Institutional economics examines the role of institutions--such as laws, regulations, and social norms--in shaping economic behavior and outcomes. It emphasizes how formal and informal rules influence market efficiency, transaction costs, and economic development. Explore the rest of this article to understand how institutional frameworks impact your economic decisions and the broader economy.

Table of Comparison

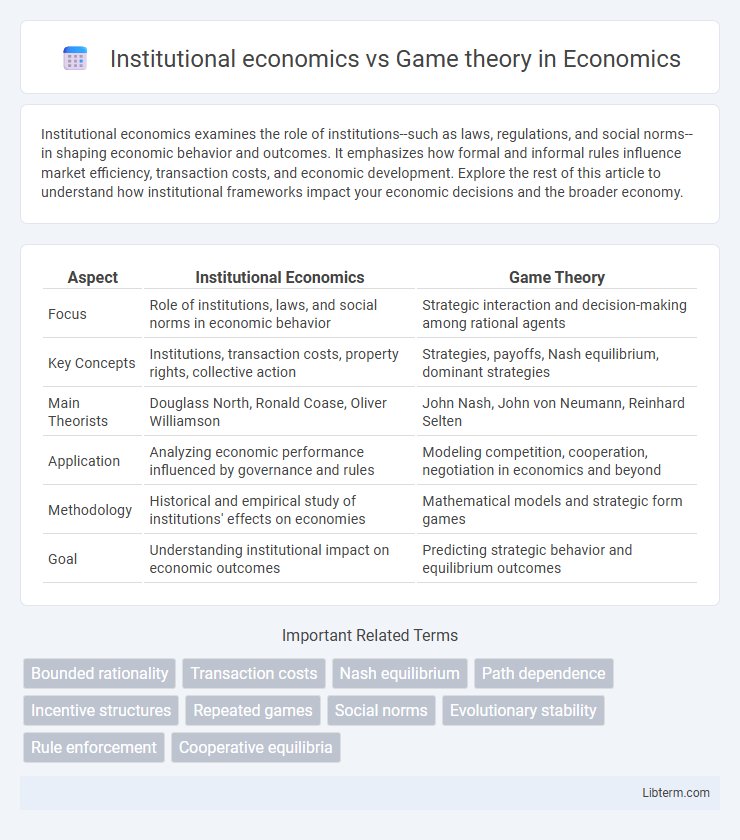

| Aspect | Institutional Economics | Game Theory |

|---|---|---|

| Focus | Role of institutions, laws, and social norms in economic behavior | Strategic interaction and decision-making among rational agents |

| Key Concepts | Institutions, transaction costs, property rights, collective action | Strategies, payoffs, Nash equilibrium, dominant strategies |

| Main Theorists | Douglass North, Ronald Coase, Oliver Williamson | John Nash, John von Neumann, Reinhard Selten |

| Application | Analyzing economic performance influenced by governance and rules | Modeling competition, cooperation, negotiation in economics and beyond |

| Methodology | Historical and empirical study of institutions' effects on economies | Mathematical models and strategic form games |

| Goal | Understanding institutional impact on economic outcomes | Predicting strategic behavior and equilibrium outcomes |

Introduction to Institutional Economics and Game Theory

Institutional economics examines how institutions--formal rules, informal norms, and organizational structures--shape economic behavior and outcomes, emphasizing the role of transaction costs and property rights in market efficiency. Game theory analyzes strategic interactions among rational agents, using mathematical models to predict decision-making outcomes in competitive and cooperative environments. Both fields contribute to understanding economic behavior: institutional economics focuses on the broader social and legal frameworks influencing markets, while game theory provides tools to model individual strategic choices within those frameworks.

Historical Development and Key Figures

Institutional economics emerged in the early 20th century with key figures such as Thorstein Veblen, John R. Commons, and Wesley Mitchell emphasizing the role of social institutions and legal frameworks in shaping economic behavior. Game theory, formalized by John von Neumann and Oskar Morgenstern in the mid-20th century, developed through mathematical modeling of strategic interactions among rational decision-makers. Both fields have distinct historical roots, with institutional economics grounded in socio-economic evolution and game theory rooted in mathematical rigor and strategic analysis.

