The absolute income hypothesis suggests that an individual's consumption level is primarily determined by their current income, implying a direct relationship between income and spending. This theory helps explain consumer behavior and economic fluctuations by focusing on income changes rather than other factors like wealth or expectations. Explore the rest of the article to understand how this hypothesis impacts economic models and personal financial decisions.

Table of Comparison

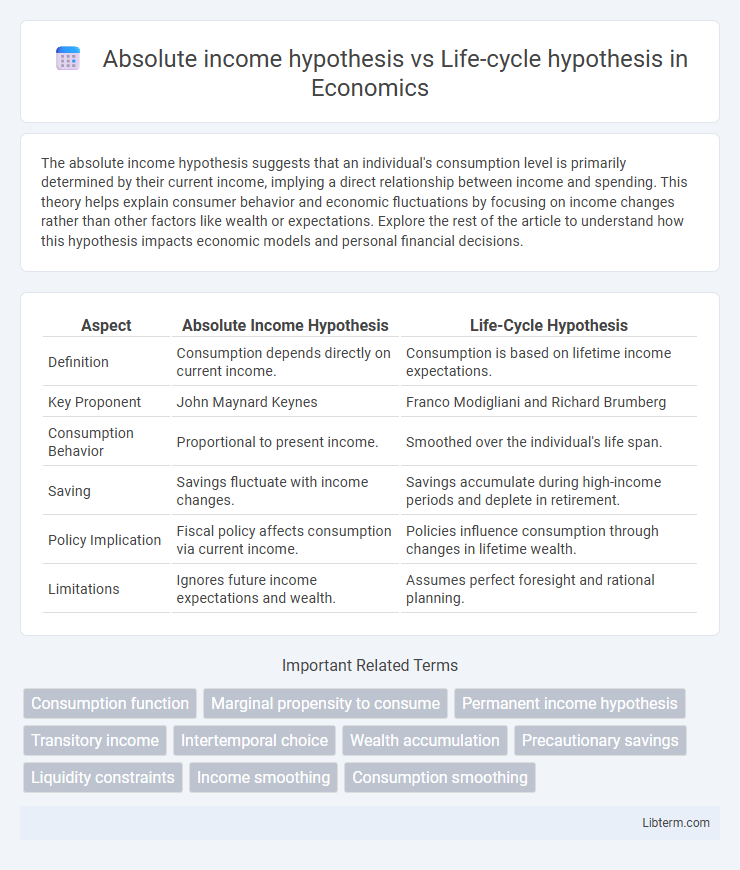

| Aspect | Absolute Income Hypothesis | Life-Cycle Hypothesis |

|---|---|---|

| Definition | Consumption depends directly on current income. | Consumption is based on lifetime income expectations. |

| Key Proponent | John Maynard Keynes | Franco Modigliani and Richard Brumberg |

| Consumption Behavior | Proportional to present income. | Smoothed over the individual's life span. |

| Saving | Savings fluctuate with income changes. | Savings accumulate during high-income periods and deplete in retirement. |

| Policy Implication | Fiscal policy affects consumption via current income. | Policies influence consumption through changes in lifetime wealth. |

| Limitations | Ignores future income expectations and wealth. | Assumes perfect foresight and rational planning. |

Introduction to Consumption Theories

The Absolute Income Hypothesis, proposed by Keynes, asserts that consumption primarily depends on current income levels, with consumers spending a fixed proportion of their income. In contrast, the Life-Cycle Hypothesis, developed by Modigliani and Brumberg, explains consumption patterns as a function of expected lifetime income, emphasizing intertemporal smoothing of consumption through savings and borrowing. These foundational consumption theories provide critical frameworks for understanding consumer spending behavior in macroeconomics.

Defining the Absolute Income Hypothesis

The Absolute Income Hypothesis, developed by economist John Maynard Keynes, posits that consumer spending is primarily determined by current absolute income rather than anticipated future income. This theory suggests that as income increases, consumption rises but at a decreasing rate, reflecting a stable marginal propensity to consume out of present income. In contrast to the Life-Cycle Hypothesis, which incorporates income expectations and savings for future consumption, the Absolute Income Hypothesis emphasizes immediate income as the key driver of consumption patterns.

