The replacement cost method calculates the value of an asset based on the expense to replace it with a similar item at current market prices, factoring in depreciation and obsolescence. This approach is commonly used in insurance claims, property appraisals, and accounting to determine fair value. Explore the full article to understand how the replacement cost method impacts your asset valuation and decision-making.

Table of Comparison

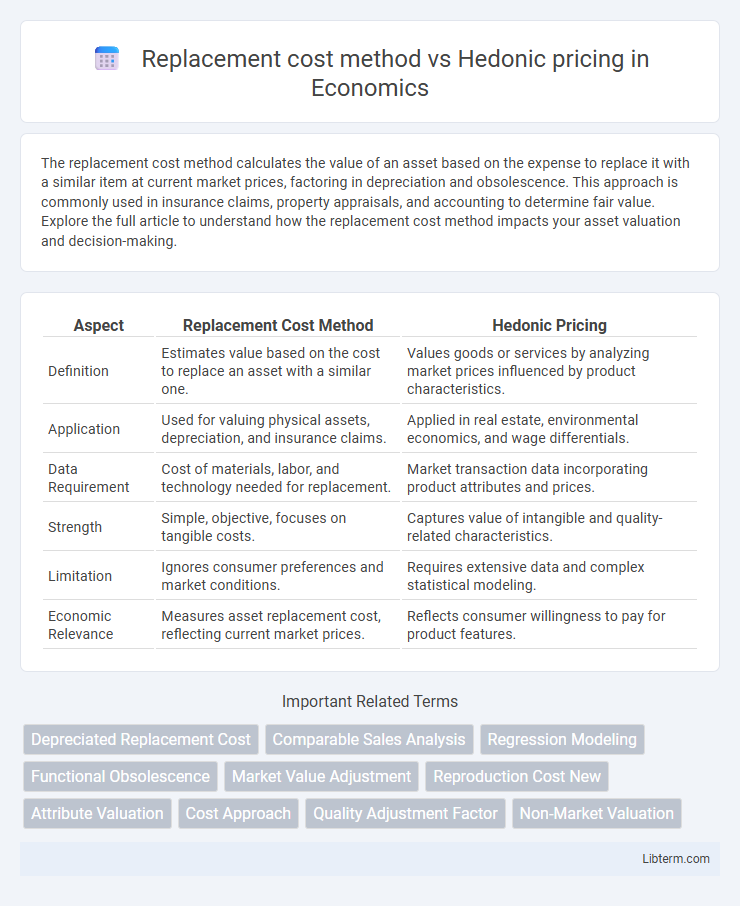

| Aspect | Replacement Cost Method | Hedonic Pricing |

|---|---|---|

| Definition | Estimates value based on the cost to replace an asset with a similar one. | Values goods or services by analyzing market prices influenced by product characteristics. |

| Application | Used for valuing physical assets, depreciation, and insurance claims. | Applied in real estate, environmental economics, and wage differentials. |

| Data Requirement | Cost of materials, labor, and technology needed for replacement. | Market transaction data incorporating product attributes and prices. |

| Strength | Simple, objective, focuses on tangible costs. | Captures value of intangible and quality-related characteristics. |

| Limitation | Ignores consumer preferences and market conditions. | Requires extensive data and complex statistical modeling. |

| Economic Relevance | Measures asset replacement cost, reflecting current market prices. | Reflects consumer willingness to pay for product features. |

Introduction to Property Valuation Methods

Replacement cost method estimates property value by calculating the expense to rebuild the structure using current construction costs, factoring in depreciation. Hedonic pricing determines property value based on the characteristics and features influencing market prices, such as location, size, and amenities. Both methods provide essential insights in property valuation, with replacement cost addressing physical attributes and hedonic pricing capturing market-driven preferences.