Foundational Concepts: Institutions and Strategic Interaction

Institutional economics centers on the role of institutions--formal rules, informal norms, and enforcement mechanisms--in shaping economic behavior and outcomes. Game theory analyzes strategic interaction where decision-makers anticipate and respond to others' choices, modeling behavior through games, payoffs, and equilibrium concepts. Both frameworks highlight the importance of structured environments: institutional economics emphasizes institutional constraints influencing incentives, while game theory focuses on the predictive analysis of strategic decision-making within those constraints.

Analytical Approaches: Rules vs. Rationality

Institutional economics emphasizes the role of formal and informal rules, norms, and conventions that shape economic behavior and outcomes, focusing on how these institutions evolve and constrain decision-making. In contrast, game theory centers on rationality, modeling strategic interactions among individuals who anticipate others' actions to maximize their own payoffs under conditions of interdependence. While institutional economics analyzes the impact of established rules on economic performance and coordination, game theory provides a framework for predicting equilibrium behavior based on rational choice within specified game structures.

Methodological Differences in Research

Institutional economics emphasizes the role of social, legal, and political institutions in shaping economic behavior, using qualitative analysis and historical context to study how rules and norms evolve and influence economic outcomes. Game theory applies mathematical models and strategic interaction frameworks to analyze decision-making among rational agents, relying heavily on formal modeling, equilibrium concepts, and quantitative methods. Methodological differences center on institutional economics' interpretive, often case-based approach versus game theory's abstract, model-driven analytical techniques.

Applications in Economic Policy and Markets

Institutional economics analyzes how legal frameworks, social norms, and regulatory institutions shape economic behavior and market outcomes, guiding policymakers in designing effective regulations and property rights systems. Game theory models strategic interactions among rational agents, providing tools to predict competitive behaviors, negotiate contracts, and address market failures such as oligopolies and public goods. Integrating institutional economics with game theory enhances economic policy development by combining institutional context with strategic decision-making insights in markets.

Strengths and Limitations of Each Framework

Institutional economics excels in analyzing the role of legal, social, and political institutions in shaping economic behavior, providing a comprehensive understanding of how enforcement and transaction costs influence market outcomes. However, its qualitative nature and broad focus can limit precise predictive power and formal modeling capabilities. Game theory offers rigorous, quantitative tools to model strategic interactions and predict equilibrium outcomes in competitive environments, but often assumes rationality and common knowledge, which can oversimplify complex institutional contexts.

Overlapping Areas and Interdisciplinary Insights

Institutional economics and game theory intersect in analyzing how institutions shape strategic interactions among individuals and organizations, emphasizing rules, norms, and enforcement mechanisms that influence behavior. Both fields utilize concepts such as incentive structures and equilibrium outcomes to explain cooperation, conflict, and coordination within economic and social systems. The interdisciplinary insights reveal how formal and informal institutions impact game-theoretic models, enhancing the understanding of transaction costs, bargaining processes, and collective action problems in complex environments.

Recent Trends and Emerging Debates

Institutional economics increasingly emphasizes the role of formal and informal institutions in shaping economic behavior, driven by recent trends in exploring the impact of digital platforms and governance structures on market outcomes. Game theory continues to evolve by integrating behavioral insights and computational methods to analyze strategic interactions in complex, multi-agent systems, addressing challenges in information asymmetry and cooperation. Emerging debates center on the extent to which institutional frameworks can be modeled through game-theoretic approaches and how these disciplines can jointly advance understanding of economic coordination and policy design.

Future Directions in Economic Theory

Institutional economics and game theory both contribute to understanding economic behavior, with future directions emphasizing the integration of institutional frameworks into strategic interactions to better model real-world complexities. Advancements in computational techniques and behavioral insights are enhancing predictive accuracy by incorporating institutional constraints and norms within game-theoretic models. This fusion aims to develop more robust economic theories that account for evolving social, legal, and technological institutions influencing strategic decision-making.

Institutional economics Infographic

libterm.com

libterm.com