Inflation-adjusted return measures the real profitability of an investment after accounting for the erosion of purchasing power caused by inflation. This metric helps you understand how much your investment truly grows in terms of value rather than just nominal gains. Explore the rest of the article to learn how inflation-adjusted returns impact your financial strategy.

Table of Comparison

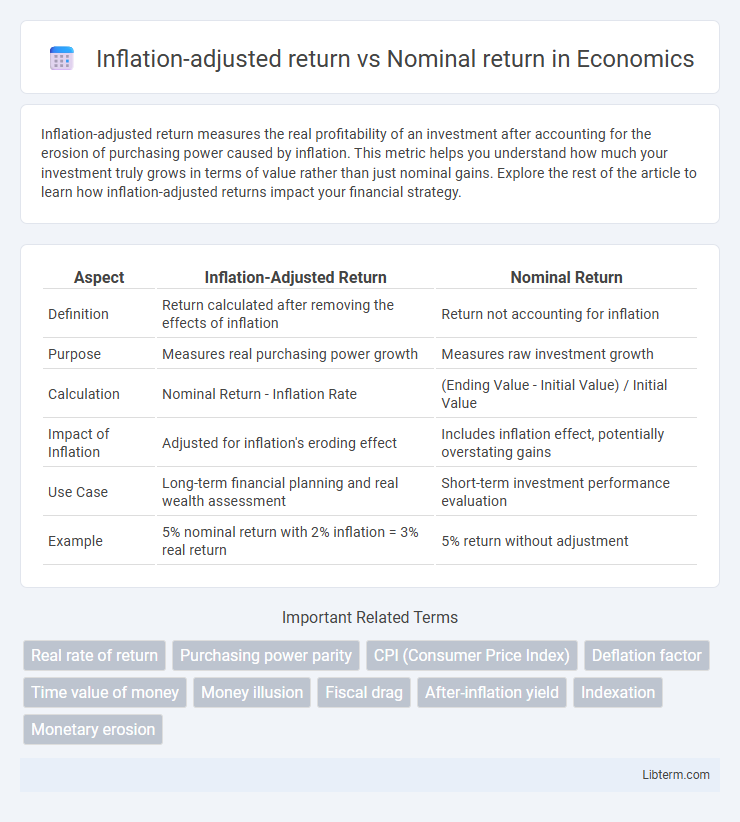

| Aspect | Inflation-Adjusted Return | Nominal Return |

|---|---|---|

| Definition | Return calculated after removing the effects of inflation | Return not accounting for inflation |

| Purpose | Measures real purchasing power growth | Measures raw investment growth |

| Calculation | Nominal Return - Inflation Rate | (Ending Value - Initial Value) / Initial Value |

| Impact of Inflation | Adjusted for inflation's eroding effect | Includes inflation effect, potentially overstating gains |

| Use Case | Long-term financial planning and real wealth assessment | Short-term investment performance evaluation |

| Example | 5% nominal return with 2% inflation = 3% real return | 5% return without adjustment |

Introduction to Investment Returns

Nominal return represents the percentage increase in an investment's value without accounting for inflation, reflecting the raw profit or loss over a period. Inflation-adjusted return, or real return, measures the actual purchasing power gained, subtracting the inflation rate from the nominal return to provide a more accurate assessment of investment performance. Understanding the difference between nominal and inflation-adjusted returns is essential for evaluating true investment growth and making informed financial decisions.

Defining Nominal Return

Nominal return represents the percentage increase in an investment's value without accounting for inflation, reflecting the raw earnings over a period. It includes interest, dividends, and capital gains, providing a straightforward measure of performance. Investors should distinguish nominal return from inflation-adjusted return to understand the true purchasing power of their gains.

Understanding Inflation-Adjusted Return

Inflation-adjusted return measures the real gain or loss on an investment by accounting for the eroding effect of inflation on purchasing power, offering a more accurate reflection of true investment performance. It is calculated by subtracting the inflation rate from the nominal return, which represents the raw percentage gain without considering inflation. Understanding inflation-adjusted returns is essential for investors to evaluate the real growth of their investments and make informed decisions that preserve or increase wealth over time.

Key Differences Between Nominal and Real Returns

Nominal return represents the percentage increase in an investment's value without accounting for inflation, while inflation-adjusted return (real return) reflects the actual purchasing power gained after subtracting inflation effects. The key difference lies in the real return providing a more accurate measure of investment growth by showing true earnings in constant dollars, unlike nominal return that can be misleading during periods of high inflation. Investors rely on real returns to assess whether their investments are genuinely increasing wealth or merely keeping pace with rising prices.

Why Inflation Matters for Investors

Inflation-adjusted return reflects the real purchasing power of an investment by accounting for changes in inflation, while nominal return shows the raw percentage gain without considering inflation's impact. Investors must focus on inflation because rising prices erode the true value of returns, affecting their ability to meet financial goals and maintain lifestyle standards over time. Ignoring inflation risks overestimating investment performance and compromising long-term wealth preservation.

Calculating Inflation-Adjusted Returns

Calculating inflation-adjusted returns involves subtracting the inflation rate from the nominal return to measure the real increase in purchasing power. The formula is: Real Return = [(1 + Nominal Return) / (1 + Inflation Rate)] - 1, which accounts for inflation's erosion on investment gains. This method provides a more accurate assessment of investment performance by reflecting true growth after inflation effects.

Real-World Examples: Nominal vs Real Returns

Inflation-adjusted return provides a more accurate measure of investment performance by accounting for the erosion of purchasing power, unlike nominal return which reflects raw percentage gains without adjustment. For example, if an investment yields a 7% nominal return while inflation is 3%, the real return is approximately 4%, illustrating how inflation diminishes actual earnings. Historical data from the U.S. stock market shows that nominal returns averaged around 10%, but after inflation adjustments, real returns typically hover near 7%, demonstrating the importance of considering inflation in financial planning.

Impact of Inflation on Long-Term Investments

Inflation-adjusted return accounts for the erosion of purchasing power by subtracting inflation from nominal return, providing a true measure of investment growth over time. Long-term investments that ignore inflation risk overstating gains, leading to inflated expectations of real wealth accumulation. Understanding this distinction is crucial for accurate portfolio performance evaluation and achieving sustainable financial goals.

Strategies to Protect Returns from Inflation

Inflation-adjusted return measures investment gains after accounting for inflation, preserving purchasing power, while nominal return reflects raw percentage gains without inflation considerations. Strategies to protect returns from inflation include investing in Treasury Inflation-Protected Securities (TIPS), real estate assets, and commodities like gold, which historically hedge against inflation. Diversifying portfolios with inflation-linked bonds and inflation-sensitive equities ensures returns maintain value despite rising price levels.

Conclusion: Choosing the Right Metric for Investment Performance

Choosing the right metric for investment performance depends on your financial goals and the economic context. Inflation-adjusted return offers a clearer picture of real purchasing power growth by accounting for inflation's impact, making it essential for long-term wealth preservation. Nominal return provides the raw percentage gain or loss, useful for understanding total earnings but insufficient alone to gauge true investment success.

Inflation-adjusted return Infographic

libterm.com

libterm.com