The Neo-Fisherian Phillips curve challenges traditional views by suggesting that higher nominal interest rates can lead to higher inflation in the long run. This theory contrasts with the conventional Phillips curve, which posits an inverse relationship between inflation and unemployment. Discover how this innovative approach reshapes economic policy and what it means for your understanding of inflation trends by reading the full article.

Table of Comparison

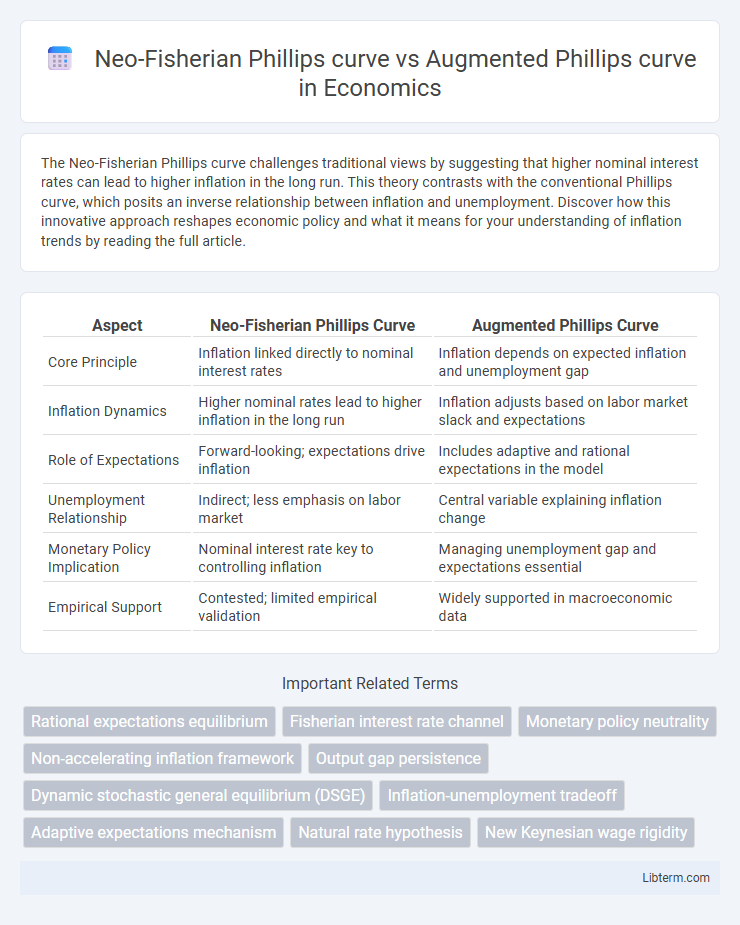

| Aspect | Neo-Fisherian Phillips Curve | Augmented Phillips Curve |

|---|---|---|

| Core Principle | Inflation linked directly to nominal interest rates | Inflation depends on expected inflation and unemployment gap |

| Inflation Dynamics | Higher nominal rates lead to higher inflation in the long run | Inflation adjusts based on labor market slack and expectations |

| Role of Expectations | Forward-looking; expectations drive inflation | Includes adaptive and rational expectations in the model |

| Unemployment Relationship | Indirect; less emphasis on labor market | Central variable explaining inflation change |

| Monetary Policy Implication | Nominal interest rate key to controlling inflation | Managing unemployment gap and expectations essential |

| Empirical Support | Contested; limited empirical validation | Widely supported in macroeconomic data |

Introduction to the Phillips Curve Concept

The Phillips curve concept illustrates the inverse relationship between inflation and unemployment rates, highlighting how lower unemployment can drive higher inflation. Neo-Fisherian Phillips curve theories challenge traditional views by emphasizing the role of nominal interest rates and inflation expectations in shaping inflation dynamics. The Augmented Phillips curve incorporates additional factors such as inflation expectations and supply shocks, refining the original model to better capture real-world economic fluctuations.

Historical Evolution of the Phillips Curve

The Neo-Fisherian Phillips curve challenges traditional Keynesian interpretations by emphasizing the role of nominal interest rates in influencing inflation expectations, diverging from the original Phillips curve that linked inflation inversely to unemployment. The Augmented Phillips curve incorporates adaptive inflation expectations by including lagged inflation terms, reflecting a more dynamic relationship observed during periods of stagflation in the 1970s. Historically, the Phillips curve evolved from a simple empirical correlation in the 1950s to complex models that integrate expectations, monetary policy, and rational behavior, capturing the shifting macroeconomic realities over time.