Understanding the Life-Cycle Hypothesis

The Life-Cycle Hypothesis explains consumption patterns based on individuals' expected lifetime income, suggesting people save during their working years and dissave during retirement to smooth consumption. This theory contrasts with the Absolute Income Hypothesis, which posits consumption depends solely on current income levels. Empirical evidence highlights the Life-Cycle Hypothesis's ability to account for savings behavior and intertemporal consumption decisions across different age groups.

Historical Context and Development

The Absolute Income Hypothesis, developed by John Maynard Keynes in the 1930s, posits that consumption depends directly on current income, reflecting the economic conditions of the Great Depression. The Life-Cycle Hypothesis, introduced by Franco Modigliani and Richard Brumberg in the 1950s, emerged as a response to limitations in Keynesian theory, emphasizing consumption smoothing based on expected lifetime income rather than current income alone. These theories marked a shift from static to dynamic understanding of consumer behavior, influencing modern macroeconomic models and policy design.

Core Assumptions and Mechanisms

The Absolute Income Hypothesis assumes consumption depends directly on current income, implying a stable marginal propensity to consume out of income at any time. The Life-Cycle Hypothesis posits that individuals plan their consumption and savings based on expected lifetime income, smoothing consumption to maintain stability regardless of short-term income fluctuations. Core mechanisms differ as the Absolute Income model emphasizes immediate income changes impacting consumption, while the Life-Cycle model incorporates future income expectations and age-related consumption patterns into decision making.

Mathematical Models Compared

The Absolute Income Hypothesis, formulated by Keynes, models consumption (C) as a linear function of current income (Y), expressed as C = a + bY, where 'a' is autonomous consumption and 'b' is the marginal propensity to consume. The Life-Cycle Hypothesis, introduced by Modigliani, represents consumption as the present value of lifetime resources, mathematically defined as C = (W + RY) / T, where W is wealth, R is real interest rate, Y is permanent income, and T is the time horizon. The key mathematical distinction lies in the Absolute Income model's focus on current income fluctuations, while the Life-Cycle model integrates intertemporal budget constraints to smooth consumption over a lifetime.

Empirical Evidence and Real-world Applications

Empirical evidence supports the Absolute Income Hypothesis by showing that consumer spending rises with current income levels, as observed in short-term economic fluctuations and cross-sectional data. The Life-Cycle Hypothesis finds validation in long-term consumption patterns, where individuals borrow and save to smooth consumption over their lifetime, evidenced by retirement savings behavior and responses to income shocks. Real-world applications include fiscal policy design, where understanding these models helps predict consumer responses to tax changes and social security reforms, guiding effective stimulus measures and retirement planning policies.

Strengths and Weaknesses of Each Hypothesis

The Absolute Income Hypothesis emphasizes the direct relationship between current income and consumption, providing a straightforward model for predicting spending patterns but often oversimplifying by ignoring future income expectations and savings behavior. The Life-Cycle Hypothesis accounts for income variability over a lifetime, offering a more comprehensive understanding of consumption and saving decisions across different age groups, yet it requires detailed data on individuals' future earnings and can be complex to apply empirically. Each hypothesis contributes valuable insights to economic modeling, with the Absolute Income Hypothesis excelling in short-term analysis and the Life-Cycle Hypothesis providing depth in long-term financial planning.

Policy Implications and Economic Impact

The Absolute Income Hypothesis suggests consumption decisions depend on current income, leading policymakers to focus on short-term income stabilization measures, which can quickly influence aggregate demand. In contrast, the Life-Cycle Hypothesis emphasizes consumption smoothing over a lifetime, prompting policies that support savings, pensions, and social security to sustain long-term economic growth. Understanding these differences guides fiscal and monetary strategies, impacting consumption patterns, capital accumulation, and overall economic stability.

Conclusion: Which Hypothesis Prevails?

Empirical evidence generally supports the Life-Cycle Hypothesis over the Absolute Income Hypothesis, as it better explains consumption patterns by accounting for income variations across different life stages. The Life-Cycle Hypothesis highlights how individuals smooth consumption by saving during high-income periods and dissaving during retirement, aligning with observed behavior. In contrast, the Absolute Income Hypothesis, which links consumption directly to current income, fails to capture long-term saving and spending dynamics.

Absolute income hypothesis Infographic

libterm.com

libterm.com