Understanding the Replacement Cost Method

The Replacement Cost Method estimates property value by calculating the cost to rebuild or replace the structure with similar materials and specifications, adjusting for depreciation. This approach emphasizes tangible construction expenses and physical deterioration rather than market conditions or buyer preferences. Unlike Hedonic Pricing, which derives value from market data and property attributes, the Replacement Cost Method focuses on the intrinsic cost of replication and is often used in insurance valuations and property tax assessments.

Exploring the Hedonic Pricing Method

The Hedonic Pricing Method analyzes property values by breaking down the impact of individual characteristics such as location, size, and amenities on market prices, providing detailed insights into consumer preferences. This approach contrasts with the Replacement Cost Method, which estimates value based on the cost to rebuild or replace a property, excluding market-driven attributes. Hedonic pricing is particularly effective in capturing value variations linked to environmental factors, neighborhood quality, and structural features, making it a nuanced tool for real estate valuation and policy analysis.

Key Differences Between Replacement Cost and Hedonic Pricing

Replacement cost method estimates property value based on the expense to replace or reproduce an asset with similar utility, emphasizing physical costs such as materials and labor. Hedonic pricing evaluates property value by analyzing how various attributes, including location, size, and amenities, contribute to market prices through statistical models. The key difference lies in replacement cost focusing on reconstruction expenses, while hedonic pricing derives value from the market's valuation of individual property characteristics.

Advantages of the Replacement Cost Method

The Replacement Cost Method offers precise valuation by estimating the cost to replace an asset with a new one of similar utility, ensuring accuracy in assessing physical depreciation and obsolescence. It is especially advantageous for unique or specialized properties where market comparables are limited or unavailable, providing a clear, objective basis for appraisal. This method facilitates insurance underwriting and financial reporting by delivering straightforward calculations grounded in current construction costs and material prices.

Benefits of the Hedonic Pricing Method

The Hedonic Pricing Method offers a precise assessment of property values by analyzing individual attributes such as location, size, and amenities, capturing market preferences that the Replacement Cost Method overlooks. It provides dynamic market-driven insights essential for accurate valuation and policy-making, reflecting real-time consumer behavior and environmental factors. This method enhances decision-making in urban planning and environmental economics by quantifying the economic impact of non-market goods and services.

Limitations of Both Valuation Approaches

The Replacement Cost Method often faces limitations due to its reliance on estimating current construction costs, which may not reflect market demand or property desirability, leading to potential overvaluation. Hedonic Pricing, while useful for capturing market preferences by analyzing property attributes, struggles with data requirements and may omit intangible factors such as neighborhood reputation or future developments. Both methods can produce biased valuations when market conditions are volatile or when unique property characteristics are difficult to quantify accurately.

Appropriate Use Cases for Each Method

The Replacement Cost Method is most appropriate for valuing properties or assets with tangible, easily measurable components, such as real estate or machinery, where the cost to reproduce or replace the item directly reflects its value. Hedonic Pricing is better suited for markets where value is derived from multiple interrelated attributes, like housing markets, where features such as location, size, and amenities impact prices. Use the Replacement Cost Method when assessing insurance claims or asset depreciation, and apply Hedonic Pricing for detailed market analysis and policy evaluation in sectors with heterogeneous goods.

Factors Influencing Method Selection

Factors influencing the selection between the Replacement Cost Method and Hedonic Pricing include the purpose of valuation, data availability, and complexity of the asset. Replacement Cost Method is preferred for tangible assets with clear reproduction costs, while Hedonic Pricing excels in capturing market preferences and attributes for assets influenced by multiple features. Market transparency, asset uniqueness, and the level of detail required in valuation also significantly impact the method choice.

Conclusion: Choosing the Right Valuation Method

Selecting the appropriate valuation method depends on the property type and purpose; the Replacement Cost Method excels for insurance valuations by estimating reconstruction expenses, while Hedonic Pricing is ideal for market value assessments based on attributes influencing buyer preferences. Understanding the context and available data ensures accurate property valuation, optimizing decision-making in real estate investments and insurance claims. Balancing these methods enhances precision by aligning with the specific valuation goals and market conditions.

Replacement cost method Infographic

libterm.com

libterm.com