The Static Trade-Off Theory explains how companies balance the benefits of debt, such as tax shields, against the costs of financial distress and bankruptcy risk. Optimal capital structure is achieved when the marginal benefit of debt equals its marginal cost, guiding firms in leveraging decisions to maximize value. Explore the rest of the article to understand how this theory impacts your financial strategy and corporate financing choices.

Table of Comparison

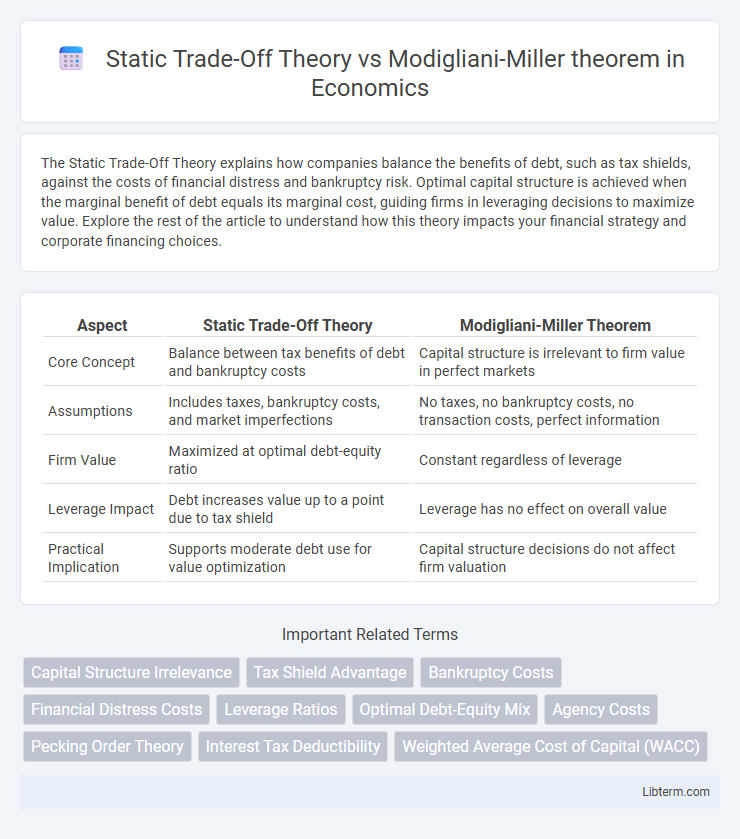

| Aspect | Static Trade-Off Theory | Modigliani-Miller Theorem |

|---|---|---|

| Core Concept | Balance between tax benefits of debt and bankruptcy costs | Capital structure is irrelevant to firm value in perfect markets |

| Assumptions | Includes taxes, bankruptcy costs, and market imperfections | No taxes, no bankruptcy costs, no transaction costs, perfect information |

| Firm Value | Maximized at optimal debt-equity ratio | Constant regardless of leverage |

| Leverage Impact | Debt increases value up to a point due to tax shield | Leverage has no effect on overall value |

| Practical Implication | Supports moderate debt use for value optimization | Capital structure decisions do not affect firm valuation |

Introduction to Capital Structure Theories

The Static Trade-Off Theory balances the benefits of tax shields from debt against bankruptcy costs to determine an optimal capital structure, emphasizing a firm's target debt ratio. The Modigliani-Miller theorem, under conditions of perfect capital markets and no taxes, asserts that capital structure is irrelevant to firm value, focusing on the irrelevance principle in financing decisions. These foundational theories provide contrasting perspectives on how firms choose their mix of debt and equity financing.

Overview of Static Trade-Off Theory

Static Trade-Off Theory explains that firms balance the tax benefits of debt financing against the costs of financial distress to determine optimal capital structure. It suggests firms target a leverage ratio where the marginal tax shield benefit equals the marginal expected bankruptcy costs. This framework contrasts with the Modigliani-Miller theorem, which assumes perfect markets and no taxes, concluding capital structure is irrelevant to firm value.

Key Concepts of Modigliani-Miller Theorem

The Modigliani-Miller theorem establishes that, under perfect market conditions without taxes, bankruptcy costs, or asymmetric information, a firm's value remains unaffected by its capital structure. It emphasizes capital structure irrelevance, asserting that the mix of debt and equity does not influence the overall cost of capital or firm value. This foundational concept contrasts with the Static Trade-Off Theory, which incorporates taxes and bankruptcy costs to suggest an optimal capital structure balancing the benefits and costs of debt.

