustments and failing to capture supply-side shocks effectively. Comparative studies suggest that neither model fully explains business cycle complexities, encouraging hybrid approaches that incorporate elements of real shocks and monetary influences for improved empirical alignment.

Policy Implications: RBC Versus IS-LM

The Real Business Cycle (RBC) model emphasizes that economic fluctuations result primarily from real shocks, such as technology changes, implying limited effectiveness of fiscal and monetary policies. In contrast, the IS-LM model suggests that active government intervention through fiscal policy and central bank actions can stabilize output and employment during demand shocks. Policymakers relying on the RBC framework often advocate for minimal interference, while IS-LM proponents support targeted policies to manage economic cycles.

Conclusion: Comparing RBC and IS-LM Models

The Real Business Cycle (RBC) model emphasizes technology shocks and rational expectations as primary drivers of economic fluctuations, contrasting with the IS-LM model's focus on monetary and fiscal policy impacts within short-term equilibrium frameworks. Empirical evidence supports RBC's explanation of output variability through productivity changes, while IS-LM provides intuitive insights into interest rate and income dynamics in response to policy shifts. Policymakers favor the IS-LM model for its practical applicability to demand management, whereas RBC offers a structural interpretation grounded in microeconomic foundations and long-term growth factors.

Real Business Cycle (RBC) model Infographic

libterm.com

libterm.com