Foundations of the Neo-Fisherian Phillips Curve

The Neo-Fisherian Phillips curve derives from the Neo-Fisher hypothesis, linking long-run nominal interest rates directly with inflation through rational expectations and intertemporal budget constraints under price stickiness. It contrasts with the Augmented Phillips curve by emphasizing a long-run positive relationship between nominal rates and inflation, challenging the traditional view of a trade-off between inflation and unemployment. Key foundations include microfoundations from New Keynesian models, incorporating forward-looking agents and nominal rigidities to explain persistent inflation dynamics driven by monetary policy.

Core Principles of the Augmented Phillips Curve

The Augmented Phillips Curve integrates expectations of inflation, emphasizing the role of adaptive and rational expectations in wage and price setting, which contrasts with the Neo-Fisherian Phillips Curve that highlights a long-run proportional relationship between nominal interest rates and inflation. This model incorporates supply shocks and demand pressures, allowing inflation dynamics to adjust based on deviations from natural unemployment rates and expected inflation. Its core principle is that inflation depends on expected inflation and the unemployment gap, making it a more flexible framework for analyzing monetary policy impact on price stability.

Inflation Dynamics and Interest Rate Relationships

The Neo-Fisherian Phillips curve posits that higher nominal interest rates lead to higher inflation in the long run due to the Fisher effect, challenging traditional views on monetary policy's impact on inflation dynamics. In contrast, the Augmented Phillips curve incorporates expectations and supply shocks, emphasizing that inflation is driven by real economic slack and adaptive inflation expectations. Interest rate relationships differ, with the Neo-Fisherian approach suggesting a direct positive correlation between nominal rates and inflation, while the Augmented Phillips curve maintains a negative correlation modulated by inflation expectations and output gaps.

The Role of Expectations in Each Framework

The Neo-Fisherian Phillips curve emphasizes that expected inflation directly influences nominal interest rates, suggesting a strong link between central bank policy and long-term inflation expectations. In contrast, the Augmented Phillips curve incorporates adaptive and rational expectations, highlighting that both past inflation and unemployment gaps interact to shape future inflation dynamics. Expectations in the Augmented Phillips curve adjust as agents update their beliefs based on inflation inertia and real economic activity, making it more responsive to short-term economic fluctuations.

Empirical Evidence: Neo-Fisherian vs Augmented Models

Empirical evidence comparing the Neo-Fisherian Phillips curve and Augmented Phillips curve reveals contrasting inflation dynamics in response to monetary policy shocks. Studies indicate the Neo-Fisherian model predicts a positive relationship between nominal interest rates and inflation in the long run, challenging the conventional downward-sloping Augmented Phillips curve, which incorporates expectations and wage rigidity. Data from inflation episodes in the US and Eurozone highlight that inflation persistence aligns more closely with the Augmented Phillips curve, while some high-inflation environments provide partial support for Neo-Fisherian predictions.

Policy Implications and Monetary Policy Debates

The Neo-Fisherian Phillips curve suggests that higher nominal interest rates lead to higher inflation, challenging traditional views that low interest rates stimulate inflation, influencing monetary policy toward sustaining higher rates to achieve inflation targets. The Augmented Phillips curve incorporates expectations and supply shocks, supporting policy that balances inflation control with output stabilization, advocating flexible responses to macroeconomic conditions. These differing perspectives fuel debates on the effectiveness of interest rate adjustments, shaping central banks' strategies in targeting inflation and managing economic growth.

Criticisms and Limitations of Both Approaches

The Neo-Fisherian Phillips curve faces criticism for its counterintuitive implication that higher nominal interest rates lead to higher inflation, conflicting with empirical evidence showing inflation persistence aligns more closely with expectations and past inflation. The Augmented Phillips curve, while incorporating expectations and supply shocks, is limited by its assumption of stable inflation dynamics and struggles to account for periods of stagflation or deflation, reducing its predictive reliability. Both approaches often underestimate the role of global economic factors and structural changes, leading to challenges in capturing the complexity of modern inflation behavior and policy effects.

Future Directions in Phillips Curve Research

Future directions in Phillips curve research emphasize integrating Neo-Fisherian perspectives, which highlight the role of monetary policy in shaping inflation expectations, with the traditional Augmented Phillips curve that incorporates real economic variables and adaptive expectations. Researchers are increasingly exploring nonlinear dynamics and incorporating forward-looking behavioral models to better capture inflation persistence and the impact of credible policy commitments. Advances in macroeconomic modeling and high-frequency data analysis aim to refine the empirical validity of these frameworks, improving inflation forecasting and policy design.

Neo-Fisherian Phillips curve Infographic

libterm.com

libterm.com