Underlying Assumptions: Trade-Off vs MM Theorem

The Static Trade-Off Theory assumes the presence of corporate taxes and bankruptcy costs, suggesting firms balance tax benefits of debt against the costs of financial distress to determine optimal leverage. In contrast, the Modigliani-Miller theorem operates under idealized conditions, including no taxes, no bankruptcy costs, and efficient markets, implying capital structure is irrelevant to firm value. These differing assumptions lead to fundamentally distinct conclusions about the impact of capital structure on firm valuation and leverage decisions.

Debt-Equity Optimization in Static Trade-Off Theory

The Static Trade-Off Theory emphasizes balancing the tax advantages of debt with bankruptcy costs to optimize a firm's capital structure, promoting a specific debt-equity ratio that maximizes firm value. In contrast, the Modigliani-Miller theorem asserts capital structure irrelevance under perfect market conditions, implying no optimal debt-equity mix exists. Debt-equity optimization in the Static Trade-Off Theory incorporates tax shields and financial distress costs to identify an optimal leverage level that minimizes the weighted average cost of capital (WACC).

Irrelevance of Capital Structure: Modigliani-Miller Perspective

The Modigliani-Miller theorem asserts that under perfect market conditions, capital structure is irrelevant to a firm's value, emphasizing that neither debt nor equity financing affects total firm value. This irrelevance principle contrasts with the Static Trade-Off Theory, which considers bankruptcy costs and tax shields, suggesting an optimal debt level exists. Modigliani and Miller's insight relies on assumptions like no taxes, no transaction costs, and symmetric information, forming a foundational benchmark in corporate finance.

Real-World Implications and Limitations

Static Trade-Off Theory highlights the balance firms seek between tax benefits of debt and bankruptcy costs, emphasizing practical capital structure decisions in real-world markets. In contrast, the Modigliani-Miller theorem assumes perfect markets with no taxes or bankruptcy costs, providing a foundational but idealized framework that limits its direct application. Real-world implications reflect that firms face market imperfections, making the Static Trade-Off Theory more relevant for predicting leverage behavior despite its simplifications.

Impact of Taxes, Bankruptcy Costs, and Agency Problems

The Static Trade-Off Theory emphasizes balancing the tax benefits of debt, such as interest tax shields, against bankruptcy costs and agency problems, suggesting optimal leverage exists to maximize firm value. In contrast, the Modigliani-Miller theorem, under the assumption of no taxes and bankruptcy costs, asserts capital structure irrelevance, indicating taxes and financial distress are key real-world deviations influencing leverage decisions. Agency problems arise from conflicts between shareholders and debt holders, impacting firm value by increasing monitoring costs and influencing the trade-off between debt tax shields and potential financial distress.

Empirical Evidence and Academic Critiques

Empirical evidence shows mixed support for the Static Trade-Off Theory, with studies indicating firms balance tax benefits of debt against bankruptcy costs, while Modigliani-Miller theorem's proposition of capital structure irrelevance often fails under real-world conditions like taxes and asymmetric information. Academic critiques highlight the simplicity of Modigliani-Miller assumptions, emphasizing their limited applicability outside perfect markets, whereas the Static Trade-Off Theory faces challenges explaining persistent deviations from target leverage ratios. Both frameworks remain foundational, yet ongoing research integrates behavioral factors and market imperfections to better capture observed capital structure dynamics.

Conclusion: Choosing Between Trade-Off Theory and MM Theorem

The Static Trade-Off Theory balances the benefits of debt tax shields against bankruptcy costs to determine optimal capital structure, while the Modigliani-Miller theorem posits capital structure irrelevance under perfect markets without taxes or bankruptcy costs. Firms operating in real-world conditions often find the Trade-Off Theory more applicable due to market imperfections, tax considerations, and financial distress risks. Choosing between these frameworks depends on the firm's specific context, with the Trade-Off Theory providing practical guidance for leverage decisions and the MM theorem serving as a foundational benchmark in capital structure analysis.

Static Trade-Off Theory Infographic

libterm.com

libterm.com