Modern Portfolio Theory (MPT) revolutionizes investment strategies by emphasizing diversification to maximize returns for a given level of risk. It uses quantitative models to allocate assets efficiently, balancing risk and reward based on expected returns, variances, and covariances. Discover how understanding MPT can enhance your investment decisions by reading the rest of the article.

Table of Comparison

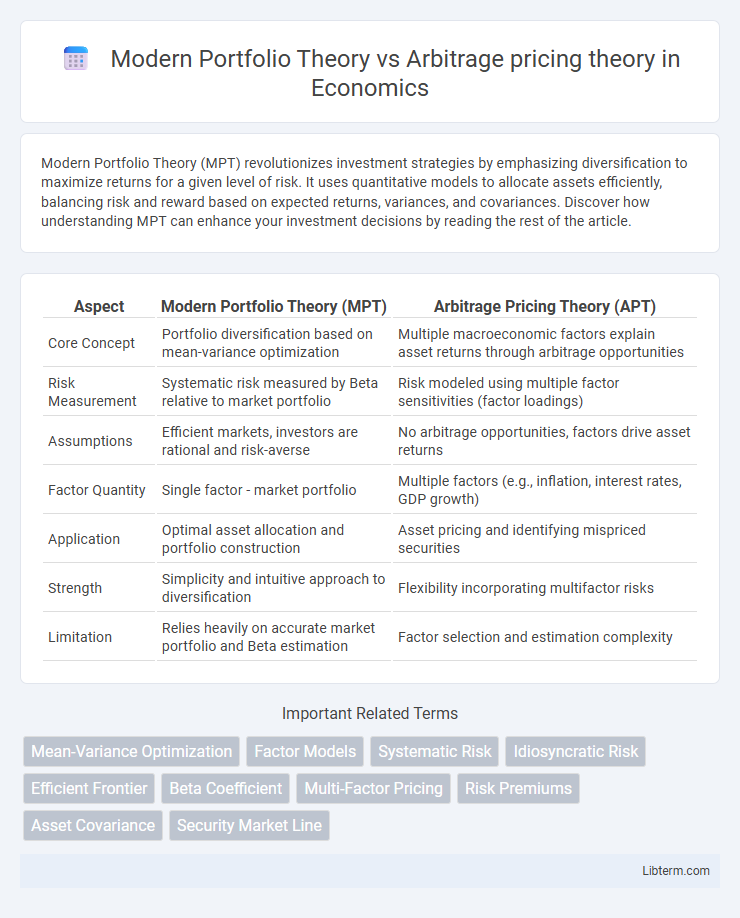

| Aspect | Modern Portfolio Theory (MPT) | Arbitrage Pricing Theory (APT) |

|---|---|---|

| Core Concept | Portfolio diversification based on mean-variance optimization | Multiple macroeconomic factors explain asset returns through arbitrage opportunities |

| Risk Measurement | Systematic risk measured by Beta relative to market portfolio | Risk modeled using multiple factor sensitivities (factor loadings) |

| Assumptions | Efficient markets, investors are rational and risk-averse | No arbitrage opportunities, factors drive asset returns |

| Factor Quantity | Single factor - market portfolio | Multiple factors (e.g., inflation, interest rates, GDP growth) |

| Application | Optimal asset allocation and portfolio construction | Asset pricing and identifying mispriced securities |

| Strength | Simplicity and intuitive approach to diversification | Flexibility incorporating multifactor risks |

| Limitation | Relies heavily on accurate market portfolio and Beta estimation | Factor selection and estimation complexity |

Introduction to Investment Theories

Modern Portfolio Theory (MPT) emphasizes optimizing portfolio diversification to maximize returns for a given level of risk by analyzing asset correlations and variances. Arbitrage Pricing Theory (APT) expands this by modeling asset returns through multiple macroeconomic factors, allowing for a multifactor approach to risk assessment and pricing. Both theories provide foundational frameworks in investment analysis, with MPT focusing on portfolio construction and APT on pricing securities using systematic factors.

Overview of Modern Portfolio Theory (MPT)

Modern Portfolio Theory (MPT), developed by Harry Markowitz in 1952, revolutionized investment strategy by introducing the concept of portfolio diversification to optimize returns while minimizing risk. MPT quantifies risk through the variance or standard deviation of portfolio returns and emphasizes the efficient frontier, representing the set of optimal portfolios offering the highest expected return for a given level of risk. This theory relies on the assumption that investors are rational and markets are efficient, guiding asset allocation to maximize portfolio efficiency based on expected returns, variances, and covariances among assets.

Core Principles of Arbitrage Pricing Theory (APT)

Arbitrage Pricing Theory (APT) posits that asset returns are influenced by multiple macroeconomic factors, unlike Modern Portfolio Theory (MPT) which relies on the singular market risk factor in the Capital Asset Pricing Model (CAPM). Core principles of APT include the assumption of no arbitrage opportunities, the linear relationship between expected returns and various risk factors, and the use of factor sensitivities to calculate asset prices. APT's multifactor approach provides a more flexible framework for asset pricing by accounting for systematic risks such as inflation, interest rates, and GDP growth.

Historical Development and Key Contributors

Modern Portfolio Theory (MPT), developed by Harry Markowitz in the 1950s, revolutionized investment strategy by introducing the concept of diversification to optimize portfolios based on risk and return. Arbitrage Pricing Theory (APT), formulated by Stephen Ross in the 1970s, expanded on asset pricing models by incorporating multiple macroeconomic factors influencing asset returns beyond the market portfolio. Both theories significantly shaped financial economics, with Markowitz's work laying the foundation for quantitative portfolio management and Ross's APT providing a multifactor approach to explain security prices.

Risk and Return: How MPT and APT Differ

Modern Portfolio Theory (MPT) assesses risk by focusing on portfolio variance and the efficient frontier, emphasizing diversification to optimize expected return for a given level of risk. Arbitrage Pricing Theory (APT) models risk through multiple systematic factors, allowing more nuanced identification of sources affecting asset returns beyond market risk. While MPT relies on a single-factor market model, APT provides a multifactor approach, enhancing the precision of return predictions and risk assessment.

Assumptions Underlying MPT and APT

Modern Portfolio Theory (MPT) assumes investors are rational and risk-averse, markets are efficient, and returns follow a normal distribution, relying primarily on mean-variance optimization to construct portfolios. Arbitrage Pricing Theory (APT) relaxes these assumptions by allowing multiple factors to explain asset returns, assuming markets are arbitrage-free and that asset returns are generated by linear combinations of various macroeconomic factors. Both theories provide frameworks for asset pricing, but MPT hinges on simplified risk-return trade-offs, while APT incorporates multifactor risk sensitivities without requiring market equilibrium.

Diversification Strategies in MPT vs. APT

Modern Portfolio Theory (MPT) emphasizes diversification by combining assets to maximize returns for a given risk level, based on the correlation between securities and mean-variance optimization. Arbitrage Pricing Theory (APT), however, diversifies exposure across multiple macroeconomic factors or risk sources rather than relying solely on asset correlations. While MPT focuses on eliminating unsystematic risk through portfolio composition, APT targets mispricings by exploiting factor sensitivities to achieve risk-adjusted returns.

Practical Applications in Portfolio Management

Modern Portfolio Theory (MPT) emphasizes diversification by optimizing asset allocation based on expected return and risk, using the efficient frontier to balance portfolio risk against return. Arbitrage Pricing Theory (APT) provides a multifactor approach, identifying various macroeconomic factors that influence asset prices, allowing portfolio managers to capture specific systematic risks not accounted for in MPT. In practical portfolio management, MPT guides broad strategic asset allocation, while APT enables fine-tuning through targeted exposure to economic factors, enhancing risk management and return predictability.

Limitations and Criticisms of Both Theories

Modern Portfolio Theory (MPT) faces criticism for its reliance on assumptions such as normally distributed returns, investor rationality, and static correlations, which often fail in real-world markets with volatile and asymmetric risks. Arbitrage Pricing Theory (APT), while more flexible in identifying multiple risk factors, struggles with specifying the correct number and nature of these factors, leading to potential model misspecification and estimation challenges. Both theories also assume frictionless markets, ignoring transaction costs and market inefficiencies that can significantly affect portfolio returns and risk assessments.

Conclusion: Choosing Between MPT and APT

Modern Portfolio Theory (MPT) emphasizes diversification by modeling asset returns through a single market factor, aiming to optimize risk-return trade-offs using mean-variance analysis. Arbitrage Pricing Theory (APT) incorporates multiple macroeconomic factors to explain asset returns, allowing for a more flexible and multifactor risk assessment. Selecting between MPT and APT depends on the complexity of the investment environment and data availability, with MPT suited for simpler, market-driven portfolios and APT preferred in multifactor scenarios offering deeper insights into various systematic risk drivers.

Modern Portfolio Theory Infographic

libterm.com

libterm.com